The number of companies drilling high impact (HI) exploration wells has fallen by 50% between 2010–2014 and 2020–2024. Westwood’s latest Wildcat report examines where these HI explorers have gone, the consequences of fewer active players, and which companies are still committed to drilling HI wells. Key findings from the report are shared in this insight.

Why it will be difficult to increase exploration drilling

- The number of companies drilling HI exploration wells has halved since 2014

- 136 companies have exited exploration completely and another 102 remain in exploration but didn’t drill any HI wells in 2020-2024

- There were only 17 new exploration companies created since 2014 that drilled HI exploration wells in the last five years and still exist

- Companies need to return to drilling, and a new wave of companies needs to be created if exploration is to increase significantly, but it’s unclear if the investor appetite will be there

A delayed energy transition and expectations of higher future oil and gas demand have led to calls for more exploration to plug future supply shortfalls after a decade of cutbacks and declining exploration discoveries. Global replacement of production by HI exploration discoveries declined to only 11% in the 2020-2024 period compared to 33% between 2010-2014, according to Westwood research.

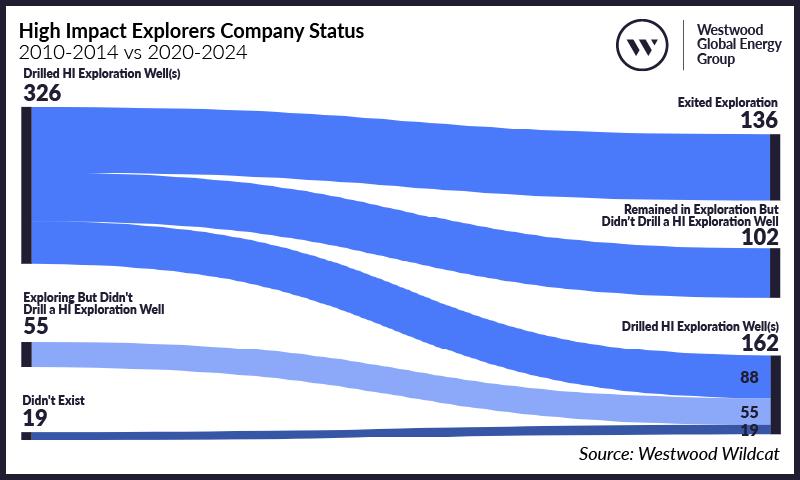

In the new report, Westwood analysed the change in the makeup of companies drilling HI exploration wells since the 2010-2014 period, when prices averaged over $100 per barrel, to understand the capacity of the industry to explore more. The number of E&P companies drilling HI exploration wells fell by half from 326 in 2010-2014 to only 162 in 2020-2024. This fall mirrored the decline in the number of HI exploration wells completed per year, which fell from an average of 150 per year in 2010-2014 to 77 in 2020-2024.

So, what happened to these explorers?

High Impact Explorers Company Status

Source: Westwood Wildcat

Of the original 326 companies, only 88 (27%) drilled HI exploration wells in 2020-24. 136 companies (41%) had exited exploration completely, for a variety of reasons, and 102 (32%) remained in exploration, holding exploration acreage but not drilling.

More than half of the companies who exited exploration merged with or were acquired by another company. In almost all cases the M&A transaction resulted in fewer exploration wells being drilled than the individual companies did before the combination. Another 24 companies made strategic exits from the upstream sector. 13 remained in upstream but not exploration, 20 companies entered administration and/or were dissolved, and 10 became inactive. A few of the exiting companies could conceivably return to exploration with another change of strategy.

More likely is that several of the 102 companies who didn’t drill HI wells in 2020-2024 but still hold exploration licences could return to HI exploration drilling if strategy changes and funding allows. The 88 explorers, who were still drilling HI wells in 2020-2024, drilled 28% fewer net HI wells, on average, compared to 2010-2014. The 88 continuing explorers were joined by additional 55 companies, who held acreage but did not drill a HI well in 2010-2014.

The 19 new E&P companies created after 2014 that went on to drill one or more HI exploration wells between 2020-2024, did little to replace the 136 companies that exited exploration. Only two were brand new listed small exploration companies compared to 47 listed small companies that exited exploration.

Many of the larger companies have now committed to increase exploration spending, some by up to 50%, but the dramatic fall in the number of companies active in exploration drilling makes stepping up drilling activity much harder. If the industry were to return to 2010-2014 levels of drilling, it would require the remaining E&Ps to drill roughly twice the number of wells they did in the $100/barrel+ 2010-2014 period. This is an unlikely proposition, so more HI drilling is going to need more companies returning to exploration and a new wave of E&P company start-ups.

The ability of the industry to materially increase discovered resources is not just limited by the attractiveness of the geology available to explore – the rarity of golden plays like the pre-salt in Brazil or the Upper Cretaceous in Guyana is well documented. It is also limited by the smaller pool of HI explorers, their capacity to fund HI drilling and their ability to build prospect inventories big enough to support more drilling. Those calling for the industry to explore more may be disappointed.

Christine Shearman, Farmouts Research Manager – Global E&A

cshearman@westwoodenergy.com

Wildcat subscribers can access the full report – Where Have the High Impact Explorers Gone? – on the Client Library. Non-subscribers can contact sales@westwoodenergy.com for more information.

Source: Westwood Global Energy Group