Woodside has announced its fourth quarter report for period ended 31 December 2025.

Performance highlights

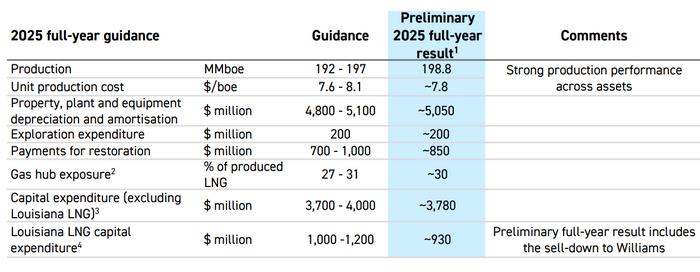

- Delivered record full-year production of 198.8 MMboe (545 Mboe/d), exceeding 2025 production guidance.

- Quarterly production of 48.9 MMboe (531 Mboe/d), down 4% from Q3 2025, driven by seasonal weather impacts and lower Australian east-coast demand.

- Delivered strong oil asset performance with 99.2% reliability at Sangomar and 98% reliability at Shenzi.

- Achieved a second consecutive quarter of 100% reliability at Pluto LNG and 99.8% reliability at the North West Shelf Project.

- Achieved an average realised quarterly price of $57/boe, down 5% from Q3 2025 reflecting lower oil-linked and gas pricing.

Project highlights

- The Scarborough Energy Project was 94% complete, and is on budget and on track for first LNG in Q4 2026. The Scarborough Floating Production Unit (FPU) departed China and subsequent to the period arrived in Australia.

- The Beaumont New Ammonia Project achieved targeted first ammonia production in December.

- The Trion Project was 50% complete, and remains on target for first oil in 2028.

- The Louisiana LNG Project, comprising three trains, was 22% complete; Train 1 was 28% complete. The project is targeting first LNG in 2029.

- Approved the Greater Western Flank Phase 4 Project, a subsea tie-back investment to the existing North West Shelf Project.

Business and portfolio highlights

- Completed the sell-down of a 10% interest in Louisiana LNG LLC (HoldCo) and an 80% interest and transfer of operatorship in Driftwood Pipeline LLC (PipelineCo) to Williams.

- Finalised agreements to extend gas flows from Pluto through the Pluto-KGP Interconnector until 2029.

- Entered into sale and purchase agreements with SK Gas International, BOTAS and subsequent to the period, JERA for the long-term supply of LNG.

- Appointed Liz Westcott as Acting CEO, following the resignation of Meg O’Neill.

Woodside Acting CEO Liz Westcott said the company delivered strongly against its 2025 business objectives, outperforming production guidance while advancing key growth projects.

'We achieved record annual production of 198.8 million barrels of oil equivalent in 2025. This performance was driven by sustained plateau production at Sangomar through late October and Pluto LNG operating at 100% reliability for the second half of the year.

'In recent days we marked a special milestone for the Scarborough Energy Project with the safe arrival of the floating production unit at the field and commencement of hook-up activities. The project was 94% complete at the end of the year and remains on budget and on target for first LNG cargo in Q4 2026.

'In late December first production was achieved at Beaumont New Ammonia. Final project commissioning will continue through early 2026 ahead of project completion and Woodside assuming operational control. Production will commence with conventional ammonia with lower-carbon ammonia planned for 2H 2026.

'Woodside has finalised agreements with leading global customers to supply conventional ammonia from Beaumont. These deliveries will commence in 2026 and continue through year-end, under contracts that reflect prevailing market prices.

'We also continued to progress our major development pipeline, with the three-train foundation phase of the Louisiana LNG Project reaching 22% completion at quarter-end, targeting first LNG in 2029.

'During the period Woodside entered a strategic partnership with leading US gas infrastructure company Williams, selling a 10% interest in the Louisiana LNG HoldCo and an 80% operating interest in PipelineCo, further demonstrating the quality of the project. Under the transaction, Williams will contribute approximately $1.9 billion in capital expenditure and assume offtake obligations for 10% of Louisiana LNG’s produced volumes.

'The Trion Project in Mexico was 50% complete at the end of the year, with hull assembly and installation of all critical equipment on the topside’s modules now completed.

'Also during the quarter, we took a final investment decision to develop the North West Shelf Project’s Greater Western Flank Phase 4. The project extends production from the North West Shelf by around one year and delivers an internal rate of return of approximately 30%.5

'During the period we signed long term LNG sale and purchase agreements with SK Gas International and BOTAS, supplied from Woodside's global portfolio including LALNG, evidencing the value customers place on our product.

'Woodside strengthened its position in the Gulf of America as the successful bidder on eight exploration blocks.

'We are looking forward to first LNG from Scarborough in the fourth quarter of this year. Our 2026 volume guidance of 172 - 186 MMboe reflects planned down time at Pluto as we prepare the facility to begin processing Scarborough gas and for first LNG cargo in Q4 2026.

'Woodside continues to execute our strategy as outlined at our recent Capital Markets Day. The executive team and I remain focused on safely delivering our operations and projects while maintaining rigorous cost management during the CEO transition period.'

Click here for full announcement

Source: Woodside Energy