Strong global portfolio delivers value and growth

Strong first half performance

- Determined a fully franked interim dividend of 53 US cents per share (cps).

- Delivered production of 548 Mboe/d (99.2 MMboe) and reduced unit production costs to $7.7/boe.1

- Achieved strong progress on major projects with Scarborough 86%, Trion 35%, and Beaumont New Ammonia 95% complete.

- Positioned to unlock future value through the final investment decision (FID) to develop the Louisiana LNG Project.

- Completed the sell-down of a 40% interest in Louisiana LNG Infrastructure LLC to Stonepeak.

- On track to meet Woodside’s net equity Scope 1 and 2 greenhouse gas emissions reduction target of 15% by 2025.2

Achieving operational excellence

- Recorded over one million work hours in Sangomar’s first year with no recordable injuries.

- Maintained exceptional performance from Sangomar with 100 Mbbl/d produced (100% basis, 80 Mbbl/d Woodside share).

- Achieved strong operated LNG plant performance with combined reliability of 96%.

- Contributed approximately 8% of EBIT from our marketing and trading capability.

Strong financial outcomes and capital discipline

- Achieved net profit after tax of $1,316 million.

- Delivered strong EBITDA of $4,600 million from underlying base business.1

- Delivered operating cash flow of $3,339 million.

- Disciplined capital management resulted in strong liquidity of $8,430 million and gearing of 19.5%, within the target range.1

- Issued $3,500 million of senior unsecured bonds in the US market, with the book heavily oversubscribed

Summary

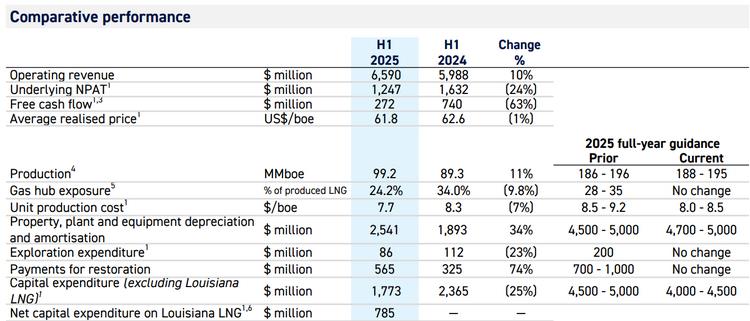

Woodside delivered strong half-year production of 548 thousand barrels oil equivalent per day (99.2 million barrels of oil equivalent total) and reported a half-year net profit after tax (NPAT) of $1,316 million. Underlying NPAT was $1,247 million, compared to $1,632 million in the corresponding period in 2024. Operating revenue rose 10% year-on-year to $6,590 million.

The directors have determined a fully franked interim dividend of 53 US cents per share (cps), representing an 80% payout ratio of underlying NPAT, and an annualised yield of 6.9%. 7

CEO Meg O’Neill said the results demonstrate Woodside’s world-class business is rewarding shareholders with strong dividends today, while ensuring the balance sheet strength to deliver major growth projects.

'Strong underlying performance of our assets, our robust financial performance, and a focus on disciplined capital management have enabled us to maintain our interim dividend payout ratio at the top end of the payout range.

'The outstanding performance of our high-quality assets over the first half has continued to support safe, reliable operations. This has been complemented by a strong focus on cost management, resulting in a reduction in our unit production costs. We have also taken a disciplined approach to future growth and reduced spend on new energy and exploration as we prioritise delivering sanctioned projects.

'A highlight was the ongoing exceptional performance of our Senegal Project, which marked one year since first oil in June 2024. In just the first half of 2025, Sangomar has generated revenue nearing $1 billion, with gross production of 100 thousand barrels per day. Proved reserves have also been added, following positive early field performance. Sangomar’s success has showcased Woodside’s world-class project execution and operational capabilities.

'Our excellence in project delivery was further demonstrated in the first half. The Scarborough Energy Project in Western Australia is 86% complete and targeting first LNG cargo in the second half of 2026. Our Trion Project offshore Mexico is 35% complete and targeting first oil in 2028.

'In April we took a final investment decision on Louisiana LNG, positioning Woodside as a global LNG powerhouse able to meet growing customer demand in the Pacific and Atlantic Basins. The Project’s compelling value proposition was reinforced with key infrastructure, offtake, and gas supply agreements signed with high-quality partners. This included completion of the sell-down of a 40% interest in Louisiana LNG Infrastructure LLC to Stonepeak for $5.7 billion, which will see Stonepeak contribute 75% of the expected Project capital expenditure over both 2025 and 2026.

'We continue to receive strong interest from high-quality potential partners as we explore further sell-downs of Louisiana LNG. This highlights the distinct value Woodside offers, with our business model well positioned to deliver compelling long-term value in the US LNG market, further differentiated by our extensive LNG experience, portfolio marketing capabilities, and balance sheet strength.

'Further strengthening our operational capabilities and subsequent to the period, we agreed to assume operatorship of the Bass Strait assets offshore Victoria from ExxonMobil. This agreement creates flexibility for future development opportunities through existing infrastructure.

'Safety remains at the forefront of everything we do. We marked significant safety milestones across our global portfolio over the period including 100,000 hours worked across two major turnarounds at the North West Shelf Project in Western Australia with no lost-time injuries. Our outstanding safety record at Sangomar continued, with no recordable injuries during the Project’s first year of operations.'

Click here for full announcement

Source: Woodside