- Strategic merger with BHP Petroleum delivered high-quality resources and record production in 2023

- Top quartile proved reserves life against peer group. 158% of production replaced by proved plus probable reserves added in 2023

- Reserves additions from deepwater projects sanctioned in the Gulf of Mexico and improved performance in North West Shelf and Pluto, partly offset by reserves reductions in Shenzi

- Expected impairments associated with the goodwill and purchase price allocated to Shenzi at the time of the merger with BHP Petroleum, and Wheatstone short-term pricing, to be included in 2023 full-year financial statements

Woodside announced today that it added 266 MMboe of proved oil and gas reserves in 2023, replacing 132% percent of production, and 318 MMboe of proved plus probable reserves in 2023, replacing 158% of production.(1) Proved reserves life is 12.2 years given 2023 production levels, benchmarking in the top quartile of global peers.(2)

Woodside CEO Meg O’Neill said the reserves update reflects the quality of the larger portfolio following the merger with BHP’s petroleum assets and establishes a continued platform for delivering strong shareholder returns.

'Woodside has delivered strong operational performance over the past 12 months. We achieved record production in 2023, while progressing a world-class funnel of development opportunities, which have us well positioned for growth and returns.

'Our success in integrating the strategic merger with BHP Petroleum, combined with our ability to advance major projects and improve performance has delivered a high-quality resource base that enjoys top quartile reserves life.

'We continued to see strong performance from our core assets in 2023.'

(1) Reserve replacement is the extent to which the year’s production has been replaced by reserves added to our reserve base. This includes changes resulting from extensions and discoveries, transfers, revisions to previous estimates, and acquisitions and divestments.

(2) Peer set is APA, ConocoPhillips, Coterra Energy, Devon, ENI, EOG, Equinor, Hess, Inpex, Marathon, OXY and Santos. Comparison is relative to 2022 Annual Reports. Canadian oil sands companies are excluded.

Reserves and Resource update

At 31 December 2023, Woodside’s remaining proved (1P) reserves were 2,450.1 MMboe, proved plus probable (2P) reserves remaining were 3,757.1 MMboe. The best estimate (2C) contingent resources remaining were 5,902.0 MMboe.(3)

The first-time booking of reserves at Trion in Mexico and Mad Dog Southwest in the US Gulf of Mexico increased proved reserves by 204.1 MMboe and proved plus probable reserves by 300.0 MMboe. Revisions of previous estimates and transfers in 2023 resulted in a net increase of 61.8 MMboe for proved reserves, and 17.8 MMboe for proved plus probable reserves. This includes improved performance and technical updates at North West Shelf and Pluto, offset by a 13.4 MMboe proved reserve, and a 30.2 MMboe proved plus probable reserve, reduction at Shenzi.

The reduction in reserves at Shenzi are mainly associated with the performance of infill sidetracks and performance of the Shenzi North development following start up.

Additionally, in 2023, Woodside completed a transaction whereby Calgary-based Paramount Resources took a 50% equity interest in, and operatorship of, 28 leases of the Liard field in Canada. The transaction resulted in Woodside’s 2C contingent resources decreasing by 2,241.2 MMboe.

A copy of Woodside’s Reserves and Resources Statement is attached.

2023 financials update

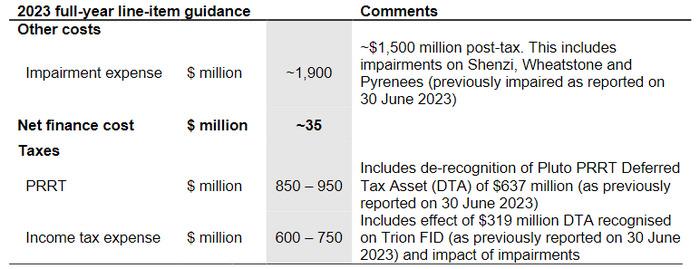

The 2023 full-year financial statements are expected to recognise non-cash post-tax asset impairments amounting to approximately $1,500 million, including approximately $1,200 million ($1,400 million pre-tax) impairment for the Shenzi asset. This is primarily related to goodwill and a portion of the purchase price assigned to Shenzi on completion of the merger with BHP Petroleum. The goodwill and purchase price allocation resulted from application of acquisition accounting principles and reflect both higher hydrocarbon prices and Woodside’s share price at the merger completion date. Goodwill is not amortised and, once impaired, is not subject to a future impairment reversal. For reference, Shenzi represented approximately 5% of 2023 production and approximately 2% of 2023 year-end proved plus probable reserves.

The 2023 full-year financial statements are also expected to recognise a non-cash post-tax impairment of approximately $300 million for Wheatstone, mainly related to short-term pricing.

Impairments will be excluded for the purposes of calculating the 2023 full-year dividend, consistent with prior practice. All impairment values are subject to the completion of the 2023 external audit.

(3) Proved reserves include 228.1 MMboe fuel; proved plus probable reserves include 338.9 MMboe fuel; 2C contingent resources include 362.3 MMboe fuel (Woodside share).

Source: Woodside