Block Energy, the exploration and production company focused on Georgia, has announced its operations update for the three months ended 31 December 2022.

Highlights

- Over 135,290 operational man-hours worked in Q4 2022, with one minor Lost Time Incident

- Commenced Project II (Patardzeuli full-field redevelopment), drilling and testing the JSR-01 DEEP well on time and budget. Encouraging results, confirming unswept oil in the Field, support the continuation of the project.

- The Company has upgraded its service rig to undertake low-cost drilling and workover operations in the shallow reservoirs of all its fields and in particular will support the advancement of Project II.

- Drilling operations on well WR-B01Za commenced in December, with operations progressing as planned

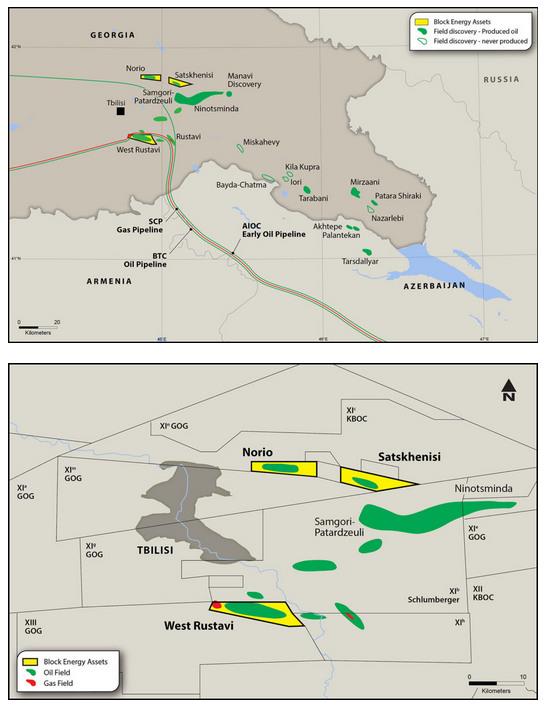

- Binding agreement signed for the farmout of non-core areas of licence XI? in exchange for work programme valued at c. $3m gross.

- Q4 production of 34.4 Mboe (Q3: 37.1 Mboe) or an average of 374 boepd

- Q4 revenue of $1,840,400 (Q3: $1,833,000)

Health, Safety & Emissions

Over 135,290 operational man-hours have been worked by staff and contractors in Q4, and over 382,542 in the twelve months ended 31 December 2022, with one minor LTI.

The Company again sought to minimise emissions, in-line with its commitments, but was required to flare 300,000cum of gas due to the temporary shutdown of the Bago gas pipeline and electricity outages prior to the installation of the generator at the early production facility.

The Company has implemented a procedure for the recording of Project I emissions and is working to reduce other emissions further. In 2023, the Company plans to record Scope II emissions and fulfil its intention to reduce those emissions also.

Operations

Drilling operations on well WR-B01Za are progressing as planned, with operations having commenced in mid-December. Well WR-B01Za is targeting a fracture system identified by a high density of seismic attribute lineations on the west side of the Krtsanisi anticline on the West Rustavi oil field. The well is located 500m to the west and up-dip from the successful JKT-01Z well, which has been on continuous production, providing significant returns on the original investment.

Well JSR-01 DEEP successfully confirmed the concept of unswept oil in the Patardzeuli Field. This encouraging result supports the Company's continued advancement of Project II and the development of the Patardzeuli oil Field.

Well JSR-01 DEEP was safely drilled to a depth 470m deeper than the original donor well and was successfully completed below budget. The well was drilled at an inclined angle, allowing the testing of different zones to help evaluate the remaining oil potential and inform future drilling and development plans. The well has been handed over to the production operations team.

Corporate

The Company entered a binding agreement for a 50% farmout of non-core areas of Licence XI? to Georgia Oil & Gas Limited, in exchange for a work programme with an estimated value of $3m gross, comprising $2.5m for 2D seismic acquisition and $0.5m for seismic reprocessing ("Project IV").

The farmout advances the Company's exploration opportunities through a sizable work programme at no cost to the Company. None of the existing fields, current production nor future development plans associated with Projects I, II and III, within Licence XI?, are subject to the farm-out.

Furthermore, in late November 2022, SLB (previously Schlumberger) notified the Company of its decision not to exercise its right to acquire 108 million ordinary shares in Block Energy plc. This decision creates a significant gain in value for Block and a reduction in dilution for our shareholders.

The options had been granted in 2020, as consideration for the acquisition of the Schlumberger Rustavelli Company Limited, which provided Block with additional production, material additional oil reserves, significant gas resources, oil inventory, materials and a US$ 133 million cost recovery offset for the profit sharing allocation with the State.

Oil and Gas Production

During Q4, gross production (including the state of Georgia's share) was 34.4 Mboe (Q3: 37.1 Mboe), comprising 27.4 Mbbls of oil (Q3: 28.1 Mbbls) and 7.0 Mboe of gas (Q3: 9.0 Mboe). The average gross production rate for Q4 was 374 boepd (Q3: 404 boepd),

Production during the quarter was adversely affected by increased pump maintenance, requiring production wells to be temporary shut-in.

During 2022, gross production (including the State of Georgia's share) was 183 Mboe (2021: 156 Mboe), comprising 120 Mbbls of oil (2021: 101 Mbbls) and 63 Mboe of gas (2021: 55 Mboe).

Oil Sales

In Q4 2022, the Company sold 21.3 Mbbls of oil (Q3: 17.9 Mbbls) for US$ 1,691,400 (Q3: US$ 1,614,000), at a weighted average price of US$ 79 per barrel (Q3: US$ 92 per barrel), which represents a c.5% increase in revenue and a 14% decrease in the realised oil price quarter on quarter.

During 2022, the Company sold 84.9 Mbbls of oil (2021: 86.7 Mbbls) for US$ 7,492,600 (2021: US$ 5,519,000), resulting in a weighted average price of approximately US$ 89 per barrel (2021: US$ 64 per barrel), which represents a 39% increase in the realised price in 2022 compared with 2021.

Gas Sales

In Q4 2022, the Company sold 27.3 MMcf of gas (Q3: 36.1 MMcf) for US$ 149,000 (Q3: US$ 192,000), resulting in a weighted average price of approximately US$ 5.45/Mcf (Q3: US$ 5.31/Mcf).

During 2022, the Company sold 170 MMcf of gas (2021: 191 MMcf) for US$ 769,620 (2021: US$ 596,000), at a weighted average price of US$ 4.52/Mcf (2021: US$ 3.11).

Block Energy's Chief Executive Officer, Paul Haywood, said:

'Block made significant progress in the fourth quarter, which further strengthens our position and ability to deliver on the potential of our extensive assets in Georgia. In addition to another quarter of solid revenue generation, the Company was able to drive Projects I and II forward, while also creating exposure to material exploration upside at no cost, through the farmout. Meanwhile drilling of well WR-B01 Za is ongoing and progressing to plan. We look forward to providing further updates on our progress.'

Source: Block Energy