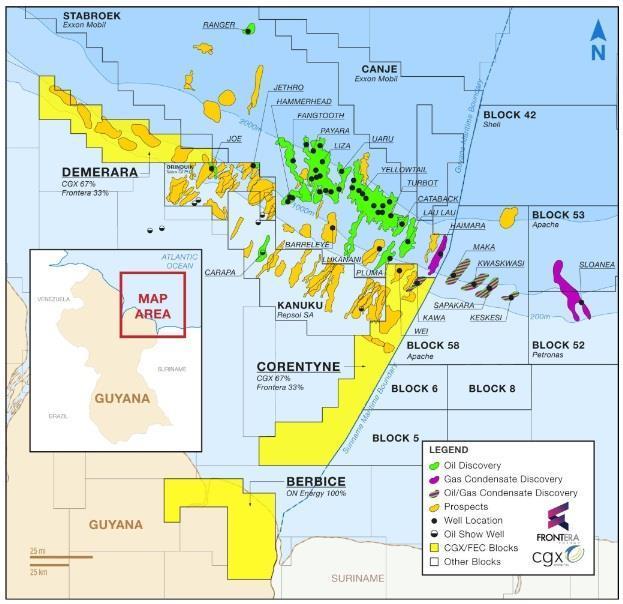

CGX Energy, operator and joint venture partner with Frontera Energy in the Petroleum Prospecting License for the Corentyne block offshore Guyana, announced May 3 that the Wei-1 well, on the Corentyne block, approx. 200 kms offshore from Georgetown, Guyana, has encountered oil.

CGX holds a 32.00% participating interest with Frontera holding the remaining 68.00% participating interest in the Corentyne block. The Well, planned to be drilled to a total depth of 20,500 feet, to date has been successfully drilled to a depth of 19,142 feet. Wei-1 is located 14 kms west of the Kawa-1 discovery well announced by the JV Partners last year.

Operations were interrupted when a wireline fluid sampling tool became stuck in the Well and was not recovered. An open hole sidetrack will begin shortly from below the last casing point and will progress to the planned total depth. The Joint Venture expects the Well to be completed within the original timeframe announced on January 23, 2023 of 4 to 5 months after spudding the Well.

The Well has encountered multiple oil-bearing intervals in the western channel fan complex of the northern portion of the Corentyne block in formations of Maastrichtian and Campanian ages. A comprehensive logging campaign in the Maastrichtian interval indicated the presence of medium sweet crude oil of 24.9 API. Downhole fluid analysis confirmed light sweet crude oil in the Campanian interval. Logging while drilling (LWD) and cuttings indicated the presence of hydrocarbons in the upper portion of the Santonian; fluid samples have not yet been obtained. Core samples will be attempted in the Santonian interval when drilling resumes. It is not yet certain that the hydrocarbons encountered to date in the Well are yet sufficient to underpin commercial development on the Northern portion of the Corentyne block.

As drilling operations continue, the Joint Venture has revised its Well total cost estimates to approx. $175-$185 million to successfully reach the target total depth, complete the anticipated logging runs and complete the well. The increase in cost includes the delays associated with the late release of the rig by a third-party and adjusting the spud date to January 2023. CGX is required to fund its 32% interest, after partner carry, of approx. $11 to $15 million and is currently assessing strategies to fulfill this obligation.

Source: CGX Energy