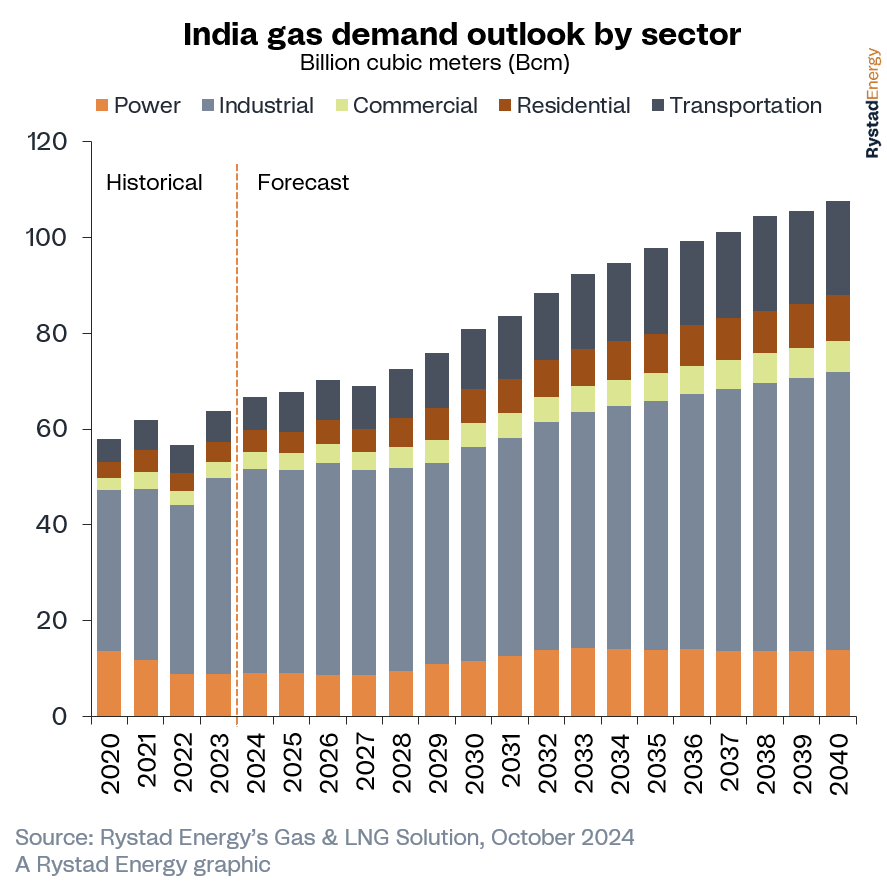

Fueled by population growth, economic development and a shift towards cleaner energy, India’s gas consumption is expected to nearly double to 113.7 billion cubic meters (Bcm) by 2040 from 65 billion cubic meters (Bcm) in 2023, according to Rystad Energy's research. Near-term demand is supported by a 51% jump in domestic gas production since 2020 to 36.7 Bcm by 2025, but this will not be enough to meet the country’s growing demand for natural gas. The result is that India will continue to rely heavily on imports to satisfy its future energy needs.

Recognizing this uptick in gas demand, India has bolstered its trade security by signing long-term contracts extending into 2030 and beyond. These agreements help shield India from global price fluctuations and supply chain disruptions, ensuring a steady flow of gas to support its growing economy. By securing these agreements, the country not only enhances its energy security but also strengthens its position in the global liquified natural gas (LNG) market, advancing its shift toward a cleaner energy mix.

The nation’s heavy reliance on coal is clear, particularly during recent heatwaves which have temporarily driven up coal usage alongside LNG for power generation. Gas, on the other hand, currently accounts for just 2% of the country’s power mix, as the focus remains on more cost-effective options like coal and renewables – in fact, coal-generated power is not projected to start falling this side of 2040. While gas-for-power isn’t expected to be a major driver for gas demand, the sector could still see growth, however, depending on future policies to promote coal-to-gas switching or introduce carbon pricing.

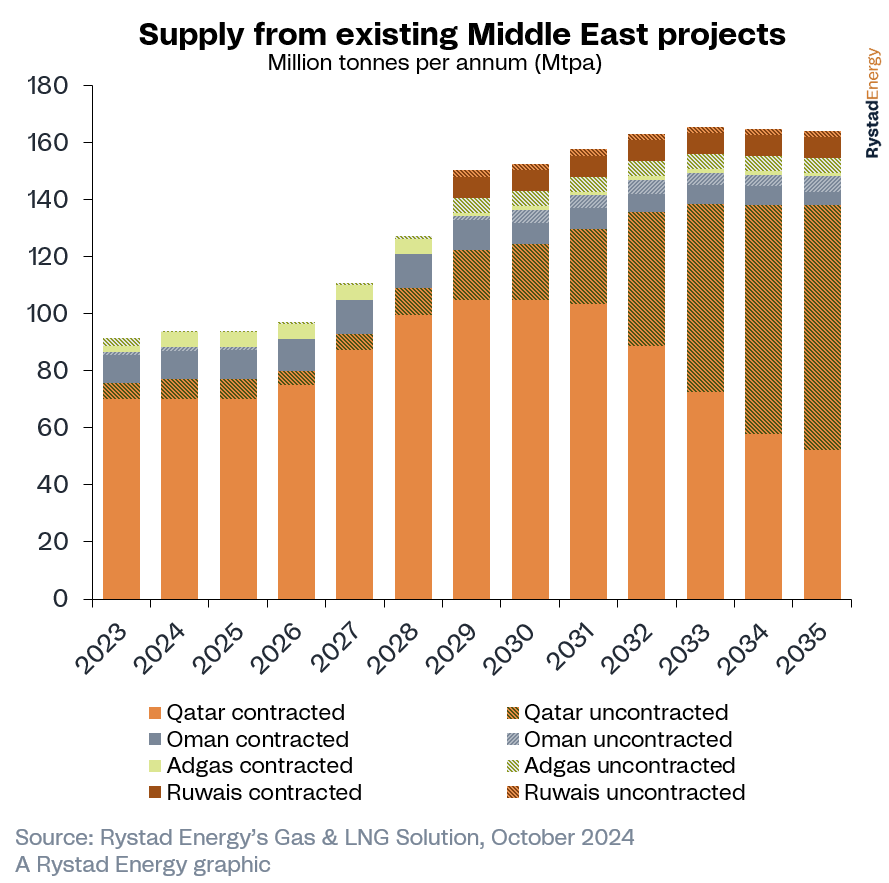

'India’s LNG sector is experiencing significant growth. Looking ahead, a strategic next step could involve continued dealings with the Middle East. The geographical proximity of the two regions, combined with the substantial volume of uncontracted LNG production in the Middle East, presents an excellent opportunity for India to secure favorable terms – it’s an ideal buyer-seller relationship that could help fuel India’s needs. The nation is well-positioned to attract aggressive targeting from Middle Eastern producers and offtakers, with nearly 100 million tonnes per annum of Middle East LNG remaining uncontracted by 2035,' says Kaushal Ramesh, Vice President, Gas & LNG Research, Rystad Energy.

Learn more with Rystad Energy's Gas & LNG Solution.

Demand drivers: Food security comes first

Looking ahead, India’s gas demand will come from several sectors, including the country’s expanding city gas distribution (CGD) network as well as the fertilizer, refining and petrochemicals industries. Urea production in India heavily depends on natural gas as a key input, with limited alternatives available in the short term. As the government aims for complete food security, it continues to provide substantial subsidies for urea production, resulting in steady demand for gas in this sector, regardless of price fluctuations.

Following the successful restart of four gas-based fertilizer plants in 2021 and 2022, Indian urea production reached 30 million tonnes in 2023. This was still short of that year’s urea demand of 35 million tonnes, suggesting further growth potential in the near term. Meanwhile, rising demand for oil products and petrochemicals could increase India’s refining capacity to around 335 million tonnes per annum (Mtpa) by 2030, with many expansions expected to occur near LNG terminals.

The CGD sector also supports gas use across transportation, industrial, commercial and domestic applications through the development of compressed natural gas (CNG) stations and piped natural gas (PNG) networks. India’s CGD network has expanded rapidly in recent years, with the number of CNG stations rising more than fivefold since 2015 to 5,710 by April of last year and the number of PNG connections more than quadrupling to 12 million over the same period. After the latest CGD bidding rounds, nearly 100% of India’s geographical area is expected to be covered by the CGD network, reaching a population of over 1.4 billion.

Potential pitfalls

While there are positive signs for the Indian gas sector, several challenges could hinder its growth. A key issue is Indian buyers’ history of renegotiating or even abandoning near-complete deals, which creates uncertainty for suppliers. This preference for flexibility and cost-effectiveness over long-term commitments highlights India's focus on securing the best prices for its consumers in a volatile global market – but it could limit LNG growth prospects.

Additionally, slow infrastructure development has hampered the growth of India’s gas sector. Regasification terminals remain concentrated in the western part of the country, and efforts to expand the gas pipeline network to other regions have been inconsistent. This slow progress is due to regulatory hurdles, challenges in securing investments, difficult terrain, and competing priorities as India channels significant resources into renewable energy development alongside its gas infrastructure.

Contacts

Kaushal Ramesh

Vice President, Gas & LNG Research

Phone: +61 02 8067 8468

kaushal.ramesh@rystadenergy.com

Allison Anne Samuel

Analyst, Gas & LNG Research

Phone: +65 6909 3718

allison.samuel@rystadenergy.com

Kartik Selvaraju

Media Relations Manager

Phone: +65 8779 4619

kartik.selvaraju@rystadenergy.com

Source: Rystad Energy