Genel Energy has announced its unaudited results for the six months ended 30 June 2023.

Paul Weir, Chief Executive of Genel, said:

'The closure of the Iraq-Türkiye pipeline on 25 March 2023 has resulted in minimal sales and no payments from the KRG since that date. This has materially impacted both our current and expected cash flows, with the current period seeing a free cash out flow.

Approval of the Iraqi budget in June put in place a framework for the restart of payments and exports, with production from Kurdistan incorporated in the budget, and this was an important step. Discussions are now ongoing between Iraq and Türkiye regarding the commercial and political arrangements that would enable the resumption of exports.

As we await a positive outcome to discussions between Iraq and Türkiye, we retain a material cash position, prioritised for investment in new assets, and remain clear and determined on our direction of travel. We have accelerated the ongoing reshaping of our portfolio, organisation, and plans, and we continue to diligently review assets and businesses that can support delivery of the business that we have framed over the past 12 months.

Given the $170 million impact so far that the lack of payments and revenue is expected to have on our liquidity at year-end, and with no clear line of sight on when either pipeline exports or payments will restart, we have taken the decision to suspend the dividend. We remain committed to building a business with predictable, repeatable, and diversified cash flows, which would ultimately support the re-establishment of a dividend programme.'

Summary

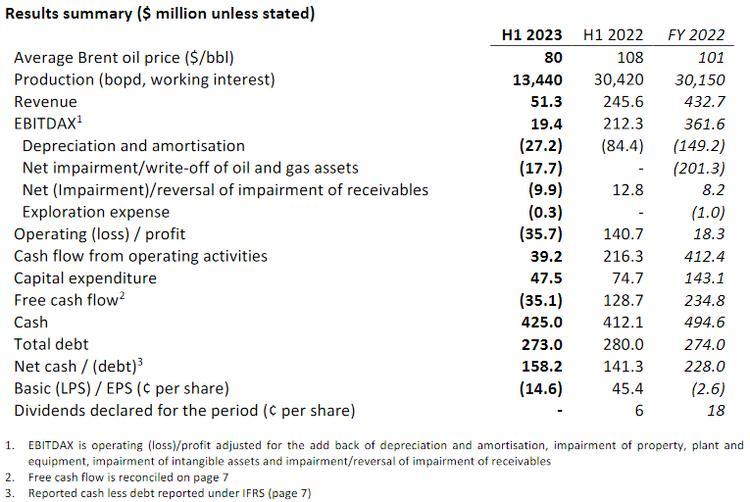

- The prolonged closure of the Iraq-Türkiye pipeline has materially impacted production, which averaged 13,440 bopd in H1 (H1 2022: 30,420)

- Two payments totalling $61 million were received from the Kurdistan Regional Government (‘KRG’) in the period, with $110 million now overdue

- Given the loss of cash flow in the period and the lack of visibility on both the timing of pipeline exports resuming and the re-establishment of a reliable record of payments, Genel has suspended its dividend programme

- In addition, the Company will assess the timing of further investment in Somaliland following the completion of civil engineering work, based on the financial outlook at the time

- Work on assessing the future plans for Sarta, with a goal of making operations profitable, has been made more challenging by the investment environment, and consequently Genel has informed the Ministry of Natural Resources of its intention to surrender the asset and terminate the Sarta PSC

- Significant cash balance of $425 million at 30 June 2023 ($496 million at 31 March 2023) is prioritised for addition of new assets

- Net cash of $158 million at 30 June 2023 ($229 million at 31 March 2023)

- Total debt of $273 million at 30 June 2023 ($274 million at 31 March 2023)

- A socially responsible contributor to the global energy mix:

- Zero lost time injuries ('LTI') and zero tier one loss of primary containment events at Genel and TTOPCO operations

- Three million work hours since the last LTI

Outlook

- As a consequence of the reduction in operational activity, Genel has right-sized the organisation and reduced spend compared to expectations at the start of 2023

- Genel currently expects full year capital expenditure to be c.$70 million (original guidance $100-125 million), with two thirds of this already spent

- Limited local sales are ongoing from the Tawke licence

- Genel continues to actively review and work up opportunities to invest our cash to build a business that delivers resilient, reliable, and diversified cash flows that support a repeatable dividend programme in the long-term

- The London-seated international arbitration regarding Genel’s claim for substantial compensation from the KRG following the termination of the Miran and Bina Bawi PSCs is progressing. The trial remains scheduled for February 2024

Click here for full announcement

Source: Genel Energy