The transaction to sell Equinor's non-operated equity position in the Corrib gas project in Ireland closed 31 March 2023 after receiving the necessary regulatory approvals.

Equinor entered into an agreement with Vermilion Energy for the sale of the company’s non-operated equity position in the Corrib gas project in Ireland in November 2021. The details of the deal are set out below, and are published here:

The transaction was organised through a share sale of Equinor Energy Ireland Limited, a company 100% owned by Equinor ASA. Equinor owned 36.5% of the Corrib project, alongside Vermilion (the operator with 20%) and Nephin Energy (43.5%).

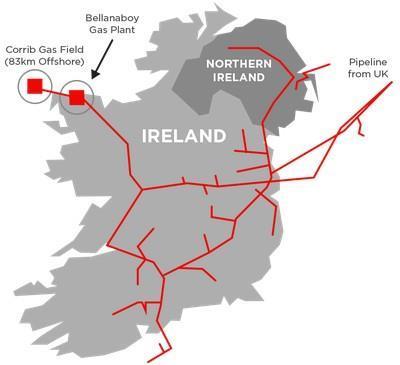

The Corrib field started production in 2015 and is located 83 kms off Ireland’s northwest coast in water depths of almost 350 meters. The equity gas volumes to Equinor for 2021 are estimated at ~58 MMScf/d.

Equinor and the buyer agreed a consideration of USD 434 million, before closing adjustment, with an effective date set at 1 January 2022. As part of the transaction, Equinor and Vermilion agreed to hedge approx. 70% of the production for 2022 and 2023, and also agreed a contingent payment that will be paid on a portion of the revenue if European gas prices exceed a given floor level.

'The Corrib field has been an important non-operated project for Equinor for several years. We have taken the decision to sell the asset to focus our portfolio, in line with our strategy, to capture value from the current strong market and to free up capital that we can re-invest elsewhere,' said Arne Gürtner, senior vice president responsible for the United Kingdom & Ireland.

The sale of Corrib means that Equinor will no longer have active business presence in Ireland, after also deciding to withdraw from an early phase offshore wind project in the country.

See also, Vermilion's announcement: Vermilion Energy Inc. Announces Closing of the Corrib Acquisition

Source: Equinor