Zenith Energy, the listed international energy production and development company, has announced the acquisition of an agrivoltaic project at development stage located in the Piedmont region of Italy, through its wholly-owned Italian subsidiary, responsible for managing its solar energy portfolio, WESOLAR S.R.L.

Overview of the Acquisition

- The Acquisition comprises a photovoltaic solar energy production project located in the Piedmont region, with an expected installed capacity of approximately 10 MWp.

- The Acquisition is classified as being in the development stage.

- Piedmont, and particularly the Province of Alessandria, where the new plant will be developed, is one of the most industrialised areas in Italy. This characteristic makes the sale of electricity from renewable sources particularly profitable, due to strong local energy demand. Demand to acquire this type of project remains consistently high.

- This additional acquisition in Piedmont enables Zenith to further consolidate its significant presence in the region, where approximately 60 MWp of projects are already under development, while at the same time complementing the Company's existing pipeline in Piedmont, Puglia and Lazio.

- Italy stands out as one of the world's leading countries in the development and implementation of photovoltaic technology.

- The Company expects the project to reach Ready-to-Build status within the next 12-15 months.

- The consideration for the acquisition of the land for the new project amounts to EUR 768,215.00, conditional upon the achievement of all necessary permits to reach Ready-to-Build status.

Advanced negotiations are currently underway for the acquisition of two additional projects.

Strategy Overview

In the solar energy industry, a 'pipeline' refers to the aggregate portfolio of development projects being actively advanced toward construction day after day. Zenith's pipeline is composed of projects progressing daily through design, permitting, and grid-connection milestones, moving step by step toward Ready-to-Build ('RtB') status. This expanding portfolio carries tangible market value, which typically increases as projects mature and de-risk through successive development stages.

As previously announced in the Company's regulatory news announcement dated December 4, 2025, Zenith received the results of an independent valuation of its existing solar energy development pipeline. At that time, the pipeline totalled 110.5 MWp and was independently valued at €27,500,000.00.

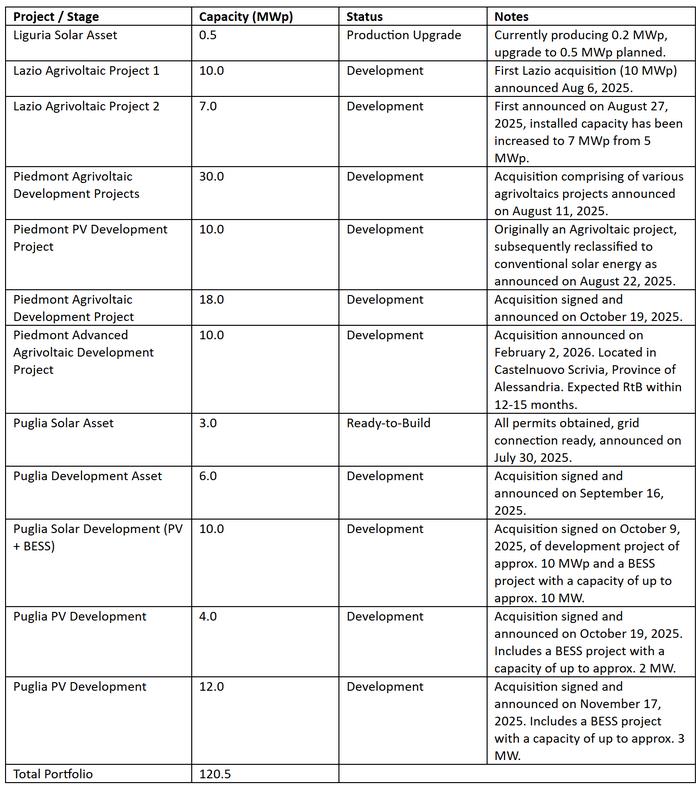

Since the independent valuation was completed, Zenith's solar portfolio has increased to 120.5 MWp as of February 2, 2026. Accordingly, the previously announced independent valuation does not reflect the additional capacity acquired since that date. The Company believes that the increase in portfolio capacity provides further support for the value-creation potential of its renewable energy development activities, although no updated independent valuation has been published for the enlarged portfolio.

Zenith intends to maintain a balanced approach across its Italian portfolio, progressing projects toward RtB status while selectively assessing opportunities to monetise portions of the development pipeline with professional counterparties, and to construct selected assets to establish tangible and recurring electricity production revenue.

Overview of Zenith Energy's Solar Portfolio (as of February 2, 2026)

Andrea Cattaneo, Chief Executive Officer of Zenith Energy, commented:

'We are pleased to have secured an additional agrivoltaic development project in Piedmont, further strengthening Zenith's footprint in a high-demand industrial area in the Province of Alessandria. This acquisition reflects our continued focus on building a high-quality Italian solar pipeline and advancing it efficiently through permitting and grid-connection milestones.

With this latest addition, Zenith's Italian solar portfolio increases to 120.5 MWp, reinforcing the scale and strategic positioning of our regional clusters across Piedmont, Puglia and Lazio.

We believe we can reach a portfolio of 200 MWp by the end of 2026, while maintaining at the same time the strict discipline we adopted in 2025 in the choice of locations.

Our priority remains to progress projects toward Ready-to-Build status, enabling us to both realise near-term value through selective monetisation and to construct selected assets to generate tangible and recurring production revenue.'

Source: Zenith Energy