Zenith Energy, the listed international energy production and development company, has announced the signing of a new agreement to acquire a solar energy development project located in the Puglia region of Italy by its wholly-owned Italian subsidiary created to manage its solar energy portfolio, WESOLAR S.R.L.

Overview of the Acquisitions

- The Puglia Acquisition is located in Italy's Puglia region and comprises approximately 12 MWp of ground-mounted PV capacity across roughly 15 hectares of flat, well-levelled land, resulting in minimal earth-moving requirements.

- In addition, the Company has secured sufficient land to accommodate an integrated 3 MW Battery Energy Storage System ("BESS") to optimise energy dispatch and support the local grid.

- A BESS is designed to store electricity generated during low-price periods and discharge it during higher-priced fasce orarie (time-of-use tariff periods), thereby maximising revenue. In Italy, electricity prices fluctuate throughout the day-with peak hours (fasce orarie di punta) commanding materially higher prices-allowing strategic storage and release to enhance project returns.

- The Puglia Acquisition is currently classified as being in the 'Development' stage.

- Puglia is among Italy's most favourable regions for solar power generation, benefiting from high solar irradiation levels that support superior economic performance for photovoltaic projects.

- The Puglia Acquisition strengthens the Company's presence in the region and complements its existing development pipeline in Piedmont and Lazio. Together, these three clusters form a strategically significant solar development portfolio across some of Italy's most attractive and highly sought-after renewable-energy generation areas.

- Italy continues to rank among the global leaders in photovoltaic technology, deployment, and installed capacity.

- The Company expects the project to reach Ready-to-Build status within 12-16 months.

- The total consideration for the Puglia Acquisition is EUR 1,050,000, including the associated land. Payment will be made upon securing all required permits and achieving Ready-to-Build status at the conclusion of the development process.

Strategy Overview

In the solar energy industry, a 'pipeline' refers to the aggregate portfolio of development projects being actively advanced toward construction. Zenith's pipeline is composed of projects progressing daily through design, permitting, and grid-connection milestones, moving step by step toward Ready-to-Build ('RtB') status. This expanding portfolio already carries tangible market value, which increases as projects mature and de-risk through successive development stages. Owing to Zenith's optimised site selection and high-quality development standards, portions of the portfolio could already be monetised with professional counterparties, reflecting its strong commercial quality and competitiveness.

Zenith plans to sell only a portion of its development portfolio. This strategic divestment will generate immediate profit and strengthen both profitability and liquidity, while allowing the Company to continue expanding its project base and initiate construction of selected solar assets.

To ensure full transparency and effective communication with shareholders, Zenith is commissioning an independent valuation of its development portfolio, illustrating the progress achieved since the Company's strategic shift in early 2025 toward solar energy development and production.

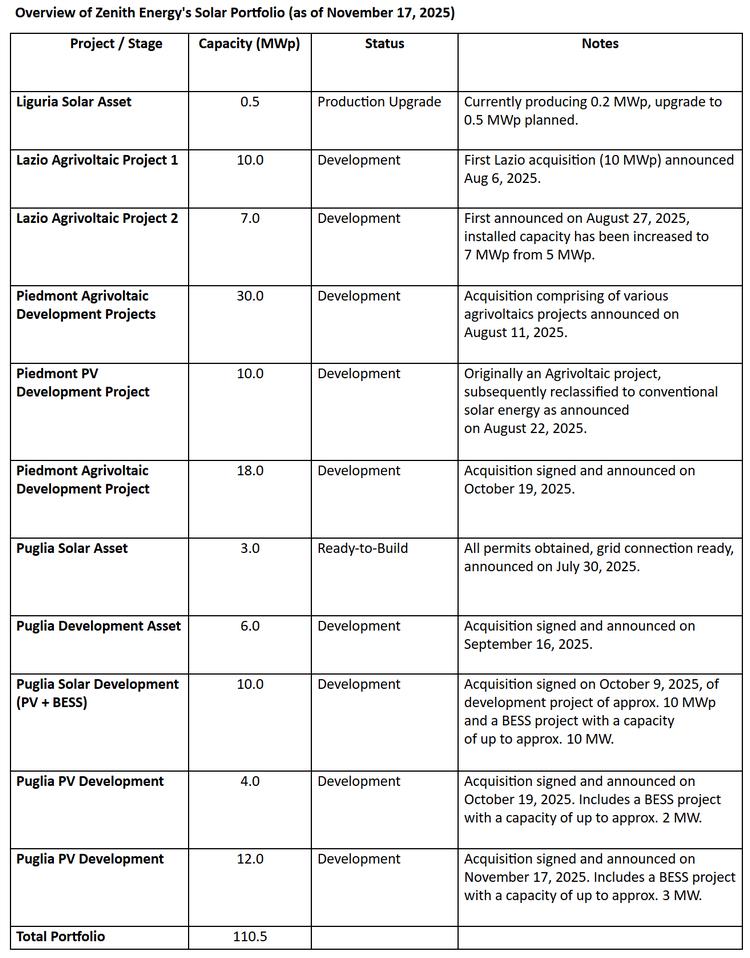

With the original 100 MWp development target now substantially met, Zenith will define a new capacity objective and broaden its strategy to support continued growth in electricity production.

The Company has also initiated development activities in BESS segment, a highly attractive and complementary market that enhances grid stability and long-term value creation.

As previously announced, funding for these next phases will be secured through financing from specialised renewable-energy lenders and through the sale of selected portions of the existing development portfolio to interested professional counterparties.

Transition to Production: Creating Tangible and Recurring Revenue

As part of its long-term growth strategy, Zenith intends not only to develop and sell projects, but also to select certain RtB assets and construct them, enabling the Company to generate direct, tangible revenue from electricity production.

While development-stage asset sales generate strong near-term profitability, owning and operating selected plants provides stable, predictable, and recurring cash flows supported by Italy's favourable solar-generation economics. Production assets benefit from long operating lives, low operating costs, and exposure to steady market demand for clean electricity. This dual-track model strengthens Zenith's financial profile by combining short-term value creation from development sales with long-term revenue generation from energy production.

By constructing and operating a portion of its RtB pipeline, Zenith enhances its revenue base, builds tangible asset value on the balance sheet, and demonstrates its capability as a fully integrated renewable-energy operator.

Andrea Cattaneo, Chief Executive Officer of Zenith Energy, commented:

'We are pleased to expand our presence in Puglia, further strengthening Zenith's strategic cluster in one of Italy's most attractive solar regions. With this latest addition, our development portfolio now surpasses the 100 MWp milestone, reflecting consistent progress and strong execution.

The Puglia acquisition also reinforces our commitment to Battery Energy Storage Systems, a core element of our strategy to enhance flexibility, resilience, and long-term project value.

With a solid development base in place, our next priority is to bring selected Ready-to-Build assets into construction, supported by specialised lenders. This will provide tangible production revenue and further demonstrate the quality and bankability of Zenith's portfolio.

As outlined, we will divest a portion of our pipeline to realise immediate value while continuing to expand and advance our project base. This balanced model positions Zenith for sustained profitability and long-term growth across both solar and storage.'

Source: Zenith Energy