Highlights

- Independent Technical Report gives unrisked P50 and P10 Contingent recoverable gas resources of 109.28 and 234.42 BCF respectively net to PRD.

- Unrisked P50 and P10 Prospective recoverable gas resources of 139.67 and 312.16 BCF respectively net to PRD.

- Independent Technical Report for scoping potential CNG development gives NPV @10% 128.08 and undiscounted positive cash flow of US$207.504 million net PRD's economic interest with an IRR of 138%.

- Input assumptions 20 mm cfgpd production profile maintained for 6 years to recover 32.85 BCF net PRD at a flat gas price of US$12/mcf.

- Fully funded for all 2024 firm commitments

Predator Oil & Gas Holdings, the Jersey based Oil and Gas Company with near-term operations focussed on Morocco and Trinidad, has provided a corporate update.

Further to the announcement of 12 January 2024 in respect of an operations update, the Company is publishing today an Independent Technical Report ('ITR') by Scorpion Geoscience for the Guercif block and resource potential of the Moulouya Sub-Area following an evaluation of the 2023 drilling programme results.

https://wp-predatoroilandgas-2020.s3.eu-west-2.amazonaws.com/media/2024/01/Guercif_ITR_20240124.pdf

Gas resources

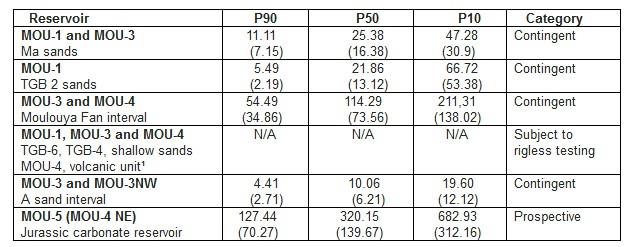

Table 1 Unrisked Contingent and Prospective Gas-in-Place and (Recoverable Resources) BCF (billion cubic feet of gas) net to PRD.

¹ Second phase of rigless testing using Sandjet will evaluate these intervals to determine whether the NuTech petrophysical interpretation indicating the presence of gas can be verified for some or all of these intervals.

As previously announced the Company's proposed 2024 work programme of rigless well testing and discretionary appraisal and exploration drilling, subject to regulatory consent and approvals, is designed to incrementally add potential resources for scalable CNG development funded expeditiously through managing organic cash flow.

Today's announcement of the expected commencement of rigless testing on or about 29 January 2024 is the first step in the process focussed on evaluating specific sands within the broader Ma and TGB 2 intervals in MOU-1 and MOU-3. For guidance only gas flow rates in the range 1 to 3 mm cfgpd from each of these wells in a success case would potentially be sufficient to support a future CNG pilot development option.

Depending on the rigless testing results, in particular whether or not there is any evidence for any rate of reservoir pressure depletion with time, well test data may be capable of being extrapolated to support the 2C and, potentially 3C, gas volumetrics shown in Table 1 for the Ma and TGB sand intervals. Test results and the composition of the test products may also help to calibrate other sands within these intervals that NuTech petrophysical logs suggest may be gas-bearing.

In the event the rigless test results are in alignment with the possible range of 2C and 3C recoverable resources, then a scoping CNG gas profile of 20 mm cf/day maintained for 6 years to recover a gross volume of 43.8 BCF may be achievable from 4 production wells (2 infill wells to be drilled at an appropriate time after production has been established and the rate of reservoir pressure depletion has been measured). Additional infill drilling may be required depending on well deliverability performances over time.

Based on this profile the ITR gives, using a flat industrial gas market price of US$12 per mcf, an unrisked scoping NPV@10% of US$108 million and an IRR of 138% with undiscounted positive cash revenues of US$ 207.504 million for the net Predator economic interest, equivalent to an unrisked and undiscounted US$6.345 million per BCF of CNG production.

Timing of "First Gas" depends on a number of third party factors including government and environmental consents and approvals and the long lead time for the purchase or leasing of CNG trailers and gas compressors. Once the rigless testing results become available the CNG services and equipment market can be evaluated with greater certainty in respect of delivery times.

The ITR summarises, amongst other matters: the geological risks; the impact of potential well formation damage; and the possible origins of the gas sampled to date pre-testing. It is intended that as far as is possible these risks will be addressed by the first phase of rigless testing.

These risks are enhanced in the case of several zones shown in Table 1 identified in MOU-1, MOU-3 and MOU-4 for rigless testing using Sandjet. Prudently therefore the Company does not assign any potential resources to these intervals at this time. Any gas resources confirmed within any of these intervals would be available for CNG development upscaling for very low additional development costs.

The ITR recognises additional prospectivity for gas in the Jurassic (both carbonate and clastic reservoirs) in structural and stratigraphic traps which include the up to 177 km² feature the edge of which was tested by MOU-4. If successfully proved up by future drilling it would require, once the demand in the industrial market had been satisfied, a gas-to-power marketing strategy to underpin a development case and/or an export market through the Maghreb gas pipeline, located just 9 kilometres from the area of current geological focus for the Company.

The Company is fully funded to complete its entire planned rigless testing programmes at Guercif.

IRELAND

The Company has received since its last operations update a communication from the GeoScience Regulation Office ("GSRO") at the Department of the Environment, Climate and Communications informing the Company that consideration of its application for a successor authorisation to Licensing Option 16/26 Corrib South is hoped to be concluded during Q1 2024 and that the GSRO would be writing to the Company shortly in relation to this matter.

Paul Griffiths, Executive Chairman of Predator, commented:

'We are pleased to be finally making progress on the rigless testing programme. The initial phase is important to us for designing and implementing the Sandjet rigless testing programme which will follow on after the Sandjet operational planning work is completed.

Sandjet rigless testing will be focussing on the Moulouya Fan and multiple zones at other levels which NuTech petrophysical logs suggest may contain hydrocarbons but which require validation by other means.

Cory Moruga planning work is being progressed in Trinidad this week to put in place a small operations teams to implement the proposed workover operations after planning is complete and environmental approvals have been received.

Ireland has taken us by surprise. We remain cautiously optimistic that we potentially have a partner for Corrib South in the event a successor authorisation is awarded. There is no guarantee that the conclusion of the GSRO DECC process would necessarily result in a positive outcome for the Company. Corrib South is a quality exploration asset adjacent to the Corrib gas field infrastructure and was formerly held by Shell under a Reserve Licence authorisation.'

Source: Predator Oil & Gas