Vår Energi will publish its financial report for the fourth quarter and full year 2022 on Thursday 16 February. Today, the Company provides an update on production and sales volumes and other relevant items.

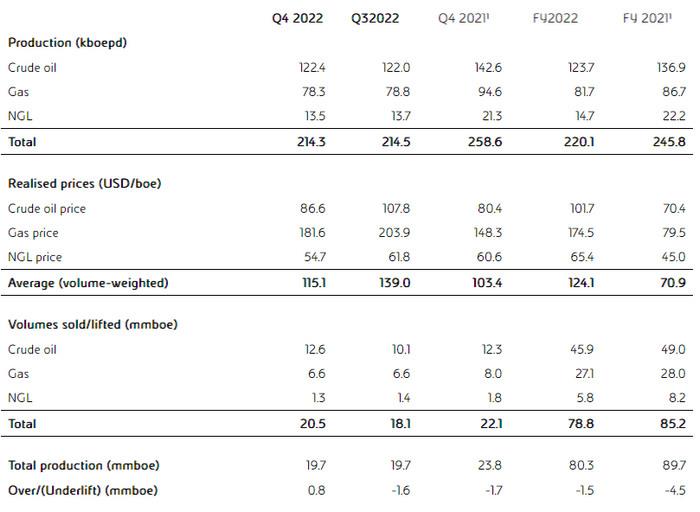

Vår Energi’s net production of oil, liquids and natural gas averaged 214 kboepd in the fourth quarter of 2022, stable compared to 214 kboepd in the third quarter of 2022 and a decrease of 18% compared to the fourth quarter of 2021¹. Production for the full year 2022 was within the revised guided range at 220.1 kboepd (down from 242 kboepd in 2021¹).

Production in the fourth quarter was negatively impacted by the fire at Åsgard B in November. This was balanced by positive contribution from all the other hub areas compared to the previous quarter.

The production split in the fourth quarter was stable from previous quarter with 63% oil and NGLs (liquids) and 37% gas. During the quarter, the Company continued to reduce NGL recovery to increase gas volumes and sales to capture the current favourable gas prices, representing approximately a reduction of 2 kboepd on an annual basis. Total volumes produced in the fourth quarter were 19.7 mmboe whereas volumes sold in the quarter amounted to 20.5 mmboe.

The Company obtained an average realised price (volume-weighted) of USD 115 per boe in the quarter in a continued strong commodity price environment. Realised gas price of USD 182 per boe is a result of flexible gas sales agreements, allowing for optimisation of indices and various exit points in Europe. Vår Energi had fixed price contracts for approximately 30% of fourth quarter gas volumes at an average price of USD 150 per boe.

¹ With effect from 1 January 2022, the Company adjusted its gas conversion factor from 6.65 to 6.29 boe per 1 000 Sm3 gas to be in line with Norwegian industry practice based on typical properties on the NCS. Production in Q4 2021 recalculated from 259 kboepd to 253 kboepd with adjusted conversion factor

Other items

Vår Energi’s functional currency is NOK, whilst interest-bearing loans are in USD. The strengthening of the NOK in the fourth quarter 2022 is expected to lead to a related net exchange rate gain of approximately USD 280 million.

Vår Energi has changed the calculation of over-/underlift in the financial statements to be in line with other operators on the NCS. From the fourth quarter of 2022, over-/underlift positions are valued at production cost.

Non-cash impairment charges are estimated to be in the range of USD 100 million before tax (around USD 25 million post tax) for the fourth quarter, mainly related to Balder. There are no material changes to the reserves, production profile or project economics of Balder that have resulted in the impairment.

Following the recent reorganisation of Vår Energi, the categorisation of the key strategic hub areas has changed to be the Barents Sea, The Norwegian Sea (including Åsgard), North Sea (including Tampen) and Balder area (including Grane). Fields previously categorised as ‘Other’ have been allocated to the hub areas. Historic data per field can be found on https://investors.varenergi.no/.

As previously communicated, the following items impacted the free cash flow in the fourth quarter: Cash tax payments of NOK 17 billion (USD ~1.7 billion), final payment to Exxon of USD ~340 million and a dividend payment for the third quarter of USD 290 million.

The information above is based on a preliminary assessment of the Company's fourth quarter and full year 2022 financial results and may be subject to change until the financial statements have been finally approved and published by the Company.

Presentation of Fourth quarter and full year 2022 and Capital Markets Update to be held on 16 February

Source: Var Energi