TotalEnergies has announced its Q1 2025 results

The Board of Directors of TotaEnergies, chaired by CEO Patrick Pouyanné, met on April 29, 2025, to approve the 1st quarter 2025 financial statements. On the occasion, Patrick Pouyanné said:

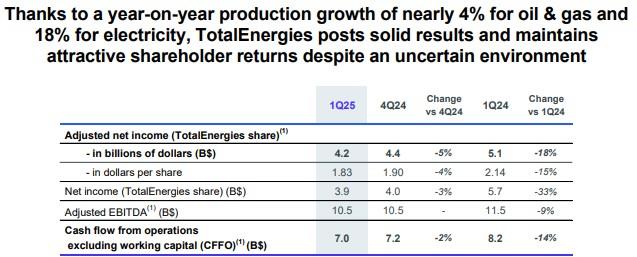

'In a price environment globally similar to the fourth quarter 2024, TotalEnergies delivered strong results in the first quarter 2025 that are in line with the positive results of the fourth quarter 2024, reporting $4.2 billion of adjusted net income and $7.0 billion of CFFO.

In the Oil & Gas business, first quarter production was above 2.55 Mboe/d, up 4% year-on-year, notably benefiting from the continued ramp up of projects in Brazil, the United States, Malaysia, Argentina and Denmark. The start-ups of the Ballymore offshore field in the United States during the second quarter and Mero-4 in Brazil expected in the third quarter will continue to add high-margin barrels and further reinforce the Company’s 2025 hydrocarbon production growth objective of more than 3%.

Exploration & Production generated adjusted net operating income of $2.5 billion and cash flow of $4.3 billion in the first quarter, up 6% and 9% quarter-to-quarter, respectively. Cash flow benefited from the accretive effect of new oil production that is both low-cost and low-emission.

Integrated LNG achieved adjusted net operating income of $1.3 billion and cash flow of $1.2 billion for the quarter, driven by LNG prices that were higher year-on-year but lower than fourth quarter 2024. LNG trading results were in line with expectations for 2025 while gas trading encountered the unexpected downturn of European markets following new heightened uncertainties on the evolution of the Russian-Ukrainian conflict.

During the first quarter, Integrated Power generated adjusted net operating income of more than $500 million and cash flow of $600 million, in line with annual Company guidance. TotalEnergies continued to deploy its differentiated Integrated Power model in Germany with the closing of the acquisition of the renewable energy developer VSB in the beginning of April and the launch of battery storage projects developed by Kyon.

In the context of weak refining margins together with declining petrochemical and biofuel margins in Europe, Downstream posted an adjusted net operating income of $0.5 billion, and a cash flow of $1.1 billion, below expectations due to operational performance at Donges and Port Arthur.

Confident in the Company’s ability to reach its 2025 underlying growth objective and taking into account the strength of its balance sheet (normalized gearing(1) of 11% excluding the seasonal effect of working capital), the Board of Directors has confirmed the distribution of the first interim dividend of €0.85/share for fiscal year 2025, an increase of 7.6% compared to 2024 and consistent with the attractive dividend growth guidance announced in February. Furthermore, it has also decided to again continue share buybacks for up to $2 billion in the second quarter despite a softening price environment with Brent below $70/b since the beginning of April and an uncertain geopolitical and macroeconomic context.'

1. Highlights (2)

Upstream

- Production start-up of the Ballymore offshore oil field, for 75,000 b/d, in the United States

- Launch, as part of GGIP, of the construction of an early gas treatment unit to stop flaring and supply gas-fired power plants in Iraq

- Signature of an agreement with Egypt and Cyprus for the export of Cyprus Block 6 gas through Egypt

Downstream

- Announcement of the shut-down of the cracker NC2 in the Antwerp platform by 2027, in the context of over-capacity of petrochemicals in Europe

Integrated LNG

- Signature of an LNG contract for 0.4 Mt/year over 10 years with GSPC, delivered in India from 2026

- Signature of an agreement for the sale of 0.4 Mt/year of LNG over 15 years to Energia Natural Dominicana from 2027

- Signature of an agreement with NextDecade for LNG offtake of 1.5 Mt/year over 20 years from the future Train 4 of Rio Grande LNG, in Texas

- Mozambique LNG: confirmation of the project financing by the US EXIM for $4.7 billion

Integrated Power

- Signature of a Clean Firm Power contract with STMicroelectronics for 1.5 TWh over 15 years

- Start-up of the 640 MW Yunlin offshore wind farm, in Taiwan

- Launch of six new battery storage projects, for a capacity of 221 MW, in Germany

- Closing of the SN Power acquisition, a hydro-electricity project developer, in Africa

- Closing of the acquisition of the Big Sky Solar facility (184 MW installed) and agreement to acquire additional wind and solar projects of more than 600 MW, in Canada

- Closing of the acquisition of the German renewable energy developer VSB

Carbon footprint reduction and low-carbon molecules

- Final Investment Decision of the second phase of the Northern Lights CCS project

- Launch of projects with Air Liquide to produce green hydrogen to European refineries

- Zeeland: Joint Venture for the construction and operation of an electrolyzer producing 30,000 tons of green hydrogen per year

- Antwerp: tolling agreement for 15,000 tons of green hydrogen per year

- Signature of an agreement with RWE for the supply of 30,000 tons of green hydrogen per year to decarbonize the Leuna refinery from 2030

- Start-up of BioNorrois, the second largest biogas production unit in France

Social and environmental responsibility

- Publication of the Sustainability & Climate – 2025 Progress Report presenting the progress made by the Company in 2024 in the implementation of its strategy and climate ambition

- Mozambique LNG: launch of official investigations in Mozambique, at the request of TotalEnergies, following allegations of human right abuses by members of Mozambique’s defense and security forces and request of the intervention of the National Commission of Human Rights.

Click here for full announcement

Source: TotalEnergies