- EBITDA of $2.16 billion, up 4% year on year

- Performance driven by domestic gas demand and efficient management of planned shut-down program

- ADNOC Gas continues to invest through the cycle to achieve its longer-term EBITDA growth target of over 40%

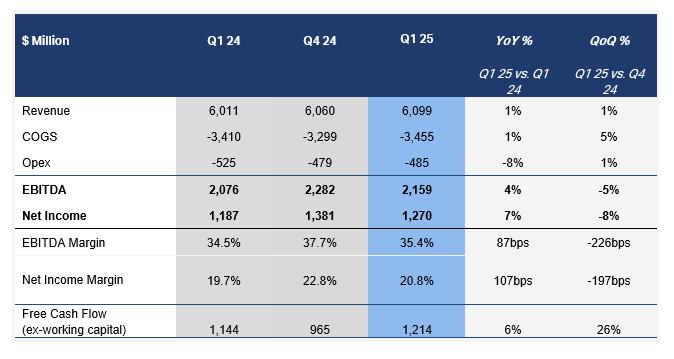

ADNOC Gas and its subsidiaries (together referred to as 'ADNOC Gas'), a world-class integrated gas processing and sales company, today announced net income of $1.27 billion and EBITDA of $2.16 billion for the first quarter of 2025, exceeding the equivalent quarter in 2024 by 7% and 4% respectively.

The performance was driven firstly by continued demand for domestic gas - up on the equivalent quarter last year - as a result of strong economic growth in the UAE, which lifted the total sales volume. Secondly, through efficient management of the planned shut-down program to boost processing capacity, a reduction in the number of days the Company’s plants were offline led to a rise in processed volumes.

Fatema Al Nuaimi, Chief Executive Officer of ADNOC Gas, said: 'This has been another outstanding quarterly performance by ADNOC Gas, supported by our resilient business model in a lower oil price market, which significantly exceeded market expectations. These results come on the back of successful supply agreements and the optimization of our ongoing shut-down program designed to power our continued growth. Looking ahead, we will use the strength of our balance sheet to invest through the cycle as we seek to realize EBITDA* growth of over 40% between 2023 and 2029.'

ADNOC Gas signed a series of mid to long term LNG supply agreements valued at circa $9 billion with the Indian Oil Corporation and JERA Global Markets of Japan during Q1, reinforcing its role as a leading supplier of lower-carbon fuel. The agreements support the growth of the Company’s international customer base as well as the transformation of global energy systems.

Q1 also saw a year-on-year uplift in CAPEX of 43% as ADNOC Gas continues to make the necessary investments through the cycle to grow the business and achieve its longer-term EBITDA targets. Project implementation remains on track, with the Company expecting to take a Final Investment Decision on its Rich Gas Development project in 2025.

As a result of the recently completed marketed offering of 3.1 billion shares in ADNOC Gas in which the free float increased by 4% to 9%, the Company is eligible for potential inclusion in the MSCI and FTSE indices as early as June and September respectively.

Alternative performance measures:

• Financial information as presented above includes ADNOC Gas' proportionate consolidation of JVs financial results.

• EBITDA includes proportionate consolidation of JVs and represents Earnings Before Interest, Tax, Depreciation and Amortization.

• Free cash flow (excluding working capital) as presented is based on the IFRS financial statements.

• The reconciliation between the financial data as presented and the IFRS financial statements is presented in the Management Discussion & Analysis Report.

*Assumes a flat oil price of $70/bbl between 2025 and 2029 and, in addition, the proportional consolidation of Ruwais LNG following completion and transfer to ADNOC Gas.

Source: ADNOC Gas