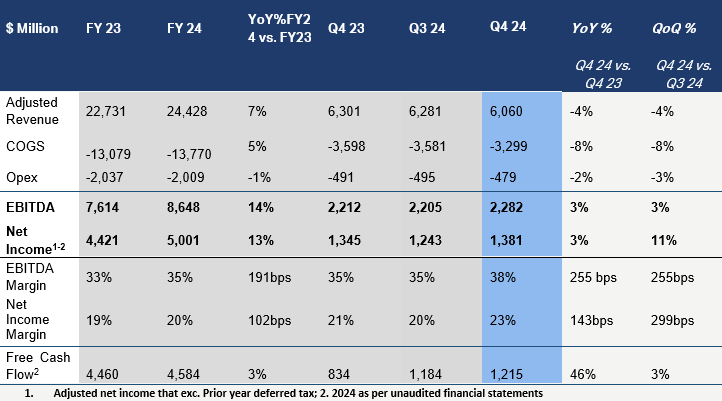

- $8.65 billion EBITDA for full year 2024, sees a rise of 14% year-on-year (YoY)

- Full year 2024 dividend of $3.41 billion confirmed, growing by 5% per annum

- Full year 2024 adjusted revenue of $24.43 billion up 7% YoY driven by greater diversified growth in the UAE economy

ADNOC Gas and its subsidiaries, a world-class integrated gas processing company, announced record earnings for the full year (FY) 2024 of $5 billion, and its highest quarterly income of $1.38 billion since its IPO, significantly ahead of the Bloomberg consensus for both periods.

Fatema Al Nuaimi, Chief Executive Officer of ADNOC Gas, said: 'Our record-breaking fourth quarter results demonstrate our ability to deliver on our ambitious growth strategy as we seek to realize EBITDA growth of over 40% by 2029. ADNOC Gas’ evolution into one of the highest income generating companies listed in the UAE, which is a testament to our commitment to create long-term and sustainable value for our shareholders, as we invest in growth projects to meet the growing demand for lower carbon Domestic Gas, LPG and LNG, both locally and globally as key fuels in the energy transformation.'

FY and Q4 2024 Results

For the full year period, adjusted net income increased by an impressive 13% year-on-year to $5 billion. The company’s strong performance was underpinned by robust demand for domestic gas which supported volume growth and improved pricing. Total sales volumes in FY 2024 increased by 2% to 3,616 million MMBTU. This increase in volume was enabled by a 13% increase in the ADNOC LNG (ALNG) joint venture contribution.

Adjusted revenues increased by 7% YoY in FY 2024 to $24.43 billion driven by a 2% increase in sales volume and improved pricing. The company’s strong top line performance for 2024 translated into a strong EBITDA growth of 14% to $8.65 billion with a high, stable margin of 35%. Free cash flow for the period reached an impressive $4.58 billion, reflecting the company’s strong cash conversion capabilities.

The company’s stellar fourth quarter results reflect the ongoing disciplined execution of its updated strategy that was unveiled after Q3 2024. The plan targets an increase of over 40% in EBITDA by 2029 and entails capital expenditure (CAPEX) of up to $15 billion for the 2025-2029 period, which includes the acquisition of ADNOC’s 60% share of the lower-carbon intensity Ruwais liquefied natural gas (LNG) project at cost in H2 2028.

ADNOC Gas delivered adjusted revenues of $6.06 billion, EBITDA of $2.28 billion and net income of $1.381 billion in the fourth quarter of 2024. The robust improvement was driven by several factors including a richer mix of gas, producing more liquids, and improved commercial terms in the domestic market.

Full year dividend confirmed

For the financial year 2024, ADNOC Gas confirms its dividend of $3.412 billion, of which an interim cash dividend of $1.706 billion was paid in September 2024 and an additional $1.706 billion is expected to be paid in April 2025, pending approval at the Annual General Meeting (AGM). The final dividend for FY 2024 is in line with the company’s robust policy to increase the annual dividend by 5% annually and reflects the company’s strong free cash flow, which exceeds the dividend commitment by over $1 billion.

About ADNOC Gas

*ADNOC Gas which refers to ADNOC Gas Plc and its subsidiaries (ADX: ADNOCGAS), listed on the ADX (ADX symbol: “ADNOCGAS” / ISIN: “AEE01195A234”), is a world-class, large-scale integrated gas processing company. We operate across the gas value chain, from receipt of feedstock from ADNOC (through large, long-life operations for gas processing and fractionation) to the sale of products to domestic and international customers. ADNOC Gas supplies approximately 60% of the UAE’s sales gas needs and supplies end-customers in over twenty countries.

Source: ADNOC Gas