Challenger Energy Group, the Atlantic margin focussed energy company, has provided an operational and corporate update.

A technical presentation for AREA OFF-3 is available on the Company's website.

Highlights

- Uruguay, AREA OFF-3:

- The first phase of the Company's technical work programme has successfully been completed, with multiple new seismic attribute supported anomalies identified

- Material aggregate resource potential from two primary prospects, comprising a best estimate (Pmean) of ~380 million barrels oil recoverable, and an upside (P10) case of ~980 million barrels oil recoverable

- Shallow water and reservoir depths of these primary prospects underpin relatively low development costs, and thus commerciality at even modest discovery volumes

- Considerable additional exploration potential, including possible slope turbidite and low stand fan play exposure in the north-east of the block

- The planned farmout process for AREA OFF-3 has commenced

- Uruguay, AREA OFF-1:

- 3D seismic acquisition expected to commence in late 2025, pending final environmental permitting

- Corporate:

- Sale of the Company's Trinidad and Tobago business has been finalised, resulting in a complete exit from all operations and exposures in that country

- The Company reports a strong cash position, with all planned operations fully-funded into 2027

Eytan Uliel, CEO of Challenger Energy, said:

'There is strong momentum across our business as we continue to execute our plan - advancing exploration activities in Uruguay, optimizing our portfolio, and continuing to execute on our business strategy. We have completed the first phase of technical work on AREA OFF-3 with encouraging results, and our farm-in process for this block has now commenced. Meanwhile AREA OFF-1 remains on track to see 3D seismic acquisition commence at the end of this year, we completed our full exit from Trinidad and Tobago, and prudent cash management means we have sufficient funds for everything we plan to do over the next 18 months. Overall, therefore, the upcoming period promises to be busy and exciting for Challenger Energy - I look forward to updating shareholders as to our continued progress'.

Uruguay AREA OFF-3 - 'farm-out process launched'

The first phase of the Company's technical work programme for the AREA OFF-3 block, offshore Uruguay, has now been completed.

That technical work programme consisted principally of reprocessing, interpreting and mapping of 1,250km2 of 3D seismic data, supplemented by a number of other geophysical and geochemical work streams, similar to the technical work processes undertaken on AREA OFF-1 prior to the farmout to Chevron.

The work completed substantially discharges all minimum work obligations for the first exploration period of AREA OFF-3 (completion of two geotechnical desktop reports are the sole remaining work items for the first period minimum work obligation, and can be completed at any time prior to the end of the first exploration period in June 2028).

Highlights from the technical work thus far undertaken on AREA OFF-3 by the Company are:

- Multiple new seismic attribute supported prospects and leads were identified from 2025 reprocessed 3D seismic data, and further corroborated by degree of structural conformance, DHI (flat spot) and amplitude variation with offset (AVO) analysis

- The two primary prospects - Benteveo and Amalia - are material, and comprise an aggregate best estimate (Pmean) of ~380 million barrels recoverable and an upside (P10) case of ~980 million barrels recoverable

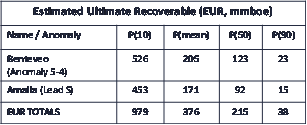

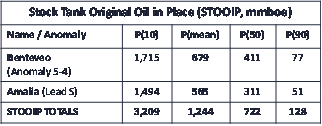

- The Company's EUR (Expected Ultimate Recoverable) and STOOIP (Stock Tank Original Oil in Place) assessments for these two prospects are summarised as follows:

|

|

|

- Shallow water depth (<350 metres) and reservoir depth (~2,300 metres) underpins relatively low development costs, and thus commerciality at even modest discovery volumes (initial estimates are that 100 - 125 mmboe recoverable would be commercial)

- Technical work has also indicated considerable additional exploration potential on AREA OFF-3, including:

- an inventory of further identified leads that remain to be mapped and interpreted in detail - exploration success with primary prospects would likely derisk several of these leads, and

- in addition to the 1,250km2 of 3D seismic data already reprocessed, mapped and interpreted by the Company, an additional 2,000 km2 of reprocessed 3D seismic data is available for licensing and further analysis, covering the north-eastern segment of the block adjacent to the Brazilian maritime border - regional 2D coverage indicates possible slope turbidite and low stand fan play exposure in this north-eastern segment of the block (a similar play system to that which has yielded many of the recent, major discoveries on the Namibian margin of the South Atlantic basin).

With the first phase of its AREA OFF-3 technical work programme now complete, the Company has launched a formal farm-out process for the AREA OFF-3 block. The initial phase of this process will see multiple parties invited to undertake technical and commercial evaluation of the opportunity. The Company will be seeking initial offers by year-end, with a view to selecting a suitable partner(s) during the first quarter of 2026.

Uruguay AREA OFF-1 - '3D seismic acquisition upcoming'

Public consultations have been held in Uruguay in relation to the award of the requisite environmental permits for 3D seismic acquisition across multiple Uruguayan offshore blocks to various seismic vendors. The award of permits is anticipated in the coming months, facilitating (as previously communicated) 3D seismic acquisition on AREA OFF-1 to commence in late Q4 2025.

Trinidad & Tobago - 'full exit completed'

As advised on 1 September 2025, the sale of the Company's entire business, assets and operations in Trinidad and Tobago has been completed. The sale took the form of a complete exit, such that the Company has not further involvement in, or exposure to, operations in that country. The Company has thus far received approximately $750,000 in cash proceeds from the sale, with a further $1 million due on an unconditional basis in instalments ($500,000 on 31 August 2026, $250,000 on 31 December 2026, and $250,000 on 31 December 2027).

Corporate - 'strong cash position and fully-funded'

The Company's half-year report for the period to 30 June 2025 was published on 3 September 2025. As indicated in that report, the Company's cash position as at 30 June 2025 was approximately $6.6 million, not including $0.7 million in restricted cash holdings, and not including the $1.75 million in proceeds due to the Company from the sale of its business in Trinidad and Tobago. As noted in the half-year report, the Company's overhead 'burn' rate and future capital needs are such that the Company expects to be fully funded for all planned activities for the balance of 2025, all of 2026, and well into 2027, without the need for any additional capital.

Source: Challenger Energy