Highlights

- Acquisition of further non-operated working interest (WI) in leases and wells with conventional onshore production and in development assets within the Permian Basin of Texas, U.S.

- Average net working interest acquired by 88 Energy of approximately 45% based on 88E WI in 435 net acres.

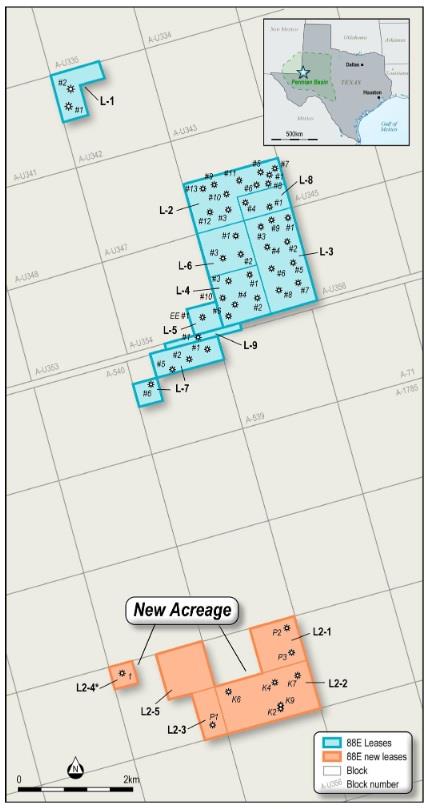

- New acreage is located approximate 4 miles south of existing Project Longhorn production assets.

- Operator of the Project Longhorn assets, Lonestar I, LLC, will also acquire a working interest in the new assets and will operate the new field through an affiliate, with the remaining interests retained by existing joint venture partners.

- The purchase price of US$1.5M (net to 88E US$1.1M) to be paid in cash by 88 Energy and the JV partner Lonestar I, LLC (the Operator).

- Attractive low-cost entry of ~US$1.00 per BOE across net 2P reserves of 1.1MMBOE (1,2).

- Additional upside potential identified in multiple zones and classified as Possible Reserves (0.3 MMBOE (1,2)), along with Contingent and Prospective Resources which are yet to be quantified.

- Operator targeting 2 new production wells in 2H 2023 expected to increase production to 160-200 BOE gross per day (~75% oil). Limited existing production of approx. 12 BOE per day gross (~75% oil) across 8 historical and depleted wells).

- Complements the further 2 work-overs planned in 2H 2023 on the existing Longhorn acreage.

- Upon successful completion of the new wells and work-overs across all its Texan acreage, together with the existing producing wells, 88 Energy expects Project Longhorn total gross production to reach approximately 500 BOE per day (~75% oil) by year end 2023.

88 Energy has announced the execution of binding agreements for the acquisition of a new non-operated working interest (averaging ~45% net to 88 Energy) in leases and wells with conventional onshore production and in development assets within the Permian Basin of Texas, U.S.

The new oil and gas production and development assets will form an expansion of the existing Project Longhorn (Longhorn) acreage and are located approximately 4 miles to the south. The newly acquired acreage is estimated to contain independently certified net 2P reserves of 1.1 MMBOE(1,2).

Importantly, all proposed well locations have been classified as low risk, accessing Proven reserves totalling 0.97 MMBOE(1,2), given the production histories from existing wells on the newly acquired leases as well as adjacent leases. Additionally, these wells should intersect multiple potentially oil-bearing intervals which have been successfully developed in the vicinity of Project Longhorn. Consequently, upside has been identified and classified as Contingent or Prospective Resources and will be quantified in due course.

The purchase price for the acquisition is US$1.5 million (net to 88E US$1.1 million) to be to be paid in cash by 88 Energy and Lonestar I, LLC.

The acquisition provides 88 Energy with immediate production upside through 2 new wells planned in 2H 2023 (on leases which Longhorn will have ~75% working interest), each anticipated to deliver IP30 of approximately 80-100 BOE per day gross (~75% oil), with each well anticipated to cost ~US$1.5 million net to 88E (to be funded primarily through forecasted cash flow from existing Longhorn production assets).

The existing Project Longhorn assets are currently producing ~400 BOE per day gross (~ 75% oil), which together with the two new wells planned on the newly acquired acreage, as well as 2 work-overs on the existing Longhorn acreage, are anticipated to deliver a gross production rate of approximately 500 BOE per day by the end of 2023.

The acquisition represents a further expansion of 88 Energy’s move into producing oil and gas assets and is in line with the Company’s strategy to build a successful exploration and production company. This further step has again been undertaken in a measured fashion via the purchase of a non-operated working interest whilst retaining a single basin focus. Project Longhorn contains well understood geology with low technical risk and provides near-term upside via low-cost field development opportunities.

Project Longhorn: Existing and New Acreage – conventional onshore oil & gas in Texas

The existing and newly acquired Project Longhorn assets are in the attractive Permian Basin; they cover approximately 1,399 net acres (of which 435 acres relates to the newly acquired leases). The combined portfolio of assets consists of 14 leases 5 newly acquired leases) with 40 producing wells (8 within the newly acquired leases) and associated infrastructure. Lonestar I, LLC will have a working interest in the assets, and through an affiliate will continue as Operator for the existing and new leases and wells, with the remaining working interests retained by existing Joint Venture partners.

The existing production wells in the newly acquired acreage have been in operation for several years. Production from the new Project Longhorn leases in FY2022 totalled approximately 5,000 BOE, which had an immaterial estimated attributable net profit/loss before tax for the project (unaudited). Current average production is approximately 12 BOE per day (88 Energy’s net working interest: ~10 BOE per day), of which approximately 75% is oil.

As part of the acquisition, 88 Energy has agreed to a low-cost 2 well work program for 2H CY2023 (on leases in which Longhorn has a ~75% working interest). These initiatives are expected to deliver initial production rates of approximately 160-200 BOE per day gross (~75% oil).

Gross (100%) and Net Entitlement Reserves to 88 Energy (~45% net working or net revenue interest ~38%) have been independently assessed by PJG Petroleum Engineers LLC as at 1 June 2023 as follows:

Further ASX Listing Rule 5.31 Information (Notes to Reserves) related to these Reserves is provided in Appendix 1.

Acquisition details

On 1 July 2023 the Company, via its 75% ownership interest in subsidiary Bighorn Energy, LLC (Bighorn), acquired an interest in the new leases (Bighorn Phase 2 leases) from Oxy USA WTP LP for consideration of US$1.5 million gross to be paid in cash by 88 Energy and Lonestar I, LLC. Bighorn will acquire interests in the Bighorn Phase 2 leases of between 8% - 100% gross working interest of the leases and wells.

Lonestar I, LLC is a privately held oil and gas production company located in Texas U.S., with significant experience in operating profitable oil and gas assets. Lonestar I, LLC and its affiliates have built a team of experienced oil and gas professionals with broad technical and commercial skills that will continue to Operate the assets on behalf of the Joint Venture. Together with 88 Energy they will work to improve production and profitability of the assets and have the capacity to both financially and technically deliver on future development work programs. 88 Energy has completed customary due diligence on both the assets and Lonestar I, LLC.

(1) Refer to page 3 for initial reserves estimates and assumptions.

(2) Net Revenue Entitlement to 88 Energy.

Source: 88 Energy