88 Energy has executed a binding Securities Purchase Agreement (SPA) with Lonestar I, LLC (Lonestar), Operator of Project Longhorn, for the sale of its 75% non-operated working interest in the producing oil and gas assets located in the Permian Basin, Texas, USA (Project Longhorn), held through subsidiary Longhorn Energy Investments LLC (88E - Longhorn).

Transaction Highlights

- Total consideration of US$3.25 million, with final consideration subject to customary working capital and completion adjustments at the effective date, 1 July 2025.

- Proceeds to be redeployed into core exploration assets in Alaska and Namibia, in line with the Company's stated growth strategy.

- The Company elected not to participate in a new multi-well drill program at Project Longhorn, and 88 Energy is no longer exposed to costs associated with Project Longhorn, with an estimated gross cost of US$2 million per well.

- Maintains financial discipline and focus on higher-impact, exploration-led value creation.

- Since its acquisition in 2022, Project Longhorn has delivered meaningful cash flow of approximately US$6.1 million, which supported exploration and overhead costs.

Managing Director, Ashley Gilbert, commented:

'The divestment of our interest in Project Longhorn is consistent with our disciplined approach to capital management and focus on assets with the potential to deliver outsized returns. This transaction further supports our efforts to accelerate progress across our exploration portfolio in Alaska and Namibia, jurisdictions that we believe offer an exceptional opportunity to generate meaningful value for our shareholders.

We thank our Project Longhorn partners and extend our best wishes for their future drilling campaigns in the Permian Basin.'

Transaction Overview

Following a strategic portfolio review conducted in Q1 2025, the Board concluded that Project Longhorn's operating asset base no longer aligned with the Company's long-term strategy, which is focused on high-impact exploration opportunities, primarily in Alaska. This decision was informed by the projected capital intensity of Project Longhorn's future development plans, which would be required to maintain projected cash flows, and by 88 Energy's objective to streamline its portfolio and redeploy capital to assets with greater upside potential. The future development plans at Project Longhorn are expected to involve a multi-well drill program, with an estimated gross cost per well of ~US$2 million, and the transaction removes the Company's obligation to future costs associated with Project Longhorn, enabling 88 Energy to deploy its resources towards higher-impact, exploration-led opportunities.

Key terms of the transaction include:

- Total Consideration: US$3.25 million

- Effective Date: 1 July 2025

- Completion Adjustments: Subject to customary reconciliation as at 30 June 2025, including adjustment for cash, receivables, crude oil inventory, and liabilities.

A divestment process was completed for the sale of Project Longhorn, with 88 Energy initially agreeing terms under a non-binding Memorandum of Understanding with a third party. Subsequently, Lonestar exercised its rights to match the offer and will now hold 100% of the assets on completion of the transaction.

Strategic Focus

The divestment marks a significant milestone in 88 Energy's strategic repositioning, allowing the Company to concentrate fully on its core exploration growth pillars:

- Alaska: Progressing near-term exploration and appraisal activity at Project Leonis and Project Phoenix, with strong prospectivity and the potential to deliver transformational value outcomes.

- Namibia: Advancing early-stage exploration in PEL 93, providing material frontier exposure within a globally prospective emerging petroleum province, following multiple high-profile discoveries in adjacent acreage.

The Project Longhorn assets have delivered meaningful cash flow from ongoing existing production and low-cost workovers since acquisition in 2022. This supported corporate overheads and exploration activities over the period, with total cash distributions of approximately US$6.1 million to the Company, net of operating expenses and capital invested in workovers.

However, the Operator's next-phase development plan, which comprises higher-cost, lower-margin new drilling which is required to maintain future cash flows from Project Longhorn, does not align with 88 Energy's capital allocation priorities.

Importantly, since acquiring its interest in Project Longhorn in 2022, the Company's leasing costs in Alaska have been significantly reduced and combined with overhead cost reductions in 2024 and current cash on hand. The need to rely on production cash flows has been meaningfully reduced, enabling the Company to dispose of its interest in Project Longhorn and bring forward potential future cash flows from the project that otherwise would be at risk over a three to five-year horizon

88 Energy is in a well-funded position for the next stage of growth and this transaction frees potential future capital expenditure to pursue higher-return opportunities across its portfolio.

Further Details on Project Longhorn

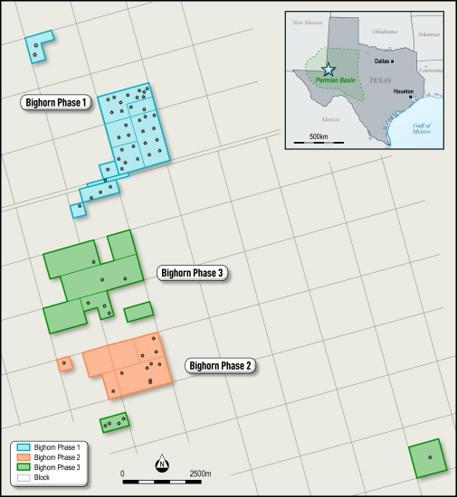

The Project Longhorn assets are located onshore in the Permian Basin, Texas, with approximately 2,830 acres (net to 88 Energy). The assets consist of 19 leases with 40 producing wells and associated infrastructure. Prior to the transaction, Lonestar I, LLC held a ~24% net working interest in the assets and is Operator. Recent activity on the assets includes the completion of six workovers in 2022 and four workovers in 2024 to increase or maintain production to combat typical decline rates, with an extensive future work program planned to underpin future production. Net reserves to 88 Energy for Project Longhorn at 31 December 2024 comprised 0.98 MMBOE (1P), 1.4 MMBOE (2P) and 1.75 MMBOE (3P). The 2025 Half year financial report will reclassify the Project Longhorn Investment to Assets Held for Sale. An impairment to bring the carrying value to fair value less costs to sell will also be recognized, with the impairment expected to be approximately US$10 million based on the headline sale price (value of proved developed and producing reserves) less anticipated sale costs, compared to the carrying value for the asset of US$12.5 million in the Company's accounts as at 30 June 2025 (US$13.5 million at 31 Dec 2024 audited accounts). This adjustment is reflective of the undeveloped resources where significant investment of over US$18 million would have been required by 88 Energy over the coming years, as well as recognition of downward oil price movements and forecast production type curve adjustments. There will be a corresponding impact on the Company's net profit/loss for the half year ended 30 June 2025 due to the impairment charge.

Source: 88 Energy