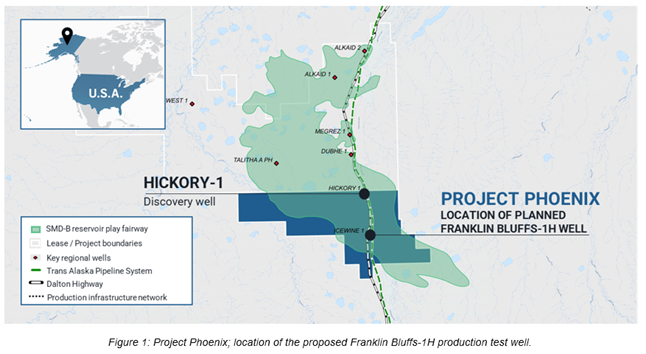

88 Energy has provided an update on Project Phoenix (~75% working interest), its advanced conventional oil and gas project located on the North Slope of Alaska.

Project Phoenix is subject to a Farmout Participation Agreement, entered into with Burgundy Xploration LLC (Burgundy) in February 2025. Under the terms of this agreement, 88 Energy is fully carried for all costs associated with the upcoming horizontal well and extended flow test.

Highlights

- Franklin Bluffs-1H horizontal well and extended flow test planned for Q3 2026.

- An initial pilot hole is planned to test the SMD, SFS and BFF reservoir zones, followed by wireline logging, before suspending the well.

- Production test in horizontal section to target the SMD-B reservoir, the best-developed topset sandstone within the Campanian sequence.

- Icewine-1 intersected a 71ft net sandstone sequence in the SMD-B with up to 14% effective porosity, while Hickory-1 recorded up to 11% porosity in the same interval.

- Analysis of pilot hole and logging results to guide horizontal well planning and design, prior to drilling the horizontal production well and commence the extended production test.

- Operational readiness is advancing, with Fairweather LLC appointed for execution support and key staffing and operational enhancements underway, including the appointment of an Alaska-based representative.

- Burgundy advancing funding initiatives and commencing operational spend to support a 2026 spud.

- Draft registration statement for Burgundy's proposed IPO confidentially lodged with the U.S. Securities and Exchange Commission (SEC).

- The prolonged United States government shutdown in 2H 2025 has delayed SEC review timelines. Consequently, 88 Energy has granted Burgundy an extension under the Participation Agreement until 30 April 2026 to complete its obligations in the farm-out agreement.

- Burgundy declared the successful bidder in the recent North Slope Fall 2025 Bid Round for a further 82,080 acres adjacent to the Toolik River Unit, with 88E securing the right to participate up to 25% working interest until 1 October 2026 at cost (bid bonus and rentals paid only).

- Burgundy to pay US$2,400,000 to 88 Energy for access to the Icewine 3D seismic data which covers a portion of the new leases recently secured by Burgundy, with US$150,000 due by 1 December 2025, and the balance within 60 days of a successful IPO.

Burgundy Joint Venture Update

Burgundy continues to progress its funding program for the Franklin Bluffs-1H horizontal well and extended production test. Supported by sophisticated energy investors, Burgundy has invested more than US$26 million into Project Phoenix and has met all cash call requirements since the Farmout Participation Agreement was executed in February 2025.

On 15 October 2025 Burgundy announced that it had confidentially submitted a draft registration statement on Form S-1 with the SEC relating to the proposed initial public offering (IPO) of common stock. The IPO is expected to occur after the SEC completes its review process, subject to market and other conditions. With the prolonged United States government shutdown in 2H 2025, this has extended usual SEC review timelines. Consequently, 88 Energy has granted Burgundy an extension under the Participation Agreement until 30 April 2026 to complete its obligations in the farm-out agreement.

Burgundy's operational readiness to drill has also advanced. Fairweather LLC has been appointed to support execution, planning is underway to secure the Franklin Bluffs 3D seismic dataset, and Burgundy has strengthened its in state presence through the appointment of a dedicated Alaska-based engineer. The Burgundy team has recently undertaken meetings in Anchorage with Government agencies, key vendors and other stakeholders to advance permitting and logistical preparations.

Together, these activities place Burgundy in a strong position to meet its joint venture commitments and support the Franklin Bluffs 1H drilling and production test programme in 2026.

Note: This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended.

Joint Venture Partner Farm-Out Recap

Under the Farmout Participation Agreement, Burgundy intends to fully fund up to US$39 million (approx. A$60 million) of Project Phoenix's total gross future work program costs in exchange for up to an additional 50% Working Interest (WI) in Project Phoenix from 88 Energy. This agreement provides a clear stage funding pathway towards a final development:

- Phase 1: Burgundy to fund US$29 million (approx. A$45 million) for the CY25/26 work programme, including drilling of a horizontal well and production testing scheduled for Q3-CY26. 88 Energy is fully carried during this phase, resulting in a 35% WI on completion.

- Phase 2: Upon Phase 1 Success; Burgundy to fund up to US$10 million (approx. A$15 million) for an additional well or other CAPEX program (88E carry up to US$7.5 million (based on its current 75% WI), resulting in a 25% WI post-Phase 2.

Project Phoenix Pilot Hole, Horizontal Well and Production Test

Following execution of the farm-out agreement with Burgundy in February 2025, planning has progressed for the Franklin Bluffs-1H horizontal well and extended production test scheduled to spud in Q3-CY26. The well will be drilled from the existing Franklin Bluffs gravel pad and will target the SMD-B reservoir, one of the most promising zones identified at the Hickory-1 discovery well.

Burgundy has proposed an initial pilot hole designed to intersect multiple reservoir intervals, including the SMD and the deeper SFS and BFF. A full wireline logging and coring programme will be completed, with plans to utilise reservoir sampling tools such as an MDT to test and recover hydrocarbons to surface if possible.

The pilot hole will be suspended while results are analyzed and incorporated into the detailed design of the Franklin Bluffs -1H horizontal well section. Key parameters include:

- Target Zone: SMD-B

- Lateral Length: ~3,500ft to ~5,200 feet

- Test Duration: ~90 days flow back and production test.

- Spud Date: 2H-CY26.

Click here for full announcement

Source: 88 Energy