88 Energy has advised that Burgundy Xploration has settled the residual balance, including interest and fees owed as part of the Hickory-1 flow test expenditure.

Highlights

- Final payment of US$2.2 million is in addition to the US$1 million received in February.

- Provides further balance sheet strength, with current cash position of over A$10 million2.

- Payment follows the Company's execution of a Farmout Participation Agreement (PA) with Burgundy in relation to Project Phoenix in February 2025.

- PA provides for a full carry for costs associated with the upcoming horizontal well programme, including an extended flow test currently scheduled for mid-CY26.

- Contributes to the procurement of long-lead items for the planned CY26 horizontal drilling and production test programme.

Background and Detail

The final payment of US$2.2 million (A$3.4 million) is in addition to the US$1 million received in February 2025, further strengthening the Company's treasury position to over A$10 million2. Settlement of these balances follows the Company's 17 February 2025 announcement outlining binding terms for a Farmout Participation Agreement (PA) with Burgundy in relation to Project Phoenix. Under the agreement, 88 Energy's wholly owned subsidiary, Accumulate Energy Alaska, Inc. (Accumulate), will be fully carried for all costs associated with the upcoming horizontal well programme, including an extended flow test currently scheduled for mid-CY26.[1]

Burgundy Xploration LLC is a Texas-based private oil and gas company backed by sophisticated energy investors, which has invested over US$26 million in Project Phoenix to date. Burgundy has secured initial funding to settle the residual balance owed to 88 Energy and to initiate procurement of long-lead items for the planned CY26 horizontal drilling and production test programme.

The recently announced PA marks a key milestone for 88 Energy, serving to financially de-risk Project Phoenix while delivering significant value for shareholders. Importantly, the PA implies a transaction value approximately 50% higher than 88 Energy's invested capital in Project Phoenix since mid-CY22, while enabling investors to continue to participate in future success. Following completion of the PA, Burgundy will become the operator of Project Phoenix, enabling 88 Energy to focus on advancing and de-risking Project Leonis.

1: Note: Burgundy's ability to provide a full carry to 88 Energy and its farm-in to this acreage is contingent on Burgundy successfully completing a fund-raising program in CY25.

2: Unaudited cash at bank balance as at date of announcement.

Project Phoenix: Forward Work-Program:

88 Energy has commenced work with Burgundy to progress planning and permitting for the horizontal test well and flow back operation scheduled for mid-CY26. Upon completion of the Farm-out transaction, transition of operatorship to Burgundy will occur.

Experienced Alaskan service provider, Fairweather LLC has been retained to manage project planning, permitting and operational support to ensure that well objectives are met. Additionally, recent work completed by ResFrac will be incorporated into the planning for the stimulation and flowback programme of the planned horizontal well.

Key Details of the Planned Horizontal Well and Flowback Operation:

- Location: Franklin Bluffs gravel pad

- Planned Zone for Flow Test: SMD-B.

- Lateral Length: ~ 3,500 ft

- Operational Test Duration: ~ 90 days

- Planned Spud Date: Mid-2026

Table 1: Indicative Project Phoenix Timeline

|

Project Phoenix |

|

|

|

|

|

|

||||||

|

Indicative Project Phoenix timeline1 |

H1-24 |

H2-24 |

H1-25 |

H2-25 |

H1-26 |

H2-26 |

||||||

|

Successful Hickory-1 flow test flows light crude oil to surface |

P |

|

|

|

|

|

||||||

|

Post-well analysis and updated Contingent Resource Estimate |

|

P |

|

|

|

|

||||||

|

Targeted farmout to de-risk and provide pathway to production test |

|

P |

|

|

|

|

||||||

|

Planning/permitting/design for horizontal production test2 |

|

n |

n |

n |

n |

|

||||||

|

Extended horizontal production test2 |

|

|

|

|

n |

n |

||||||

1 This timeline is indicative and subject to change. The Company reserves the right to alter this timetable at any time.

2 Horizontal production test subject to farm-out/funding as well as government and other approvals.

Figure 2:Project Phoenix oil flowed to surface during Hickory-1 flow testing operations Q1 2024.

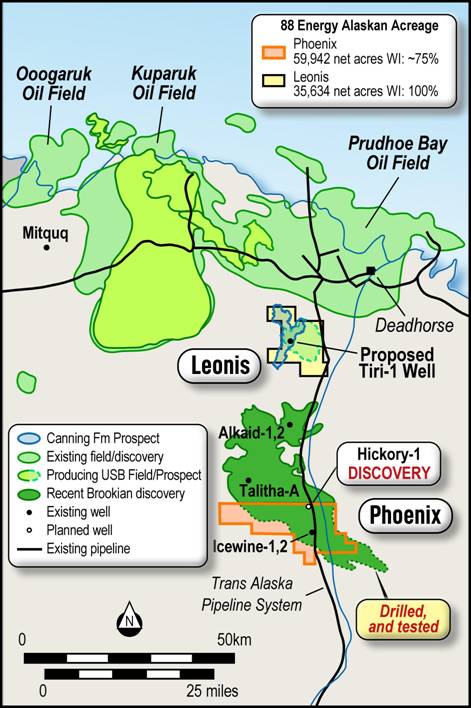

About Project Phoenix (~74.3% WI) and the Hickory-1 Discovery Well

The Hickory-1 discovery well was drilled in February 2023 and flow tested during the Alaskan winter season in Q1/Q2 CY24. Testing focused on the two shallower primary targets, the Upper SFS (USFS) reservoir, previously untested, and the SMD-B (SMD) reservoir. Each zone was independently isolated, stimulated, and flowed oil to the surface either naturally or using nitrogen lift to facilitate efficient well clean-up. On the 18th of September 2024, a contingent resource for the SMD-B, Upper SFS and Lower SFS reservoirs was issued by ERCE. This contingent resource is now added to the pre-existing contingent resource in the BFF reservoir, issued by NSAI in November 2023. The total net 2C contingent resource at Project Phoenix is 239 MMBOE (refer to page 4 for further details).

Figure 3: Alaska, North Slope, highlighting Project Phoenix and the location of the Hickory-1 discovery well.

Figure 4: Project Phoenix 88 Energy Net Entitlement 2U Contingent Resources with untested 2U Prospective Resource upside. (Project Phoenix total unrisked net entitlement prospective resources (MMBBL) 1U: 53, 2U: 153, 3U: 321 and Mean 155. Refer to announcement dated 18 September 2024 and Cautionary Statement below).

Table 2: Project Phoenix net entitlement to 88 Energy (63.3%) Contingent Resources estimates by NSAI and ERCE

|

Project Phoenix |

NET (~63.3%) Contingent Resources 4,6 |

||||

|

Reservoir |

Auditor |

UoM |

Low (1C) |

Best (2C) |

High (3C) |

|

SMD-B |

ERCE1,3 |

MMBOE |

7 |

24 |

79 |

|

Upper SFS |

ERCE1,3 |

MMBOE |

6 |

21 |

72 |

|

Lower SFS |

ERCE1,3 |

MMBOE |

8 |

35 |

123 |

|

BFF |

NSAI2,5 |

MMBOE |

62 |

158 |

367 |

|

Total (7) |

|

|

83 |

239 |

640 |

Notes to table 2:

1. ERCE: ERCE Australia Pty Ltd

2. NSAI: Netherland, Sewell & Associates Inc.

3. Refer to ASX announcement dated 18 September 2024; page 6, Appendix 2 and disclaimers for further details.

4. Million Barrels of Oil Equivalent (MMBOE) of estimate contingent resource. NGLs are converted to oil equivalent volumes on a constant ratio basis of 1:1. Gas is converted to oil equivalent volumes on a constant ratio basis of 5.5 BCF per 1 MMBOE.

5. Please refer to ASX announcement dated 18 September 2024 page 7 and ASX announcement dated 6 November 2023 for further details in relation to the BFF Contingent Resource estimate. Note the Basin Floor Fan (BFF) reservoir was drilled and tested on adjacent acreage by Pantheon Resources

6. 88 Energy net resource entitlement of ~63.3% has been calculated using an average 74.3% working interest net of a 12.5% government royalty and a 4% Overriding Royalty on 18 leases.

7. Totals by reservoir rounded and project total may not sum due to rounding.

Cautionary Statement: The estimated quantities of petroleum that may be potentially recovered by the application of a future development project relates to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration, appraisal and evaluation are required to determine the existence of a significant quantity of potentially movable hydrocarbons.

88E confirms that it is not aware of any new information or data that materially affects the information included in the referenced market announcement and that all material assumptions and technical parameters underpinning the estimates in the referenced market announcement continue to apply and have not materially changed.

Figure 5: Project Phoenix multi-reservoir discoveries with significant light oil resource confirmed.

Source: 88 Energy