AIM-listed Buccaneer Energy, the international oil & gas exploration and production company with a portfolio of production and development assets in Texas, USA, has completed a reserve valuation update in connection with its credit facility with WAFD Bank, formerly Washington Federal Savings and Loan.

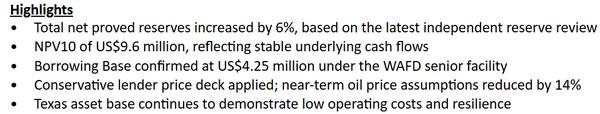

The updated valuation confirms an increase in proved reserve volumes and supports the continued strength of the Company's asset base, notwithstanding a more conservative oil price outlook applied by the lender.

Paul Welch, Buccaneer Energy's Chief Executive Officer, said:

'We are encouraged by the outcome of the latest borrowing base review, which demonstrates the underlying strength and resilience of our asset base. Total proved net reserves increased by 6% while forecast cash flows remain broadly stable year on year, despite WAFD's near-term oil price assumption being reduced by $7.45 per barrel, or 14%, to reflect its outlook on global oil markets.

Our onshore Texas assets continue to benefit from low operating costs, enabling the business to perform well in the current pricing environment.'

Click here for full announcement

Source: Buccaneer Energy