- US$188 million (CAN$257 million) investment by Irradiant, including customary working capital adjustments

- De-risks Innergex’s Texas assets and enhances the quality of its portfolio

- Strengthens and de-leverages Innergex’s balance sheet

- Innergex to maintain operating control of the assets

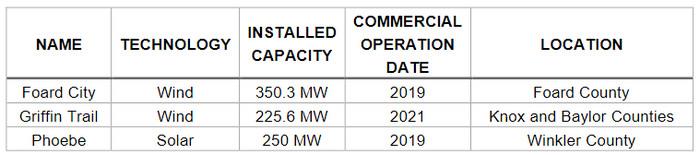

Innergex Renewable Energy has announced the signature of a partnership with Irradiant Partners, an investment manager headquartered in Los Angeles (U.S.), for a transaction wherein the Corporation will sell minority interests in its 826 MW renewable energy portfolio in Texas.

Innergex will sell to Irradiant 49.9% of the Phoebe and Griffin Trail facilities and 22.2% of the Foard City facility for a total equity consideration of US$188 million (CAN$257 million), including customary working capital adjustments. Net proceeds from the transaction will be primarily applied towards repaying the existing Foard City and Phoebe project debt and the power hedge offtake contract in place at Phoebe, with the remainder expected to be used for general corporate purposes.

'We are proud to partner with Irradiant to de-risk and enhance our Texas portfolio', said Michel Letellier, President and Chief Executive Officer of Innergex. 'We have built large scale and high-quality assets in Texas, and we believe that this new structure, where we depart from the power hedge offtake model, will

enable us to improve our overall risk profile and optimize the performance of our assets. The transaction also provides an opportunity to crystallize value from our operating portfolio in Texas.'

Transaction highlights

- US$188 million (CAN$257 million) investment by Irradiant, a Los Angeles-based private equity firm with over US$12 billion (CAN$16 billion) in assets under management.

- Innergex to sell 49.9% of the Phoebe and Griffin Trail facilities and 22.2% of the Foard City facility .

- Innergex to continue managing operations and will retain its professional and dedicated teams already in place.

- Proceeds from the sale to be applied towards repaying Foard City and Phoebe project debts and removing the power hedge offtake contract in place at Phoebe.

- Foard City and Griffin Trail’s revenue structure will remain unchanged.

About the assets

Source: Innergex