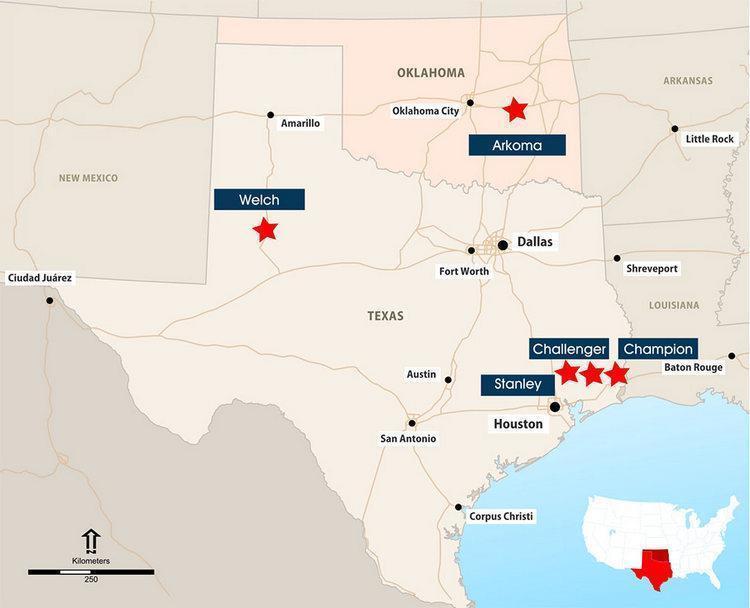

AIM-listed Mosman Oil and Gas has announced its production summary for the three months ended 31 December 2022 and recent production at the Cinnabar Project in East Texas.

US Production (Various interests)

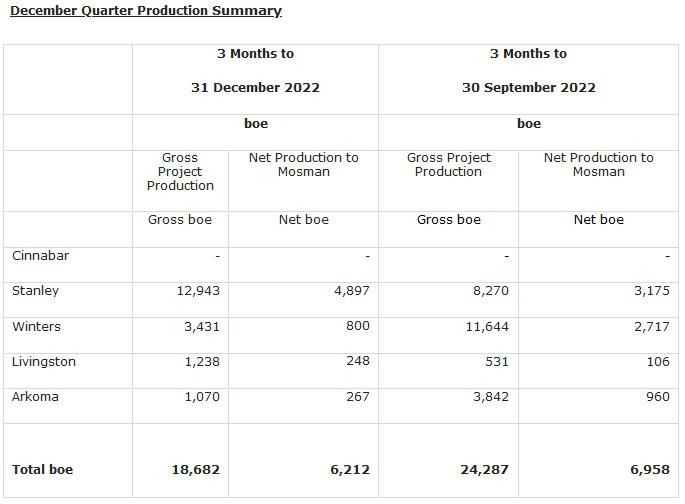

Net Production from existing developed projects was 6,212 boe (circa 67 boepd) during the December quarter with increases at Stanley and Livingston (Greater Stanley) partially offsetting reductions at Winters and Arkoma.

Following the success of the development work at Cinnabar-1 (Mosman 75% working interest), the well is now on production and has delivered a material increase in production, which will be reflected in the next quarterly production report. The initial 24 hour flow test rates at Cinnabar were 120 bopd of oil and 180 Mcfd gas (total of 150 boepd) and the well continues to produce at approximately these rates. The Mosman net oil production of 90 bopd from Cinnabar represents an indicative 134% increase in overall Net Production (when comparing the December Quarter production average daily rate of 67 boepd with the Cinnabar initial test rate of 90 bopd and it is added to it).

The Net Production of 6,212 produced in the December Quarter consisted of 3,776 barrels of oil and 14,128 MMBtu of gas. The average sale prices achieved during the period was US$82.02 per barrel for oil and US$5.69 per MMBtu for gas (September quarter was US$91.35 and US$6.99 respectively, and in each case after transport and processing costs but before royalties).

Production numbers in the Quarter are based on the current best available data (including field data if necessary) and are subject to adjustment upon receipt of final sales invoices from the purchasers of products.

Major Project Updates

Cinnabar (75% Working Interest)

Cinnabar continues to produce oil at over 120 bopd gross (90 bopd Net Production) with additional associated gas. The pipeline from the Cinnabar-1 well to the production infrastructure was installed and gas production infrastructure is being upgraded. Currently oil is collected by tanker, and the gas will be used to gas lift G-1 and for gas sales.

A Reserve Report has been commissioned and is temporary delayed by ill-health of the engineer.

Technical work is being undertaken to enable a Development Plan to be considered. This includes an update of the 3D seismic interpretation and the geological model. This work is expected to be completed in April/May 2023 as a prior to any new drilling being decided.

Stanley (34.85% to 38.5% Working Interest)

Stanley production benefitted from completion of the gas infrastructure and workovers to optimize production. January gross production to date is 226 boepd, circa 54 boepd Net Production.

Winters (23% Winters-2 Working Interest)

Winters-2 gross production had been dropping and was restored with a small workover. Recent (5 day average) production has been circa 10 bopd and 450 Mcfd (9 circa 80 boepd). This is circa 21 boepd Net Production.

Current indications (based on January field data for production) is that net production to Mosman from these major projects is circa 165 boepd. If that trend continues, the third quarter net production will be an outstanding result.

Cash Position

As at 31 December 2022 Mosman had cash in bank of circa $976,000.

John W Barr, Chairman, said:

'We are pleased to report on the progress we have made to deliver another solid quarter. Cinnabar is now the project that makes the biggest production contribution to Mosman. The delivery of this result is a step change in production and revenue. There is significant potential at Cinnabar and we will continue to build on this strong foundation'.

Source: Mosman Oil and Gas