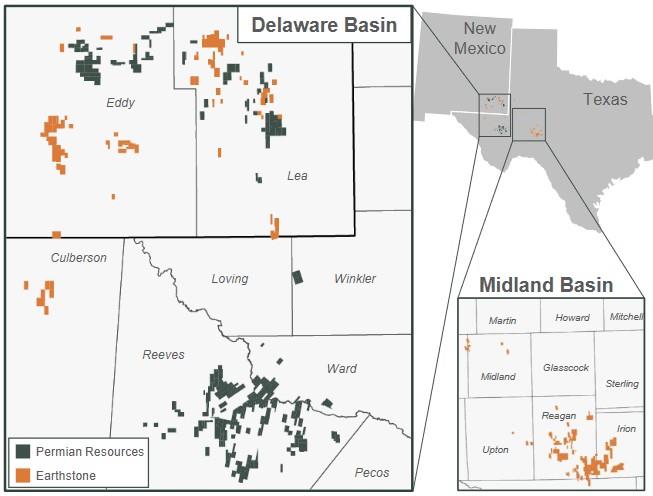

Permian Resources and Earthstone Energy have entered into a definitive agreement under which Permian Resources will acquire Earthstone in an all-stock transaction valued at approx. $4.5 billion, inclusive of Earthstone’s net debt. Under the terms of the transaction, each share of Earthstone common stock will be exchanged for a fixed ratio of 1.446 shares of Permian Resources common stock. The transaction strengthens Permian Resources’ position as a leading Delaware Basin independent E&P with over 400,000 Permian net acres, pro forma production of approximately 300,000 Boe/d1 and an enhanced free cash flow profile to increase returns to shareholders.

Key Highlights

- Enhances leading position in the Delaware Basin and increases operating size and scale

- Adds significant high-quality inventory offset the Company’s existing core acreage in New Mexico

- Highly accretive to key financial metrics before synergies, including operating cash flow, free cash flow and net asset value per share

- Expected to be accretive to free cash flow per share by an average of >30% per year during the next two years and >25% per year during the next five and ten years

- Expect to achieve synergies that will drive ~$175 million of annual cash flow improvement

- Improved free cash flow profile supports 20% increase to base dividend per share and higher future variable shareholder returns

- Meets and exceeds all of Permian Resources’ rigorous investment criteria

- Maintains strong balance sheet with expected leverage2 of less than 1.0x at closing

- Represents an 8% premium to the exchange ratio based on the 20-day volume weighted average share prices

Management Commentary

'We believe the acquisition of Earthstone represents a compelling value proposition for our shareholders and strengthens our position as a premier Delaware Basin independent E&P. Earthstone’s Northern Delaware position brings high-quality acreage with core inventory that immediately competes for capital within our portfolio,' said Will Hickey, Co-CEO of Permian Resources. 'Additionally, we have identified numerous ways to leverage our deep Delaware Basin experience and incremental scale to improve upon these assets across the board, including approximately $175 million of annual synergies. Permian Resources has a proven integration track record, and we believe the successful execution of these cost savings will create incremental value for both Permian Resources and Earthstone stakeholders.'

'We are very pleased to announce this transaction with Permian Resources and believe the combination of the two companies’ top-tier assets and history of success will create an even stronger large-cap E&P company which is uniquely positioned to drive profitable growth and development in the world-class Permian Basin. We believe this all-stock transaction provides Earthstone’s shareholders with excellent value for their investment now and in the future,' said Robert Anderson, President and Chief Executive Officer of Earthstone. 'In less than three years, we have grown Earthstone from a small-cap E&P company producing approximately 15,000 Boe per day to one with a production base of over 130,000 Boe per day, delivering significant value enhancement for shareholders along the way. Our success directly reflects our outstanding employees’ dedication, hard work and perseverance. I personally thank each and every one of our employees. I could not be prouder of the Earthstone team and the company we have built together.'

'As significant owners of the business, our primary goal is to drive value for our investors, and the Earthstone transaction is another example of value creation for shareholders. We expect the transaction to be accretive across all key financial metrics before synergies and significantly accretive including synergies, both over the short and long-term,' said James Walter, Co-CEO of Permian Resources. 'After evaluating over $20 billion of potential transactions during the past twelve months, we firmly believe the acquisition of Earthstone represented the best transaction for Permian Resources. It checks all the boxes, enhancing shareholder value while improving upon an already best-in-class company.'

Click here for Presentation: A Premier Delaware Basin Independent

Click here for full announcement

Source: Permian Resources/Earthstone via GlobeNewswire