Expected to Grow Production, Reserves, Free Cash Flow and Other Key Metrics

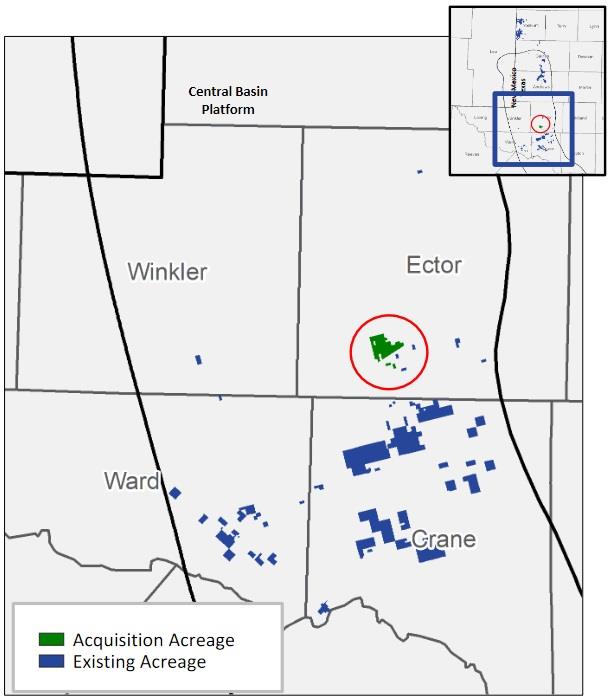

Ring Energy has entered into an agreement to acquire the Central Basin Platform ('CBP') assets of Founders Oil & Gas IV, LLC for $75 million in cash. Founders’ CBP operations are located in the Permian Basin in Ector County, Texas and are focused on the development of approx. 3,600 net acres that are similar to Ring’s CBP assets acquired in 2022 from Stronghold Energy Operating II, LLC and its affiliate.

Total consideration of $75 million, subject to customary closing adjustments, consists of $60 million in cash at closing and $15 million deferred cash payment due four months after closing. The Transaction will be funded with cash on hand and borrowings under Ring’s recently reaffirmed senior revolving credit facility.

TRANSACTION HIGHLIGHTS

- Immediately accretive to Ring’s shareholders, including production, reserves, Adjusted Free Cash Flow(1) and other key metrics;

- Total consideration is approximately 2.3x the assets’ next twelve months’ ('NTM') Adjusted EBITDA(1) beginning April 1, 2023;

- Strengthens balance sheet by lowering the Company’s leverage ratio(2) and accelerates Ring’s ability to pay down debt;

- Further increases inventory of low-risk, high rate-of-return drilling locations and improves capital allocation flexibility;

- Strategically expands core operating area capturing operating and G&A cost synergies; and

- The Transaction is expected to close in the third quarter of 2023 with an effective date of April 1, 2023.

ASSET HIGHLIGHTS

- Second quarter 2023 production was approximately 2,500 net barrels of oil equivalent per day ('Boe/d') (86% oil);

- Margin enhancing ownership with approximately 99% working interest and high net revenue interest of approximately 87%;

- Total Proved SEC year-end 2022 reserves as calculated by Ring management of 9.2 million barrels of oil equivalent ('MMBoe') (80% oil), characterized by shallow declines and long lives;

- Low-risk inventory provides significant economic returns with potential upside from targeted downspacing, including approximately 50 low-cost, high rate-of-return undeveloped drilling locations; and

- Existing infrastructure provides takeaway capacity and opportunities to reduce costs and improve efficiencies.

Mr. Paul D. McKinney, Chairman of the Board and Chief Executive Officer, commented, 'We are pleased to announce our agreement to acquire Founders’ conventional oil and gas assets in Ector County, Texas. These assets strategically expand our existing operations in the southern portion of the Central Basin Platform allowing us to capture operating cost and G&A synergies associated with a larger core operating area. These assets are similar to the Stronghold assets acquired last year, having stacked pay zones of high-quality rock with proven performance. Like the Stronghold assets, we intend to leverage our extensive expertise applying the newest conventional and unconventional technologies to optimally develop the inventory of undeveloped drilling locations afforded by the Transaction.'

Mr. McKinney concluded, 'Today’s announcement is another example of creating value for our shareholders through our value focused proven strategy. This acquisition not only increases our production, but it also allows us to reduce our expected capital spending for the second half of 2023 thereby giving us the ability to further pay down our debt. In addition, it expands our proved reserves while lowering our leverage ratio. We look forward to quickly integrating the assets into our operations and further developing the inventory of drilling locations. In short, we view this transaction as another step in gaining greater size and scale and positioning the Company to deliver on our long-term goals for our shareholders.'

See Presentation: Strategic Acquisition of Additional Assets Expanding Core Operating Footprint (July 11 2023) for further details

Click here for full announcement

Source: Ring Energy