Woodside has simultaneously signed and closed a transaction with Williams, a world-class leader in US natural gas infrastructure, for an integrated investment in Louisiana LNG. The strategic partnership involves the sale by Woodside of a 10% interest in Louisiana LNG LLC (HoldCo) and an 80% interest and operatorship of Driftwood Pipeline LLC (PipelineCo) to Williams for a purchase price of US$250 million at the effective date of 1 January 2025. The total proceeds received are $378 million including proportionate capital reimbursement since the effective date.

The transaction represents the next key stage towards realising Woodside’s strategy for Louisiana LNG. It not only secures capital and offtake commitments but also brings a strong strategic partner with complementary capabilities in US natural gas infrastructure and an existing gas sourcing platform, Sequent Energy Management (Sequent).

Williams will contribute its share of the capital expenditure for the LNG facility and pipeline, of approximately $1.9 billion. As part of the investment in Louisiana LNG, Williams assumes LNG offtake obligations for 10% of produced volumes.

Williams currently operates more than 33,000 miles of pipeline across 24 states in the US and its Sequent platform has a marketing and optimisation footprint of more than 7 Bcf/d. It will utilise its extensive pipeline experience to construct and operate the Line 200 pipeline to the Louisiana LNG Terminal.

Leveraging the established Sequent platform and capabilities, a gas supply team will operationalise and optimise daily gas sourcing and balancing in accordance with Louisiana LNG’s gas procurement strategy. Sequent's proven gas marketing and asset optimisation expertise will support reliable feedgas supply for the benefit of all Louisiana LNG participants.

Woodside CEO Meg O’Neill welcomed Williams to the Louisiana LNG Project.

'We are excited to have Williams join us as a strategic partner in Louisiana LNG given its leadership in US natural gas infrastructure and ability to add value and deliver operational benefits to enhance the project.

'This is Williams’ first investment in LNG and its participation in Louisiana LNG is a testament to the quality of the project.

'The bringing together of Woodside’s proven track record in developing and operating LNG facilities and global marketing, and Williams’ expertise in pipelines and gas sourcing, creates an energy partnership that has the combined capability to realise opportunities for long-term global energy demand.

'With strong LNG contracting momentum from Louisiana LNG and our portfolio, our existing infrastructure partner New York-based Stonepeak, and our key contracting partners including Bechtel, Baker Hughes and Chart, we are on track to deliver first LNG in 2029 and create long-term value for our shareholders.'

President and CEO of Williams Chad Zamarin expressed enthusiasm for the partnership.

'This transaction marks an important step forward in Williams’ wellhead to water strategy – integrating upstream, midstream, marketing and LNG capabilities to deliver the cleanest, most reliable energy to global markets. We look forward to partnering with Woodside, and together, reinforcing and strengthening our collective roles as trusted providers of sustainable energy solutions that meet growing global demand.'

Transaction details

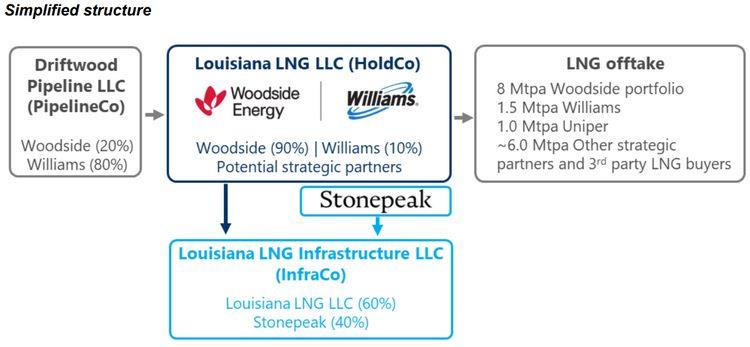

Williams will hold 10% equity in Louisiana LNG LLC (HoldCo), with the remaining 90% of HoldCo currently owned by Woodside.

HoldCo owns 60% equity in Louisiana LNG Infrastructure LLC (InfraCo), with the remainder being owned by Stonepeak.

Williams will hold 80% equity in Driftwood Pipeline LLC (PipelineCo) and manage construction and operations of the Line 200 pipeline. Woodside will own the remaining 20%.

HoldCo will continue to lead the gas procurement strategy and execute agreements greater than 12 months. Leveraging the established Sequent platform and capabilities, a gas supply team will operationalise and optimise daily gas sourcing and balancing in accordance with HoldCo’s gas procurement strategy. Optimisation value created is distributed to HoldCo. The team will be Williams-led and include secondees and oversight from Woodside.

Williams’ total share of LNG production from Louisiana LNG will be 1.6 million tonnes per annum (Mtpa). This LNG production will be supplied to Williams under an LNG SPA for approximately 1.5 Mtpa and Williams will also receive the proportionate benefit (10%) of the Louisiana LNG 1.0 Mtpa SPA previously signed with Uniper.(1)

The effective date of the transaction is 1 January 2025 with completion having occurred simultaneously with execution. The consideration includes a payment of $250 million representing Williams’ contribution to acquisition and project development costs until the effective date. Williams will also reimburse its proportionate share of development costs from 1 January 2025. The total payment received from Williams is $378 million.

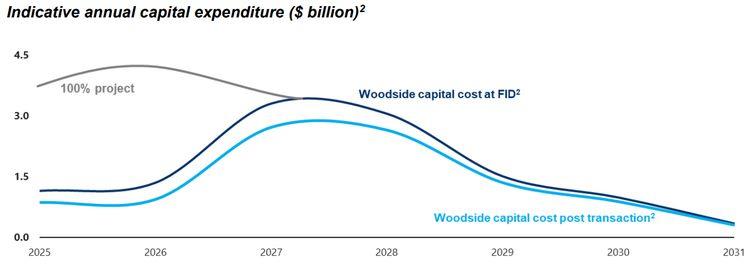

Woodside’s total capital expenditure for the Louisiana LNG Project is now expected to be $9.9 billion reduced from $11.8 billion at final investment decision (FID). The impact of this transaction on capital commitments is shown in the chart below.

HoldCo will remain consolidated in Woodside’s year end accounts. PipelineCo will be deconsolidated and recorded as an equity investment on a go-forward basis.

Woodside’s financial advisers are RBC Capital Markets and Evercore, and its legal adviser is Norton Rose Fullbright.

Source: Woodside