Following the recent completion of a £10.5 million equity placing, Zephyr Energy has provided updates on its flagship operated project in the Paradox Basin, Utah, U.S. and on its proposed acquisition of working interests in accretive production and development assets in core Rocky Mountain basins, U.S.

Paradox Project

Following the recent successful production test on the State 36-2 LNW-CC-R well, as announced on 7 May 2025, Zephyr continues work to deliver the first stage of gas infrastructure for the project. This includes equipping the pad for production, reinstatement of the 6-inch pipeline gathering system, the deployment of gas processing infrastructure to Zephyr's pre-existing gas plant footprint, as well as planning for tie-in to the adjacent 16-inch gas export pipeline.

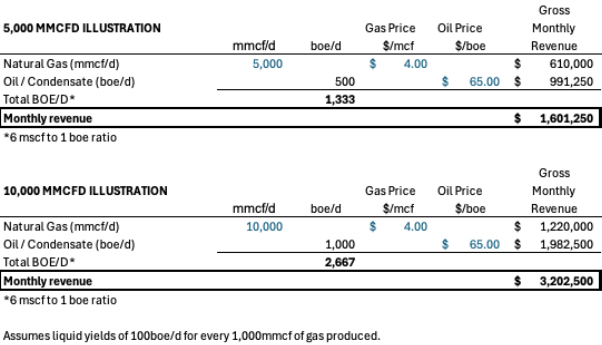

Zephyr's operations team is working with the provider of the gas processing units to develop the optimal initial processing capacity. At present, the initial processing capacity is envisaged to handle 5-10 million cubic feet of natural gas per day while also enabling the sale of valuable liquid streams consisting of both condensate and NGLs (Natural Gas Liquids). The light condensate (52-60° API) produced is expected to sell at a premium to other crudes as it can be blended with lower quality waxy crudes adding value in the refining process. As an illustration and for context, at current commodity prices, this level of processing would enable gross (100% share) gas and oil revenues of circa US$1.6-US$3.2 million per month (excluding NGL sales), as outlined below:

The initial range of processing capacity is below the peak production potential of the 36-2R well, which the Company believes is an optimal range for first operations. Over time, the scale of processing capacity is expected to increase in steps as existing wells (including the State 16-2LN-CC and Federal 28-11 wells) are tied-in and additional wells are drilled.

In parallel, the Company is in advanced discussions with respect to the export of the processed gas volumes via the nearby 16-inch export pipeline. The proposed pipeline tie in point is 70 metres from Zephyr's gas plant site, and the export pipeline currently has a considerable excess capacity that can accept both initial processed gas volumes and a meaningful expansion in gas production. While conversations with other gas off-take solutions (including cryptocurrency miners and compressed natural gas operators) are also ongoing, the Company's top priority is achieving exported gas sales, with associated condensate and NGL volumes trucked from site to end user buyers. A combination of gas off-take solutions may be utilised if commercially and economically viable.

In addition to the ongoing infrastructure engineering work, the Company has commissioned third-party reserve engineer, Sproule, to prepare an updated Competent Person's Report ("CPR") on the Paradox project. Results from the updated CPR are expected to be published in the third quarter of 2025, although timing is dependent on the delivery of the report from Sproule.

The Company has also commenced discussions with potential industry and finance partners about farm-in opportunities on the Paradox project, with a structured and formalised process to start shortly. Given the strong production test results to date, it is Zephyr's intention to find a partner to accelerate the next phase of drilling as quickly as possible.

EnerCom presentation

Zephyr's management will be presenting an overview of the Paradox project at EnerCom's 30th Annual Energy Investment Conference at 4:00 p.m. MT on 18 August 2025. The conference is widely attended by industry operators and investors, and an updated version of the Corporate Presentation will be provided by the Company on its website after the conference.

Proposed Acquisition update

Zephyr is currently completing all remaining confirmatory environmental, title and operational due diligence ahead of its proposed US$7.3 million acquisition of working interests in accretive, mature PDP production assets in core Rocky Mountain basins.

Under the terms of the Proposed Acquisition, Zephyr will acquire a working interest in a portfolio of over 400 wells, 21 of which will be operated by the Company. The non-operated wells, in which the Company will own a minority working interest, are operated by top-tier operators. At completion of the Proposed Acquisition, the acquired assets are expected to add an estimated 600,000 barrels of oil equivalent of 2P producing reserves (management estimate) and 400 barrels of oil equivalent per day, net to Zephyr, of current production (85% oil). Zephyr's working interests in the portfolio will average 7% and represents an equivalent of 31 net wells.

The acquisition offers strategic entry into key Rocky Mountain basins within Zephyr's area of interest, including the Powder River Basin (Wyoming) and the Denver-Julesburg Basin (Colorado). In addition to adding current production, the Proposed Acquisition offers significant potential drilling upside opportunity for the Company. Zephyr has been notified of an initial 13 wells scheduled to be drilled imminently, with net CAPEX of approximately US$2.5 million which will potentially be funded through the Company's US$100 million strategic partnership funding (as announced on 13 May 2025).

In preparation for the completion of the Proposed Acquisition, Zephyr has applied for regulatory approval to become an operator of record in the states of Colorado, Wyoming and North Dakota. The Proposed Acquisition is currently on track to complete in the near term, with an effective date of 1 June 2025.

Colin Harrington, Zephyr's CEO commented:

'Following the completion of our successful fundraise, we continue to make strong progress across our asset portfolio. We look forward to a prolonged period of positive news flow as we complete the Proposed Acquisition and move towards first production on the Paradox project.'

Source: Zephyr Energy