Highlights:

- Operational update on UK Southern Gas Basin:

- P2607 Joint Venture (JV) continues work on the development of the Anning and Somerville Gas Fields assuming various possible fiscal outcomes

- Hartshead continues discussions on project finance, with discussions on infrastructure funding currently underway aimed at reducing the JV upfront CAPEX

- Hartshead undertook a cost reduction initiative to reduce contractor headcount associated with project development, while still maintaining a core JV team

- Hartshead’s success in 33rd licensing round, winning ten blocks

- HHR successful in winning Ten (10) Blocks in 33rd Licensing Round

- Nine (9) blocks in the Southern Gas Basin

- Three (3) blocks adjacent to P2607

- All blocks contain either gas field re-developments or undeveloped gas fields

- Hartshead maintains a strong balance sheet position for a junior company with A$22 million in cash(1)

Hartshead Resources has provided an overview of the Company’s quarterly activities for the period ending 30 June 2024 (Quarter, Reporting Period).

Commenting on the June Quarter of 2024, Christopher Lewis, Hartshead CEO said: 'We continue to have productive discussions with all stakeholders, regarding the fiscal framework of the UK energy sector under the new Labour Government, and now wait for certainty around the fiscal and energy policy that we understand will be provided by the Government in late September or early October. Hartshead has a high-value gas development project, a highly motivated joint venture partner alongside us, and a growing portfolio of discovered gas resources. We wait on economic and market certainty in order to take the Final Investment Decision for our Anning and Somerville development project, and unlock investment in our 33rd Round Licenses. With gas prices strengthening since the beginning of the year and through the Quarter, we are looking forward to a busy second half of the calendar year following the general election and the change in Government.'

OPERATIONAL UPDATES ON UK SOUTHERN GAS BASIN

During the quarter, the Company conducted extensive dialogue with various political stakeholders to seek clarity on the future fiscal regime, however the situation remains unclear. It is anticipated that following the change in the UK Government, there will be changes to policy that relates to the oil and gas fiscal regime. Hartshead has actively lobbied and been involved in discussions on the proposed changes and provided detailed information on the impact the changes will have on industry. Throughout the consultation process all stakeholders have expressed their desire to create a fiscal regime in the UK that will still attract and enable investment and activity in the sector.

Hartshead is continuing to progress project finance and is in discussions on infrastructure funding that has the potential to significantly reduce the upfront CAPEX required by the JV, for the Phase 1 development project. This would be positive in respect to whole project economics, moving CAPEX into OPEX via a tariff

payable in respect of third-party infrastructure investment, and in respect of Hartshead funding, reducing the funding requirement that Hartshead would need to meet outside the RockRose carry.

Importantly, Hartshead remains focused on maintaining its strong cash position during the period of delay and uncertainty. The Company reiterated that it has undertaken a cost reduction initiative in respect of the areas of the project team that were recruited to deliver the current and next phase of the development

project and the related contract awards. This led to a material cut in head count and a reduction of the monthly costs to the JV and to Hartshead directly.

UK NBP gas prices have also strengthened to ~70p+/therm which was a positive sign, given the unusually mild winter in European and large supply of gas storage inventories at the exit of the winter season.

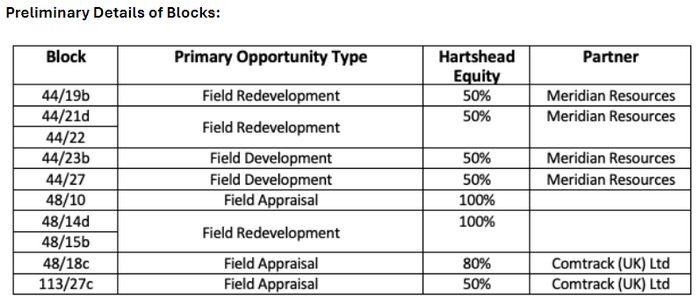

OUTSTANDING SUCCESS IN 33RD LICENSING ROUND – HRR WINS TEN BLOCKS

On 8 May (following a trading halt on 6 May), Hartshead Resources NL announced it had been notified by the North Sea transition Authority (NSTA), as the regulatory body for oil and gas exploration in the UK, that it was successful in winning ten (10) blocks in the recent UK 33rd Licensing Round.

The blocks all contain discovered hydrocarbons and present a range of re-development, development and appraisal opportunities. In addition, there are multiple near field exploration opportunities in the blocks.

Hartshead is awaiting formal notification from the NSTA, in the form of a 'Data Verification Letter' for each License to be offered. Once the Licenses have been formally awarded and License documentation executed the Company will provide a further update with details of each License, block, opportunity and resource estimates.

At the time of the announcement, Chris Lewis, Hartshead CEO, commented: 'I am delighted with such an excellent result in the 33rd Round. To have won so many blocks, with known discovered gas resources and a host of gas fields for re-development, development and appraisal vastly expands our portfolio and dramatically increases the number of opportunities we have to progress to gas production. This takes Hartshead from being a single License company to having multiple Licenses and projects within the UK. As ever, it is the hard work and commitment from our team that has delivered this result, and once again I

would like to thank the entire team for their continued efforts. I am looking forward to being able to provide further details of these exciting awards in the near future.'

Source: Hartshead Resources