Conrad Asia Energy, the ASX-listed Asia-focused natural gas exploration and development company, has provided an overview of activities for the period ending 30 June 2023.

Highlights

- Negotiations continued to advance on the key terms of the Mako field (“Mako”) gas sales agreement between a Singapore buyer and the Indonesian regulator (SKK Migas). Finalization of these terms is expected in the third quarter CY2023. These commercial terms will further the development of Mako as well as Conrad’s plan to sell down some of its 76.5% participating interest in the project.

- Mako is the largest undeveloped and fully appraised gas field in the West Natuna Basin. Mako gas will be exported by an existing pipeline network to Singapore. The development will deliver significant benefits to Singapore, as it will provide reliable natural gas while diversifying the country’s future gas supply, with lower carbon emissions compared to LNG.

- Two of the three front end engineering design (“FEED”) studies for the Mako development project have been concluded and the third is on track for completion also by the third quarter CY2023.

- Conrad has continued to explore commercialisation options for gas from the recently acquired Offshore North West Aceh (Meulaboh) (“ONWA”) and Offshore South West Aceh (Singkil) (“OSWA”) Production Sharing Contracts ("PSCs"). The PSCs contain discovered gas resources in shallow water. Conrad has been approached by parties enquiring about potential downstream utilisation of this gas.

- Competent Persons Reports (“CPRs”) over the ONWA and OSWA PSCs were issued(1) during the period ending 30 June CY2023 (“Quarter”). Three of the discoveries hold an estimated gross (100%) 2C Contingent Resource of 214 billion cubic feet (“Bcf”) of sales gas (161 Bcf net attributable to Conrad)(1). The net attributable resource is the commercial resource due to Conrad after the government fiscal take. The CPRs attributed a net present value of US$88m1 (net to Conrad) for the three accumulations. A fourth discovery, Keudapasi, has very little seismic data and has not been included in the Contingent Resource at this stage.

- Conrad continues to progress a detailed geoscientific study of both the shallow and deep-water areas of the Aceh PSCs to assess and create an inventory of leads and prospects across the area. This project is expected to be concluded during this coming quarter. The deeper water areas have several large structures with multi-trillion cubic feet of gas potential. These structures have gas chimneys and flat spots displayed on seismic data, indicating evidence of the presence of potential hydrocarbons.

Conrad Managing Director and Chief Executive Officer, Miltos Xynogalas, commented:

'During the second quarter we have maintained our focus on completing the agreement of key terms for the Gas Sales Agreement (“GSA”) for Mako Gas with the Singapore buyer. We have extended the original timeline due to the size and importance of the project but we remain confident that these negotiations will be finalised in the short term. The extended timeline has impacted the farm down process which we now expect to progress during this quarter.'

'In parallel with negotiating the key terms of the GSA, we have made progress on the Mako development and recently completed the first operational activity; a geophysical survey for the development well locations and the pipeline routes. The operation was completed on time and on budget and with no HSSE incidents. This underscores our commitment to bring the gas field onstream in 2025.

'We are extremely pleased to have commenced our activities in the two PSCs recently acquired in Aceh. These blocks contain discoveries that have increased our resource base by 75%(1). In coordination with the local authorities and through engagement of the local communities, we conducted fieldwork for the environmental baseline assessment. In the meantime, the results of the CPRs on the discovered resources and the internal studies on the exploration have confirmed the value and considerable upside of the Aceh PSCs to the company.

'Our gas portfolio continues to expand in a region that is experiencing rapid gas demand growth. Conrad is well positioned to assist the region in transitioning from coal to natural gas as our portfolio now contains a host of discovered gas resources, as well as high impact exploratory opportunities.

'During this Quarter some of the escrowed shares were released as planned, however this did not have any negative impact on the share performance demonstrating the confidence of our existing shareholders in the company and its growth potential.'

Duyung PSC - Mako Gas Field 76.5% Participating Interest, Operator

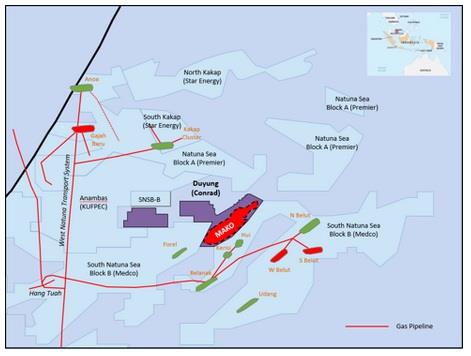

Conrad holds a 76.5% operated interest in the Duyung PSC via its wholly owned subsidiary, West Natuna Exploration Limited. Duyung is located in the Riau Islands Province, Indonesian waters in the West Natuna area, approximately 100 kilometres to the north of Matak Island and about 400 kilometres northeast of Singapore.

Gas sales agreement negotiations have been a focus of the Board and management of Conrad with tripartite engagements held between Conrad, a Singapore gas buyer, and SKK Migas. The negotiation of key terms is now expected to be finalised during the Q3 CY2023. The continued GSA negotiations will allow the Company to take advantage of an improved and favourable pricing environment given strong worldwide gas demand and low supply.

Front end engineering design studies were initiated during Q4 CY2022, with three separate FEED studies being progressed for the mobile offshore production unit (“MOPU”) processing facilities; the subsea umbilicals, risers and flowlines (“SURF”) and for the conductor support frame (“CSF”). The MOPU processing and the SURF FEEDs have been completed. The CSF FEED will conclude in Q3 CY2023. The results of this work are now being integrated and discussed with SKK Migas.

A geophysical pipeline route survey and a remote operated vehicle survey of the production manifold in the adjacent Kakap PSC (through which Conrad intends to export the Mako gas to the West Natuna Transportation System) have been completed without incident. A geotechnical survey of the MOPU location and potential well locations is scheduled over the next few months. Project optimisation discussions (e.g. precise placement of wells and facilities in light of the geophysical and geotechnical surveys) are ongoing with SKK Migas. The procurement process for all major project equipment and services contracts was commenced in Q2 CY2023.

Acquisition of environmental approvals for development is ongoing. The Government of Indonesia requires environmental permits for drilling or construction activities within the country. Included within the required permits is the project Environmental Impact Assessment (termed “AMDAL” in Indonesia). The Mako project AMDAL has been submitted to the government for review with approval expected during before the end of the year.

A farm-down process for the divestment of a portion of Conrad’s interest in the Duyung PSC is ongoing with bids expected to be received soon. Conrad has engaged a global investment bank with a proven track record in similar transactions to lead the farm-down process.

Aceh PSCs 100% Participating Interest, Operator

ONWA and OSWA, the two Aceh PSCs awarded to Conrad in January 2023, are operated by wholly owned Conrad subsidiaries ONWA PTE Ltd and OSWA PTE Ltd. Conrad holds a 100% participating interest in each block, with each PSC having a 30-year tenure.

CPRs on Conrad’s shallow water areas of the two offshore Aceh PSC were completed. The CPRs estimate a gross (100%) 2C Contingent Resource of 214 Bcf of sales gas (161 Bcf net attributable to Conrad) in three of the four discovered gas accumulations in the two PSCs1. The net attributable resource is the commercial resource attributable to Conrad after the government fiscal take.

The CPRs evaluated the flow tested gas discoveries in the PSCs to address the range of potential in-place and recoverable volumes, and to devise conceptual development schemes. The CPRs ascribe a net present value (“NPV”) to Conrad of US$88 million(1) of three of the discovered resources. The fourth discovery, Keudapasi, has very limited seismic data (two lines) and was not included in the Contingent Resources at this stage. Based on the CPR, Keudapasi has a P50 Estimated Ultimate Recovery of 30 Bcf(1).

The Contingent Resources are located in shallow waters (50-80 metres) and at shallow reservoir depths of 900-1,500 metres, in close proximity to the shoreline near several identified commercialisation opportunities. The gas discoveries of almost pure methane were made in the 1970s and have all been successfully flow tested. These gas discoveries were not previously developed due to prevailing low gas prices and immature markets. The shallow water areas of ONWA and OSWA have had a historically high exploration success rate of over 30% in both PSCs. However, in the wells which targeted the main prospective horizon, upper Miocene carbonate reefs, the success rate has been over 66% based on 1970s seismic data. Conrad intends to acquire 500 square kilometres of modern 3D seismic data in each PSC during 2024, seeking to delineate near field, low risk drilling opportunities as well as evaluate other new prospective targets.

The two PSCs also have deep-water potential where several large structures with multi-trillion cubic feet potential have been identified. These structures have gas chimneys and flat spots displayed on seismic data, indicating evidence of the presence of hydrocarbons. Despite the numerous discoveries, the Aceh PSCs are classified as “frontier areas” and have been granted attractive fiscal terms. In-house technical studies describing the geological evolution and prospectivity of the unexplored shallow and deep-water areas of the PSCs are ongoing, with first results expected during soon.

Combined with Conrad’s Mako gas field in the West Natuna Sea, the two Aceh PSCs give the Company a total 2C Contingent Resource of 578 Bcf (376 Bcf net attributable to Conrad)1 across its offshore Indonesian portfolio and represent a 75%(1) increase in net attributable resources to those reported as at 31 December 2022 in the Company’s annual report.

Additionally, the Company is making preparations for an environmental baseline assessment for each PSC in anticipation of the acquisition of seismic data during 2024. Conrad continues its efforts to establish a representative office in Banda Aceh as required by the local government and has initiated a stakeholder assessment of the PSC areas.

(1) Conrad Asia Energy Ltd ASX announcements on 16 and 18 May 2023.

Source: Conrad Asia Energy