Highlights

- Snowcap-3 will evaluate 600-foot gross reservoir interval

- Only 6 feet of which was tested in Snowcap-1 at initial rates of 1100 to 1450 bopd

- Potential to greatly accelerate production growth

- Current production up 26% to 387 bopd

- TPD CD1 well in Bonasse to 1800 feet to commence shortly

- Monetisation of Moroccan asset progressing as planned

- Re-emergence of Trinidad and Venezuela as a hydrocarbon province for oil majors

- Well-placed as one of the few London listed companies with exposure to the region

Predator Oil & Gas Holdings, the Jersey based Oil and Gas Company with producing hydrocarbon operations focussed on Trinidad and Morocco, has conditionally placed 128,571,419 million new ordinary shares of no par value in the Company (the 'Placing Shares') at a placing price of 3.5 pence each (the 'Placing Price') to raise £4.5 million (before expenses) (the 'Placing'). The placing was completed by Albr Capital Limited and Oak Securities, acting jointly.

The Placing utilises some of the Company's existing ability to issue shares under the Financial Conduct's Authority Public Offers and Admissions to Trading Regulations.

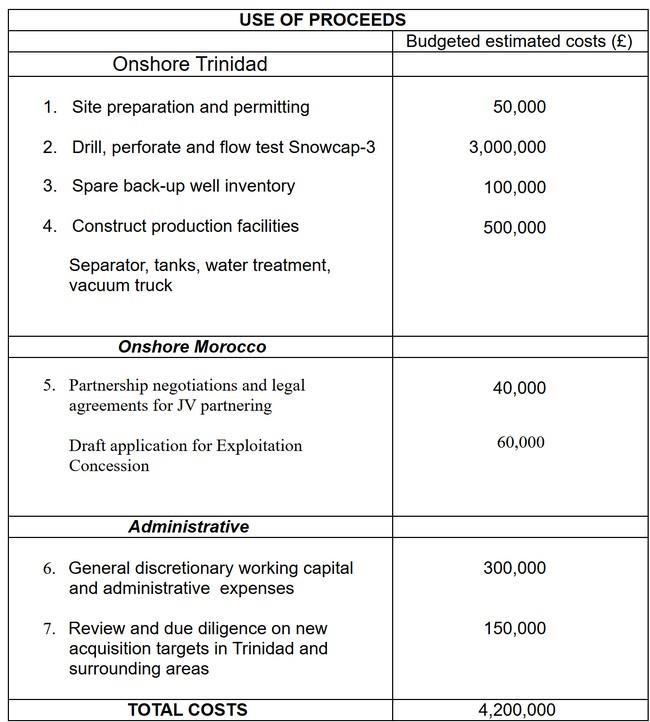

Use of Proceeds

The Proceeds of the Placing, less expenses, will be spent on:

1. Drilling and testing Snowcap-3 ("SC-3") appraisal and development well , operated solely by the Company, will evaluate the gross 600-foot Herrea reservoir interval that contains 8 very good quality reservoirs that produced in the former BP Moruga West field x kms to the SE.

Snowcap-1, drilled and tested in 2010/11, tested the topmost sand (#8 Sand). The 6-foot sand flowed at initial rates of 1100 to 1450 bopd before stabilising at a rate of 500 bopd.

In the Snowcap-1 well the primary basal Herrera #1 and #2 sands were missed due to being faulted out.

SC-3 location has been selected to penetrate an unfaulted section with good potential for a thickened #1 Sand.

The well is scheduled for Q2 2026 and is expected to take up to 20 days to drill and log to a depth of approximately 5300 feet.

It is intended to put the well in production in Q3 2026 after drilling and testing completes.

SC-3 will potentially unlock the 3P resources for the Herra #1, #2# 3 and #4 Sands of 56.9MM barrels of oil.

The impact on the Company's forecast production for 2026 has the potential to be transformational.

Production from the Company's existing fields has accreted steadily over 2 months by approximately 26% to 387 bopd following the completion of two shallow development wells and 3 heavy well workovers under our Master Services Agreement with NABI. NABI will commence this month drilling the deeper TPD-CD1 to 1800 feet in the Bonasse field.

2. Progress joint venture partnering for the Guercif gas asset to agree principles for funding the drilling and testing of the MOU-6 well and a Phase 1 gas development contingent on the application in 2026 for an Exploitation Concession.

Separately complete an Independent Technical and Resources Report for the 81 km2 TGB-6 fan penetrated by MOU-3 and prepare to farmout.

Paul Griffiths, Chief Executive Officer of Predator Oil & Gas Holdings Plc commented:

'Trinidad is a re-emerging oil and gas province for the oil majors again fuelled by successes offshore Guyana and the new strategic importance of nearby Venezuela. We intend to increase further our visibility in Trinidad through advancing the drilling of SC-3.

We have taken this opportunity to raise funds in order to undertake additional discretionary activity, strengthening the balance sheet, and enhancing production growth. Furthermore, demonstrating our operational experience and know-how gives us greater leverage to attract oil majors into our assets at some point. The offshore Guyana petroleum system extends into our licences. The TGB-6 fan in Morocco is geologically similar to the large biogenic gas fields of the East Mediterranean. Demonstrating materiality will be an important consideration for any potential farminee but recent geo-political developments have enhanced the potential for M & A consolidation'.

Source: Predator Oil & Gas