Commenting today Chris Hopkinson, Interim Executive Chairman, said:

'The production drive we initiated in October last year proved that we can overcome technical and operational challenges and I am delighted that we continue to maintain the momentum into the new financial year.

The higher oil and gas prices have been a welcome boost to revenue and cash generation giving us greater financial flexibility and enabling us to repay debt. However, we believe now is the right time, given the prevailing price environment, to focus on driving opportunities for production, that pay back in a short time frame, and to that end we will seek to finance these near-term projects.

It is also critical that we maximise the value of our oil and gas assets to facilitate a 'just transition' to a renewable energy future through the growth of our geothermal heat business. Momentum is building in the geothermal business and we look forward to achieving financial close for the Stoke-on-Trent geothermal project and moving into the execution phase of that project during the year.'

Financial Performance

* Adjusted EBITDA, Net Debt (borrowings less cash and cash equivalents excluding capitalised fees) and Underlying Operating Profit are used by the Group, alongside IFRS measures for both internal performance analysis and to help shareholders, lenders and other users of the Annual Report to better understand the Group's performance in the period in comparison to previous periods and to industry peers

Corporate and Financial Summary

- Higher operating cash flow resulted in a significant reduction in the Group's net debt to £6.1 million. Cash balances as at 31 December 2022 were £3.1 million

- The Group made a loss after tax of £11.8 million. This was after deducting a £30.0 million impairment of our shale assets following the reimposition of the moratorium on hydraulic fracturing

- Net cash capex of £7.9 million in 2022 primarily on our conventional assets

- Successful RBL redetermination confirming $17.0 million (£14.0 million) of debt capacity

- We remain focused on maintaining a strong balance sheet and funding to support our strategy. We will continue to assess funding opportunities to optimise our capital structure and manage our debt facilities effectively

- 60,000 bbls hedged for H1 23 at an average swap price of $94.9/bbl (we are no longer required to hedge under the terms of the RBL)

- Energy Profit Levy charge for 2022 of £nil

- Ring fence tax losses at 31 December 2022 were c.£260 million

- As the Company has been reshaping its strategic direction to reflect the transition to a lower carbon economy, the Board is proposing a change in the Company's name to Star Energy Group PLC (subject to shareholder approval at the AGM in June 2023)

Operational Performance

- Restructuring and reorganisation of the business to enable improved strategic planning and more efficient decision making

- Net production, averaged 1,898 boepd for the year, heavily impacted in the first half by equipment failure caused by supply chain issues, which was subsequently resolved

- A production drive was initiated in October leading to a strong recovery in H2 resulting in peak production (averaged across 5 days) of 2,432 boepd and December production averaged 2,221 boepd (net to IGas)

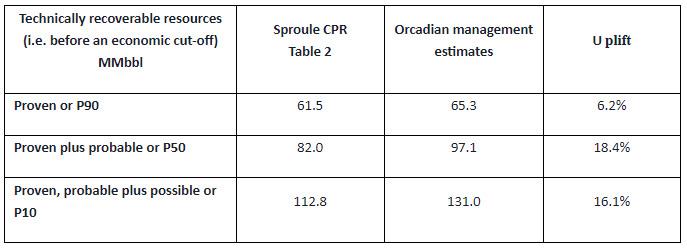

- Reserves and Resources updated CPR values 1P NPV10 of $144 million (2021: $139 million): 2P NPV10 of $215 million (2021: $190 million)+

- Planning permission submitted and validated for Glentworth Phase I - potential for additional 200 bbls/d

- The drilling of a new well in Corringham is planned for H2 2023 with both planning and permitting in place, which, if successful, is anticipated to add 110 bbls/d peak production

- Awaiting imminent outcome of the Green Heat Network Fund grant application for Stoke-on-Trent geothermal project

- We anticipate notification as to our success in the five NHS tenders through the Carbon and Energy Fund in Q2 2023

Outlook

- We anticipate net production of c.2,000 boepd and operating costs of c.$41/boe (assuming an average exchange rate of £1:$1.23) in 2023

- 2023 abandonment costs of c.£6.5 million as we ramp up the abandonment and restoration of old and uneconomic fields, in line with our licence obligations and to focus on profitable fields.

- In the process of purchasing a rig as part of setting up a dedicated abandonment division

- We expect cash capex of £15.3m in 2023

- This includes £5.9 million for near-term incremental projects to generate c.150-170 boepd and £4.0 million to develop the Bletchingley gas-to-wire project which is expected to generate circa 47 GWh of power from late 2024/early 2025, subject to financing, and £1.0 million to progress developments at Singleton and Bletchingley

- The remaining capex will be spent on the maintenance and optimisation of our existing conventional sites

+Oil price assumption of c.$75/bbl for 5 years, then inflated at 2% p.a. from 2031 (capped at $118/bbl) see D&M Report

A results presentation will be available at http://www.igasplc.com/investors/presentations.

Source: IGas Energy