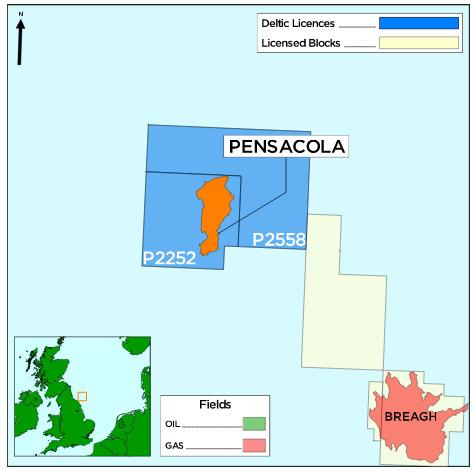

Deltic Energy, the AIM-quoted natural resources investing company with a portfolio of operated and non-operated exploration and appraisal assets in the UK North Sea, has provided the following update in relation to its Pensacola Discovery on Licence P2252 in the Southern North Sea in which Deltic holds a 30% interest.

Well Planning and Timing

Following commitment to the appraisal well in December 2023, operational planning for the Pensacola appraisal well has continued to progress according to plan.

In anticipation of drilling the Pensacola appraisal well, long lead items have been ordered, the geophysical site survey over the proposed well location has been completed and the final geotechnical site survey is scheduled to take place in May/June 2024.

The rig contract was entered into in February which secured the Valaris 123 heavy duty jack-up drilling unit to drill both the Selene exploration well and Pensacola appraisal well, with the Pensacola well due to be drilled immediately following completion of Selene operations.

The rig is currently operating in the Central North Sea following which it will move to Selene. Subject to the timing of the completion of Selene, the Pensacola well remains on track to be drilled in Q4 2024.

Farm-out Process

The feedback from Deltic's Pensacola farm-out process has indicated that the continual tinkering with the Energy Profits Levy and resultant fiscal uncertainty created by the current government, along with recent rhetoric emanating from the Labour Party, have had a severely negative effect on the ability of UK Exploration and Production (E&P) companies to commit to long term investments in the North Sea. This has resulted in many operators diverting capital away from the UKCS or delaying investment decisions, especially with respect to new large-scale opportunities like Pensacola.

Against this hostile political environment, and despite the Company's best efforts, Deltic have not yet been able to secure a farm-out partner for Pensacola and although there are a number of live discussions with respect to a way forward on Pensacola, there is a risk that a farm-out may not be secured before the end of May 2024. We remain of the view that Pensacola represents an excellent value-driven opportunity for the right partner and would be willing to engage with any additional potential partners.

Equity Capital Markets

The recent difficult state of UK equity markets, especially for smaller companies, has been well publicised. This, coupled with the impact of the political and fiscal regime on UK E&P company valuations and investor sentiment means that the Board believes that accessing traditional equity capital, as the Company has successfully done in the past, is unlikely to be a viable option to allow Deltic to meet its 30% share of the Pensacola well (currently estimated to be roughly GBP£15 million net to Deltic).

Alongside its ongoing farm out process, Deltic will continue to consider alternative sources of capital and non-traditional funding structures to mitigate costs and/or secure its equity position in the Pensacola well. However, there is no guarantee that such capital will be available or available on acceptable terms. It is particularly frustrating for the Company as a recently commissioned Competent Person's Report by RPS Energy assessed Pensacola as having a 2C NPV10 of approximately USD$200 million net to Deltic, representing a multiple of the Company's current market capitalisation.

Potential for Licence Withdrawal

If an industry and/or funding solution is not in place by the end of May 2024, being the point at which Deltic will be required to demonstrate its capacity to fund its share of costs, Deltic will be required to take steps to ensure the Company is not exposed to further expenditure on the Pensacola well if there is no reasonable expectation that the Company will be able to meet those additional liabilities which will be incurred going forward.

In such circumstances, Deltic will be required to withdraw from the Pensacola licence and transfer its interest in Pensacola to the Joint Venture partners.

Graham Swindells, Chief Executive of Deltic Energy, commented:

'The struggle to find a way forward on a project like Pensacola, which is one of the largest discoveries in the North Sea in recent decades, is a real-world consequence of our political leadership using the nationally important oil and gas industry as a political football at a time when energy security is of paramount importance.

Given the impact of fiscal and political uncertainty on investment decisions we have seen a shift away from investment in larger standalone projects, like Pensacola, towards more affordable, lower risk opportunities which defer decommissioning or increase infrastructure life such as Selene, and the Company's Syros prospect in the Central North Sea, where we have seen an enhanced level of interest.

We look forward to the start of drilling operations on the high impact Selene exploration well, in which Deltic is fully carried for the estimated cost of the success case well, which remains due to spud in July 2024. In the meantime, we will continue to pursue all avenues to progress Pensacola and will update the market in due course.'

Source: Deltic Energy