- North Sea emissions fell 7% in 2024, a fifth consecutive year of reduction

- Large-scale emissions reduction projects still needed to get industry on long-term low emissions pathways

- NSTA working closely with industry, government and other regulators to ensure progress continues

The UK’s offshore oil and gas industry has made further progress lowering its production emissions, which were down by 7% in 2024, a fifth consecutive year of reductions, a new report says.

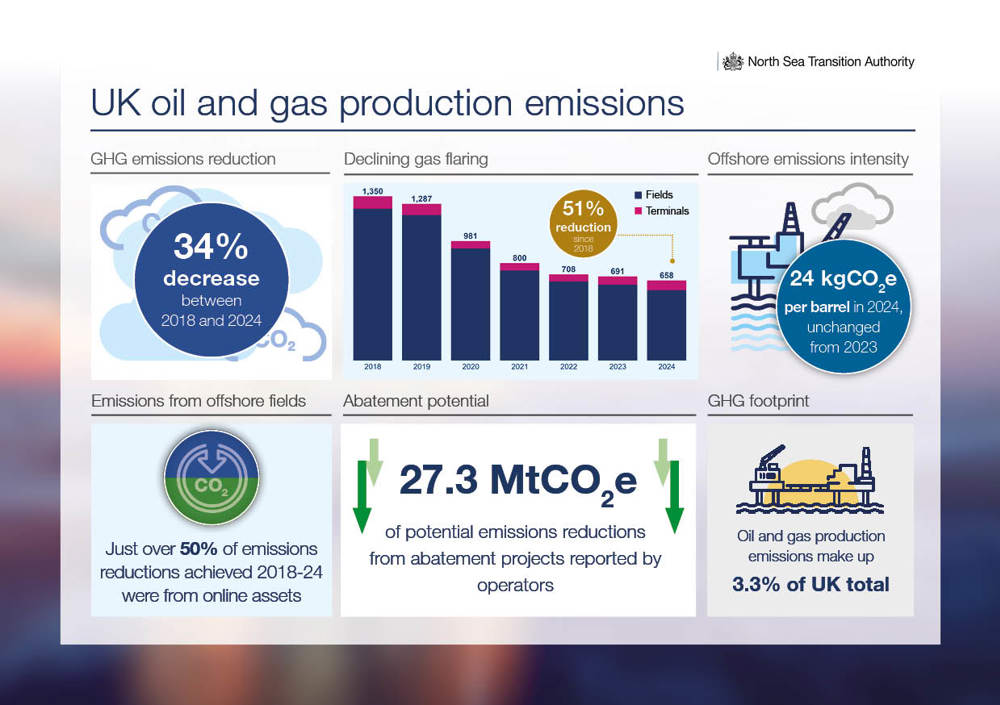

This contributed to a 34% drop since 2018, according to the Emissions Monitoring Report from the North Sea Transition Authority (NSTA). Flaring activity, which is the second largest source of production emissions, dropped 4.8% in 2024 to the lowest level on record, and was 51% lower than in 2018.

However, the report also shows projected reductions are lagging behind ambitions in the longer term unless there is significant new action. The target of halving emissions by 2030, agreed by industry and government in the North Sea Transition Deal, is now well within reach. But without serious investment in large-scale active emissions abatement projects, industry will not meet the 2040 target of lowering emissions by 90% or achieve net zero by 2050 – in what would be a blow to its credibility. As such North Sea oil and gas operators must take bold and rapid action on emissions to hit key net zero targets and justify domestic production over the coming decades.

Oil and gas meet about three quarters of the UK’s energy demand and will remain an important part of the country’s energy mix for decades to come. The sector also generates substantial tax revenues and employs tens of thousands of workers whose skills can underpin the energy transition in key areas such as carbon dioxide and hydrogen transportation and storage and floating offshore wind power.

While the UK still needs oil and gas, operators have a duty to run their assets as efficiently and cleanly as possible to retain support from the public and investors, ensuring the country can continue to benefit from its own hydrocarbon resources long-term.

Hedvig Ljungerud, NSTA Director of Strategy, said: 'Bringing down production emissions by more than a third in six years shows the North Sea oil and gas industry has been getting a lot right, reflecting its commitment. However, if operators lose focus on the task at hand, the projections are clear that UK production will become less clean and less competitive compared with imports over time.

'While the UK still consumes oil and gas, the way it is produced must become progressively cleaner. We’re encouraged that good work has begun, but there is still much more to do. It is time to commit to serious, large-scale investments in emissions reduction, and secure a leading role in the North Sea’s transition into a clean energy powerhouse.'

About half of the offshore emissions reductions achieved between 2018 and 2024 were from online assets. Since early 2021, NSTA interventions have contributed to preventing the emission of 4.5 million tonnes of lifetime carbon dioxide equivalent, the same as taking 2.5 million cars off the road for a year.

During that period, operators have invested in flaring reduction equipment and improved the efficiency of existing kit, such as gas export compressors and power generation turbines. Onshore gas compression for the Breagh field has been electrically driven since October 2024. Furthermore, multiple normally unattended platforms now have low-carbon power supplies, for example, small wind turbines, solar panels and batteries.

The NSTA wants to see more emissions reduction projects come to fruition and will provide impetus by robustly and pragmatically enforcing the OGA Plan. Launched in 2024, it sets out clear requirements for operators across four areas, including electrification and low-carbon power, which can make the biggest impact on production emissions, as power generation accounts for 80% of the current total.

Electrifying new assets – and, where reasonable, existing platforms with longer lifespans – can aid domestic energy resilience by saving fuel which would otherwise be combusted offshore, and support the expansion of floating offshore wind farms.

Work is ongoing to integrate a floating offshore wind turbine to partially power the Culzean platform, while the planned Green Volt floating wind farm has secured price guarantees from the government and could power several large oil and gas platforms.

It is vital that more electrification and low-carbon power projects reach final investment decisions in the near-term. Unnecessary delays will diminish the case for electrification by reducing the volume of emissions which could be prevented.

The NSTA is engaging with operators on the technical and economic viability of electrification projects, as well as working with government and other bodies to remove barriers to investment.

The OGA plan requires industry to live up to its longstanding commitment to achieve zero routine flaring and venting by the end of 2030. A flare gas recovery unit was recently activated on the Mariner platform and similar systems will be activated on the Clair and Elgin-Franklin installations. More projects of this nature are in early planning and the NSTA will press for them to go ahead. The regulator has also cracked down on flaring and venting breaches, imposing fines totalling £975,000 since the beginning of 2021.

Background

Read the 2025 Emissions Monitoring Report here.

NSTA colleagues will present the key findings from the 2025 EMR during a free seminar at Offshore Europe. Register here: https://www.eventbrite.co.uk/e/north-sea-transition-authority-emissions-monitoring-report-2025-tickets-1539969232429?aff=oddtdtcreator

The OGA Plan calls for concerted action across four areas: electrification and low-carbon power, flaring and venting, investment and efficiency, and focus on inventory as a whole, with increased scrutiny of assets with high emissions intensity.

Source: NSTA