Highlights:

- Hartshead and RockRose have together executed a binding agreement for Hartshead to farm-out 60% of its UK Southern Gas Basin assets (License P2607) to Rockrose for A$196.3m of gross value for phase 1, this amount includes A$48.4m of UK government Investment & Capital Allowance. There is a potential additional bonus of A$9.0m of phase 2 (Farm-out).

- A$536m of gross project expenditure satisfied by transaction, with proceeds of the farm-out to be applied to the companies 40% portion of project development cost.

- Hartshead to retain P2607 Operatorship at completion and transferring to RockRose at a mutually agreed future date.

- Farm-out provides a defined and value accretive pathway to production for Hartshead and its South Basin Gas assets.

- The Company has received firm commitments from institutional and sophisticated investors for a $20m placement at $0.04 per share which will see Hartshead fully-funded to meet its estimated share of the non-debt project development costs(1). In addition, subject to shareholder approval, directors have agreed to subscribe for an additional $750,000 at the placement price.

Hartshead Resources has entered into a Farm-out Agreement (FOA) with established UK North Sea independent RockRose Energy, part of the Viaro Energy Group, for a divestment of a 60% equity interest in its UK Southern Gas Basin License P2607 (Farm-out). The total gross consideration under the FOA is approx. A$196.3m, comprising of reimbursement of past costs, a partial carry on HHR’s share of development costs, bonus milestone payments and $48.4m of UK government Investment & Capital Allowance.

The Farm-out is a major milestone for the Company, materially de-risking the project and providing a clear pathway to the full financing and subsequent development.

Additionally, Hartshead is pleased to announce that it has received firm commitments for a placement to raise A$20m, which saw strong support from new and existing institutional and sophisticated investors. Net proceeds from the placement will augment proceeds from the Farm-out and are estimated to see Hartshead fully-funded through its share of non-debt project development costs.

Chris Lewis, Hartshead CEO, commented:

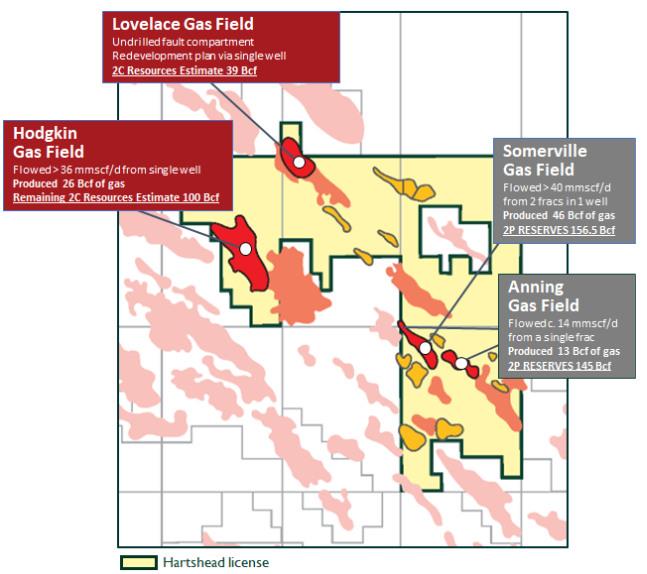

'The successful execution of a farm-out agreement with RockRose materially de-risks the Phase I development of the Anning and Somerville gas fields by securing over $536m of gross project expenditure, provides technical and commercial validation of our gas development and implies a material uplift in value for the project.

This is a landmark transaction for Hartshead shareholders. I am delighted to welcome RockRose to the P2607 Joint Venture and I am looking forward to working with the team as we progress the Phase 1 development and other opportunities in the License.

We are also very pleased to welcome new domestic and international investors to the Company and are very pleased with the level of support shown during the Placement process.'

(1) Based on CAPEX requirements detailed in ASX announcement dated 23 June 2022 ‘Substantial Uplift in Project Value Following Independent Technical and Commercial Audit of Anning and Somerville Gas Fields’. Updated CAPEX numbers will be prepared as part of FEED completion & Field Development Plan as part of the Final Investment Decision Process.

Click here for full announcement

Click here for Presentation: Transformational Farm-out and Placement

Source: Hartshead Resources