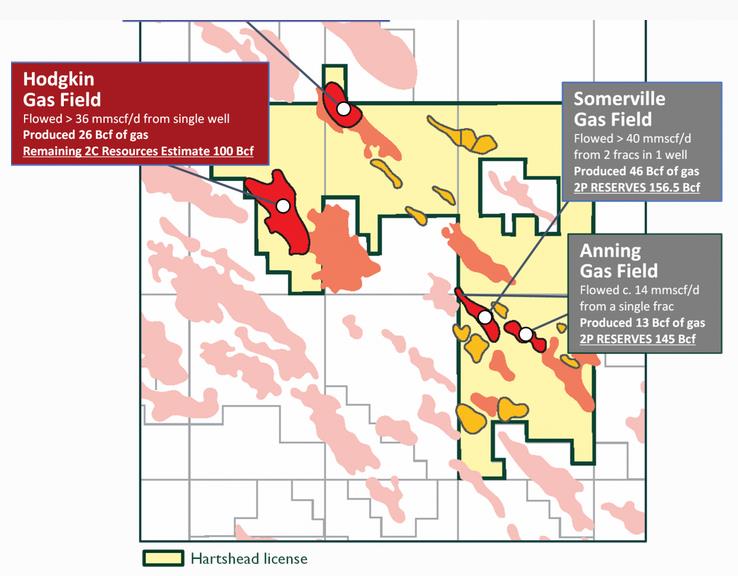

- P2607 Joint Venture (JV) continues to work on the development of the Anning & Somerville Gas Fields assuming various possible fiscal scenarios

- JV is committed to progressing the project, subject to certainty regarding future fiscal policy and 2024 JV budget remains in place

- Hartshead continues discussions on project finance, with discussions on infrastructure funding currently underway aimed at reducing upfront CAPEX for the JV

- Dialogue ongoing with various political stakeholders seeking clarity on future fiscal regime

- Hartshead has undertaken a cost reduction initiative to reduce contractor headcount associated with project development, while still maintaining a core JV team

- UK NBP gas prices strengthens to ~70p/therm

- UK 33rd Offshore Licensing Round, NSTA bid evaluation still ongoing

Hartshead Resources outlines that the P2607 Joint Venture (JV) is continuing work on the Phase 1 Gas Field Development. The JV is committed to progressing the project subject to receiving certainty regarding future fiscal policy and confirms that the current 2024 JV budget remains in place.

The Company has had extensive dialogue with various political stakeholders to seek clarity on the future fiscal regime, however at this time, the situation still remains unclear. It is anticipated that beyond the next parliamentary election in the UK, likely in Q4 2024, there will be changes to the oil and gas fiscal regime and Hartshead has been involved in discussions on the proposed changes and their impact on industry. All stakeholders have expressed their desire to create a fiscal regime in the UK that will still attract and enable investment and activity in the sector.

Hartshead is also continuing discussions on project finance and is in discussions on infrastructure funding that has the potential to significantly reduce the upfront CAPEX required by the JV, associated with the Phase 1 development project. This would be positive in respect to whole project economics, moving CAPEX into OPEX via a tariff payable in respect of third party infrastructure investment, and in respect of Hartshead funding, reducing the funding requirement that Hartshead would need to meet outside the RockRose carry.

Importantly, Hartshead is focused on maintaining its strong cash position during this period of delay and uncertainty. The Company has undertaken a cost reduction initiative in respect of the areas of the project team that were recruited to deliver the current and next phase of the development project and the related contract awards. This has led to a material cut in head count and a reduction of the monthly costs to the JV and to Hartshead directly.

UK NBP gas prices have strengthened to ~70p/therm which is a positive sign given the unusually mild winter in European and large supply of gas storage inventories at the exit of the winter season.

Chris Lewis, Hartshead CEO, commented:

'The Joint Venture continue to work to move our gas development project forward, looking at innovative funding arrangements to potentially reduce up front CAPEX. Discussions with policy makers and other stakeholders have been encouraging and I anticipate that a pragmatic solution exists to enable the continuation of the oil and gas industry in the UK.

I would like to thank RockRose for their continued support in the JV and collaboration on moving the project forward.

While it is regrettable that we have had to let so many from the project team go, we recognise the importance of preserving our cash position as much as possible until we have the clarity on policy to enable the project to once again move forward.'

Source: Hartshead Resources