Highlights:

- Funding solution for 100% of project development costs secured via uncapped free carry, totalling over A$800 million in funding secured.

- Hartshead and Viaro Energy’s subsidiary RockRose negotiated the option for Hartshead to divest an additional 20% licence interest for an uncapped free carry provided by RockRose.

- Completed the pipeline route survey covering the offtake routes for gas production from the Anning and Somerville fields.

- Multiple major tenders conducted, preparing for Phase I field development phase.

- Strong cash position of over $28 million

Commenting on the Quarter, CEO of Hartshead, Chris Lewis, said:

'The December Quarter was a critical period for the Company. Notably, the completion of the pipeline route survey, which spans the offtake routes for gas production from the Anning and Somerville fields, marked a significant milestone as the data gathered will allow us to progress the Environmental Statement as planned and ensure that tenders for the pipeline contracts reflect the real conditions on the seabed.

Furthermore, our strategic negotiation with Viaro Energy’s subsidiary RockRose, allowing Hartshead the option to divest an additional 20% licence interest for an uncapped free carry, was a major development as it covered the total costs of the Phase 1 project development and exemplified our commitment to fostering strong partnerships. We look forward to an exciting 2024 for HHR and I would like to thank shareholders for their ongoing support to date.'

Hartshead Resources has provided an overview of the Company’s quarterly activities for the period ending 31 December 2023.

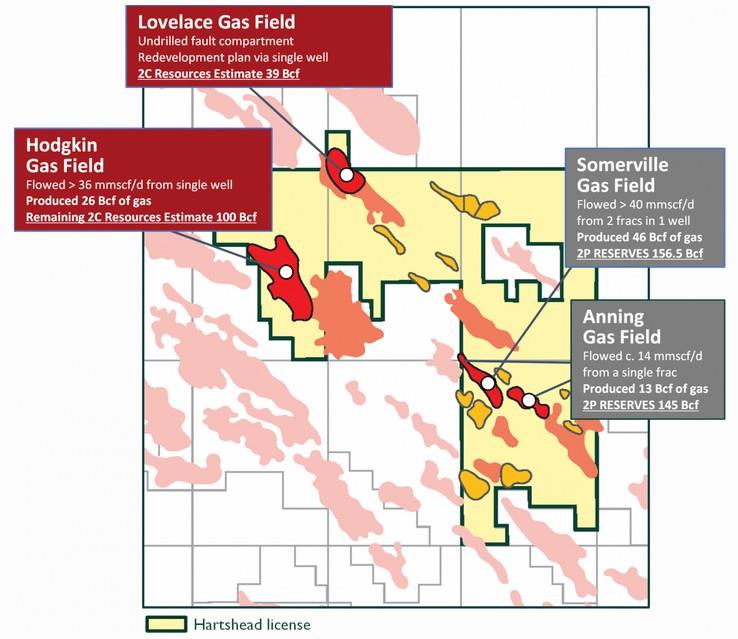

PHASE I FIELD DEVELOPMENT – ANNING AND SOMERVILLE GAS FIELDS

Funding Solution Secured for Project Development Costs:

During the Quarter, Hartshead and UK North Sea independent Viaro Energy announced that that their respective wholly owned subsidiaries, Hartshead Resource Ltd (HRL) and RockRose Energy (RockRose), have agreed amendments to the Farm-out Agreement (FOA) and Joint Operating Agreement (JOA), providing Hartshead with an option to divest an additional 20% equity interest in its UK Southern Gas Basin License P2607, in return for an uncapped free carry of all gross costs for the Phase I project development (Financing Backstop). The Financing Backstop may be exercised after Final Investment Decision has been taken and upon full expenditure of the current RockRose carry for Phase I project development costs.

The total gross consideration previously under the FOA, for a 60% divestment of License P2607 was approximately A$196.3m, comprising of reimbursement of past costs, a partial carry on HRL’s share of development costs, bonus milestone payments and A$48.4m of UK government Investment & Capital Allowance (refer ASX announcement 5 April 2023). The amendments to the FOA and JOA now provide a firm financial backstop for funding of HRL’s share of costs for Phase 1, should alternative funding not be agreed on acceptable terms to HRL.

HRL maintains, at its sole discretion, the ability to not proceed with the Financing Backstop and to source alternative financing to maintain its current 40% interest. This election is to be made once the existing carry commitment from RockRose has been fully spent. Current capital projections anticipate this would be by Q2 2025, providing Hartshead with more than 12 months to put in place project debt finance.

The Financing Backstop via an uncapped carry is a major achievement for the Company de-risking the project financing, providing a clear pathway to development and cashflow, and positions HRL with the option of a fully, debt-free funded remaining project interest.

Francesco Mazzagatti, CEO of Viaro Energy, commented 'I am quite pleased with the restructuring of our original farm-in agreement with Hartshead, as it provides us with complete certainty that the development of Anning and Somerville will be fully funded to completion. Giving our partner the option of a financing backstop ensures stability for the JV, a particular challenge for North Sea operators nowadays with the shrinking pool of traditional capital providers for E&P opportunities. With the amendments in place, we can now confidently proceed to the FID. I am grateful to the Hartshead team for a smooth and seamless cooperation at every stage of our developing partnership.'

Hartshead will continue to pursue the option to introduce project debt and maintain the current 40% equity interest in Licence P2607 however the Financing Backstop enables the Company to progress the Final Investment Decision and accelerate project development.

Project Funding

Discussions with funding providers suggest that the project maintains a conservative target debt level, which with debt funding would see the Company funded through its estimated share of development costs.

Hartshead will continue to progress discussions with various debt providers on development finance through a combination of one or more of the following instruments:

- Reserve Based Lending (RBL)

- Corporate/Nordic Bonds

- Prepayment/Commodity Offtake Facility

- Infrastructure Funds

Pipeline Route Survey Completion & Issue of Tender for Pipeline EPCI

In the Reporting Period, Hartshead announced that the Company, in conjunction with joint venture partner RockRose (UKCS2) Limited (RockRose), has completed the pipeline route survey covering the offtake routes for gas production from the Anning and Somerville fields. The survey was conducted using the Gardline MV Ocean Observer over a period of more than a month with no safety issues or incidents and a large amount of seabed technical and environment data acquired.

All the objectives of the survey were met with over 1000 km of seismic lines run and 52 Cone Penetration Tests (CPT) and 23 Vibrocores taken to help define the seabed status, along with 27 seabed samples and camera transects to identify any habitats and provide input to the environmental baseline survey. The material recovered from the survey will undergo laboratory analysis in accordance with international standards and procedures and will provide input to the Environmental Statement for the Anning and Somerville development.

Source: Hartshead Resources