Q1 production ahead of guidance, continued strategic and operational progress

Ithaca Energy, a leading UK independent exploration and production company, has announced its unaudited financial results for the three months ended 31 March 2023.

Q1 2023 Operational highlights

- Strong safety performance in Q1 2023 with no serious incidents or Tier 1 or 2 process safety events recorded in the period

- Production of 75.3 thousand barrels of oil equivalent per day ("kboe/d"), ahead of guidance of 70-72 kboe/d, following a positive end to the quarter

- Production early in the quarter was impacted by operational issues at Captain and FPF-1, with FPF-1 partially offline for ~1 month due to a damaged heat exchanger. Operations resumed in March after a swift resolution, demonstrating Ithaca Energy's deep operational expertise and production delivery capabilities

- Pierce field restarted operations following a major redevelopment to enable gas production. Gross peak production is expected to reach 30 kboe/d (Ithaca Energy working interest 7.48%), doubling the field's production prior to redevelopment

- Production split 67% liquids and 33% gas

- Ongoing offshore construction activities continued at Captain Enhanced Oil Recovery ("EOR") Phase II with engineering close to completion. B28 well construction mechanically complete, converting the well from water to polymer injection

- Commenced preparation for exploration drilling at K2 (Ithaca Energy operated, working interest 50%), and appraisal drilling at Leverett (Ithaca Energy working interest 12%) in June 2023. The Leverett field is situated in close proximity to Britannia, where Ithaca Energy holds a 32.38% non-operated working interest

- Captain Electrification Pre-FEED study completed in the quarter, confirming viability of the concept

- Pre-FID work continues across the Group's high-value greenfield and brownfield development portfolio

Q1 2023 Financial highlights

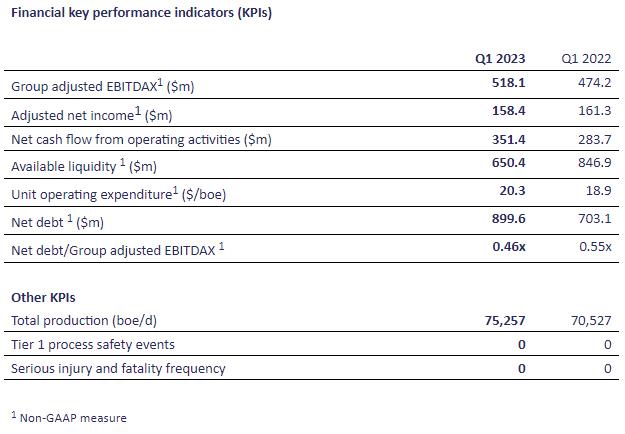

- Group adjusted EBITDAX up 9% to $518.1 million (Q1 2022: $474.2 million), driven by higher production and despite lower average oil and gas prices

- Adjusted net income of $158.4 million broadly flat (Q1 2022: $161.3 million)

- Net cash flow from operating activities up 24% to $351.4 million (Q1 2022: $283.7 million)

- Realised oil and gas prices of $83/bbl (Q1 2022: $100/bbl) and 137p/therm before hedging (Q1 2022: 227p/therm)

- Strong cost control, delivering unit operating costs of $137 million ($20.3/boe (Q1 2022: $18.9/boe)), at the lower end of guidance range of $130-$150 million for the quarter

- Producing asset capex of $90 million, at the lower end of guidance range of $90-$110 million for the quarter

- Balance sheet remains strong with further deleveraging in the quarter. Net debt of $899.6 million at 31 March 2023 (31 December 2022: $971.2 million; 31 March 2022: $703.1 million) representing a Group leverage position of 0.46x net debt to adjusted EBITDAX (31 March 2022: 0.55x) despite material M&A activity over the past 12 months

- At 31 March 2023, 10.7 million barrels of oil equivalent (68% oil) hedged from Q2 2023 into 2025 at an average price floor of $70/bbl for oil and 189p/therm for gas

Q1 2023 Corporate highlights

- On 4 May 2023, Ithaca Energy signed a marketing agreement with Shell U.K. Limited, representing a meaningful step towards securing an aligned joint venture partnership that would enable the successful future progression of the Cambo project towards FID, subject to regulatory and licensing approval processes and market conditions

- Initial 2023 interim dividend of $133 million paid in March 2023

- Targeted total dividend of $400 million reaffirmed for financial year 2023, with two further dividend payments following the first half of the financial year end and the end of the financial year

FY 2023 Management Guidance and Outlook for 2023

- Management reaffirms the previously provided guidance ranges for currently producing assets for full year 2023, and provides the following activity updates:

Production guidance:

- Guidance reaffirmed for the year ended 31 December 2023 of 68-74 kboe/d

Operating cost guidance:

- Guidance reaffirmed for the year ended 31 December 2023: $560-$630 million

Producing asset capital cost guidance:

- Guidance reaffirmed for the year ended 31 December 2023: $400-$460 million

- Material ongoing activity at the Captain EOR Phase II project that will support near-term production growth and increased reserve recovery, with first Phase II polymer production expected in 2024 and peak production in 2025, following the success of EOR Phase I

- FEED activity commenced in April 2023 to explore the potential for electrification of the Captain field, following pre-FEED studies in Q1 2023, demonstrating our continued focus on decarbonisation initiatives across our portfolio

- Exploration and appraisal activity at K2 and Leverett in Q2/Q3 provides near-term upside potential

- Continued deleveraging of the Balance Sheet, in line with the Group's capital allocation policy

- Near-term focus on maturing high value development projects in our portfolio towards FID while prioritising capital allocation to maximise sustainable shareholder returns

Chief Executive Officer, Alan Bruce, commented 'I am pleased to report a strong Q1 2023 performance with adjusted EBITDAX of $518.1 million. We remain focused on delivering safe and environmentally responsible operations as we execute our value-adding near-term developments such as Captain EORII, K2 and infill drilling at Alba'

Executive Chairman, Gilad Myerson, commented 'We delivered another strong quarter and met our commitments to deliver high operational performance in a responsible manner, deleverage our balance sheet, and distribute dividends to our shareholders. We are working constructively with the UK government to further develop our key development projects and continue to keep a watchful eye on consolidation opportunities with a focus on maximising shareholder returns.'

Source: Ithaca Energy