Highlights

- Orcadian has entered into a non-binding Heads of Agreement ('HoA') with Rapid Oil Production Ltd ('Rapid') to dispose of its interests in the Company’s non-core Crinan and Dandy

- Rapid is progressing the development of the nearby Fyne field, with the intention of achieving FDP Approval in 2023, and could bring Crinan into production as part of the Fyne cluster in phase two or three of the field development. This could potentially be followed by a Dandy tie-back via Fyne.

- If this progresses to completion, Orcadian would receive a cash consideration of US$500,000 (US$100,000 on signature of a binding Sale and Purchase Agreement, and US$400,000 on Crinan FDP Approval) plus a royalty on oil and gas produced from the fields.

Steve Brown, Orcadian’s CEO, commented:

'We are delighted to have reached an initial agreement with Rapid Oil, on the proposed disposal of these non-core assets. Rapid Oil are focussed on achieving a development plan approval for Fyne and Crinan and we believe they will be best placed to develop the Dandy fields through the same infrastructure. We look forward to converting these heads of terms into a binding agreement and will provide further updates as negotiations progress; and we look forward to potentially sharing in the cash flow from these discoveries if these fields are developed.'

Hallvard Hasselknippe, Rapid Oil Production’s CEO commented:

'We are pleased to add the potential of the Crinan and Dandy resources to our field development plan for the Fyne field, this adds approximately 7 MMbbl to our contingent resources. In particular Crinan will be a very cost efficient add-on as it can be drilled from the Fyne Central location.'

The heads of terms are subject to, amongst other items, due diligence, North Sea Transition Authority ('NSTA') consent and the finalisation of binding legal documents. Accordingly, there can be no guarantee that a final agreement will be entered into or that this disposal will complete.

Background

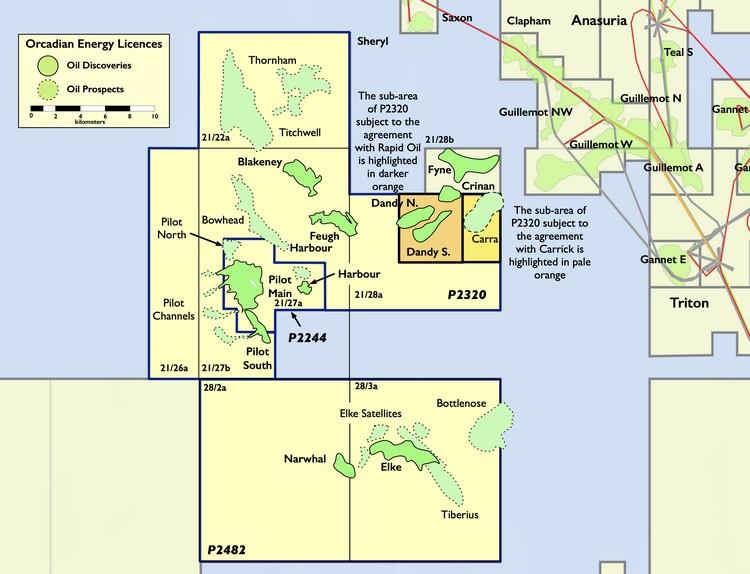

Crinan and Dandy were discovered by Mobil in 1987 and 1990 respectively, and appraised by Monument in 1998. Crinan straddles the boundary between 21/28a, Orcadian’s block, and 21/28b, Rapid Oil’s block, whilst Dandy lies entirely within 21/28a. These fields were not included in the Company’s CPR contingent resource estimate as they were considered non-core and not material to the overall Orcadian proposition, but were included as upside potential in the Company’s CPR (see page 146 of the Company’s Admission Document, available on the Company’s website)

Follow this link for a map of the proposed Crinan and Dandy subarea: https://bit.ly/Dandy_Crinan

Heads of Agreement

Rapid has agreed to pay an oil price dependent royalty which ranges from 2.5% to 4.0% for production from these fields. Rapid and Orcadian have also agreed that Orcadian’s deemed equity share of the Crinan discovery is 60%. Rapid Oil will additionally pay a 1% royalty to TGS ASA.

The intention under the HoA is that Rapid will pay Orcadian US$100,000 on signature of a binding Sale and Purchase Agreement plus a further US$400,000 on Crinan FDP Approval. These payments will be treated as a pre-payment of the royalty due to Orcadian.

There can be no guarantee that the fully termed deal will be agreed, nor that oil will be produced from these assets. In addition, if production is achieved any royalty payment would be spread over the life of the Crinan and Dandy developments (anticipated to be 10 to 20 years). Crinan and Dandy are discoveries on which Orcadian has undertaken no exploration activities, there is no turnover or profits attributable to the Crinan and Dandy sub-area. The Company currently ascribes a nominal value to the Crinan and Dandy sub-area of licence P2320. However, if the conditions of any future Sale and Purchase Agreement were to be satisfied and a royalty was to be paid, the Directors believe it could be meaningful.

Source: Orcadian Energy