Reabold Resources, the oil & gas investing company with a diversified portfolio of exploration, appraisal and development projects, has announced a corporate and operational update covering the West Newton PEDL 183 licence and four of the North Sea offshore licences, and the commencement of a share buyback programme of up to £750,000.

Key points

- PEDL 183 licence update:

- JV partnership agreed specific well path for West Newton B-2 well

- Potentially highly significant discovery in Crawberry Hill, part of the PEDL 183 licence and previously drilled by Rathlin Energy in 2013

- Rathlin to potentially bring in an industry partner to support licence activity, with West Newton B-2 drilling targeted for H2 2023, subject to final regulatory approvals and rig availability

- Reabold could provide additional funding solution for Rathlin upon receipt of the second tranche of net proceeds from the sale of Victory

- CPR published on four of the Reabold North Sea licences; follows the announcement and publication of a CPR in February 2023 on licence P2478, which includes the Dunrobin West prospect and confirmed significant resource potential

- Initiation of share buyback programme of up to £750,000 to commence on 28 April 2023

West Newton PEDL 183 licence UPDATE

WN B-2 well

The joint venture partnership at PEDL 183 has continued to analyse the geophysical, petrophysical and test data from the West Newton A and B wells in preparation for drilling. The data analysis has already confirmed the likelihood of intersecting good reservoir quality that, when taken in conjunction with the optimised drilling and completion methods, is expected to deliver good well productivity from a horizontal well from the B site ("WN B-2") and, as such, the JV partnership has committed to the specific, optimised well path for WN B-2. It is envisaged that WN B-2 will be followed by a multi-well development programme based on a 50 Mscf/d gas facility.

Potentially highly significant existing discovery in Crawberry Hill, part of the PEDL 183 licence, in the Zechstein play region

Alongside the development plans for the West Newton A and B wells, Reabold has continued to appraise other opportunities within the PEDL 183 licence. Reabold has undertaken a technical review of its Zechstein play prospectivity in the UK, including the licences acquired through the Simwell transaction and PEDL 183, combining the significant quantity of seismic data, historical wells, core analysis and other proprietary data and analysis assembled by the Company.

Through this analysis, Reabold has identified on PEDL 183 a significant potential discovery, Crawberry Hill, which was drilled by Rathlin in 2013. The Company's priority now is to develop plans with the aim of making this a drill-ready appraisal opportunity. This could add materially to the already significant resource within PEDL 183 offered from the West Newton trend. The Crawberry Hill-1 well, drilled in 2013, intersected 141m of Kirkham Abbey Formation with good indications of gas shows and porosity. The well was originally drilled to test a deeper target and does not have a full suite of logs over the Kirkham Abbey interval.

ERC Equipoise Ltd (ERCE) has undertaken a petrophysical analysis of the conventional reservoir of the Kirkham Abbey formation in the Crawberry Hill and Risby-1 wells and interprets average porosities greater than 15% in the top 20m of the Kirkham Abbey formation in Crawberry Hill-1. ERCE also interprets probable gas saturations in the top 6m of the Kirkham Abbey formation in the Crawberry Hill-1 well.

The Risby-1 well was drilled in the water leg but good porosity was calculated from the well logs and the potentially very good permeability indicated from well cuttings, which is supported by a drill-stem test in the Kirkham Abbey Formation. Detailed seismic mapping is underway to define the extent of the Crawberry Hill accumulation, which could add materially to the already significant resource within PEDL 183 offered from the West Newton trend.

In conclusion, Reabold believes the apparent discovery at Crawberry Hill to be an exciting appraisal opportunity potentially significantly enhancing the already strategic asset that is PEDL 183.

Given the significant technical analysis that has been completed to date, culminating in the JV partnership agreeing the well path for WN B-2 and the emergence of the Crawberry Hill opportunity, and in line with prudent risk management, Rathlin has decided to reduce its significant working interest position in PEDL 183 with the aim of potentially bringing in an industry partner to participate in drilling on PEDL 183.

Rathlin holds a 66.67% licence interest in and is operator of PEDL 183. Reabold has a ca. 56% economic interest in PEDL 183 via its 16.665% direct licence interest and through its ca. 59% equity ownership of Rathlin. Reabold is sufficiently funded for its 16.665% direct share of the costs for this well with its existing cash resources.

Should Rathlin's efforts to reduce their working interest position not fully meet their objective, Reabold could provide additional funding for Rathlin upon receipt of the second tranche payment from Shell relating to the sale of the Victory asset, which would allow WN B-2 to be drilled at the earliest opportunity, subject to Environment Agency permit approvals and rig availability. The exact timing and amount of the second tranche payment from Shell is currently uncertain, however the second tranche payment will be ca. £9.5 million, assuming the development and production consent for the Victory gas field is secured from the North Sea Transition Authority by 1 December 2023. If consent has not been received by this date, then Reabold expects to receive £5.2 million within 3 business days of this date, with the balancing payment to come at a later consent date. The net proceeds to be received by Reabold would be sufficient to meet Rathlin's share of the drilling costs of WN B-2, leaving Reabold financial flexibility for its capital allocation strategy of balancing portfolio investment with shareholder returns.

CPR on Reabold's Northern North Sea Assets

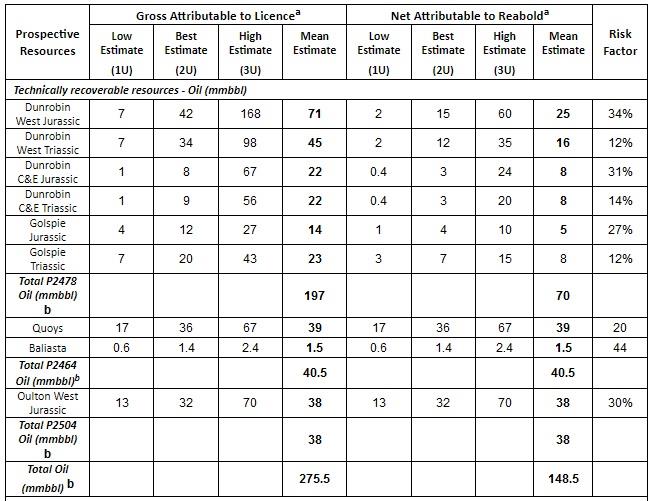

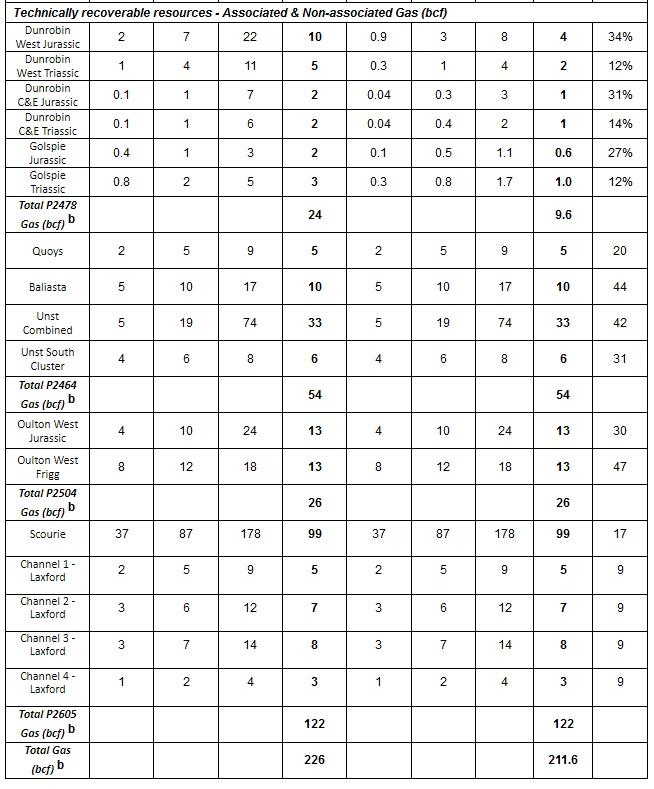

A Competent Person's Report ("CPR") prepared by RPS Group ("RPS") on four of Reabold's UK North Sea licences is available on its website at the following link: www.reabold.com/investor-relations/reports-and-presentations/. The CPR covers licences P2464, P2504 and P2605, in which Reabold has a 100% working interest, and licence P2478, in which Reabold has a 36% working interest. A P2478 (the Dunrobin complex) specific CPR was announced on 16 February 2023 and is also contained within today's published CPR. Reabold acquired these strategic off-shore North Sea licences from Corallian Energy for £250,000, as announced on 4 May 2022.

The CPR has been prepared in accordance with the June 2018 Petroleum Resources Management System ("SPE PRMS") as the standard for reporting. The key points from the CPR and a summary of the gross and net technically recoverable prospective resources are set out below.

- CPR highlights the potential across all of Reabold's key central and northern North Sea assets, namely: the Inner Moray Firth, East Shetland Basin and the North West of Shetland

- The opportunities comprise a number of play types of both gas and oil with proven potential from analogue fields

- Confirmed material contingent resources at Oulton of 11 mmbbls (2C) with an associated NPV (10) at 30 September 2022 of £59 million(1)

- Mean Estimate aggregate(2) of unrisked net prospective oil resources is 148.5 mmbbls and Mean Estimate aggregate(2) of unrisked net prospective gas resources is 211.6 bcf or ca. 36.5 mmboe(3)

- The Company believes that the CPR supports the ongoing farmout and marketing process for Reabold's North Sea assets

(1) Based on RPS assumptions.

(2) The unrisked aggregation was performed by the Company and assumes that all prospects at all levels are successful.

(3) The CPR reports oil and gas Prospective Resources. The oil equivalent value of the gas resources has been estimated by the Company using a factor of 5.8bcf per mmboe.

The table below summarises RPS's independent assessment of the Prospective Resources, from which are derived the net technically recoverable Prospective Resources attributable to Reabold's working interest, as derived from the CPR which has an effective date of 30 September 2022.

Notes:

a "Gross Attributable" are 100% of the resources attributable to the licence whilst "Net Attributable" are those attributable to Reabold's effective interest in the licence before economic limit test.

b Pmean totals are by arithmetic summation (in-house).

COMMENCEMENT OF SHARE BUYBACK PROGRAMME

Reabold is pleased to announce the launch of a share buyback programme, in accordance with the authority granted by shareholders at the Company's General Meeting on 28 February 2023.

As announced on 31 October 2022, Reabold stated that it intends to return £4 million of excess cash to Reabold shareholders upon receipt of the final £9.5 million net to Reabold from Shell, relating to the sale of the Victory asset.

However, the Company has decided to accelerate the timing of a portion of this return by commencing an initial share buyback programme for a maximum amount of £750,000. Reabold's Board evaluates many investment opportunities consistent with its investing policy and believes that the current market value of the Company's ordinary shares makes the buyback an attractive investment. Furthermore, the quantum of the buyback programme has been set by the Board after having considered the current capital position and future capital needs of the Company, such that it retains financial flexibility whilst maintaining an efficient balance sheet.

The Board will keep the Programme under review to ensure that it continues as an efficient and effective means of generating value for Reabold shareholders. While the Company has launched the Programme, there is no certainty on the volume of shares that may be acquired, nor any certainty on the pace and quantum of acquisitions.

Reabold will evaluate the mechanism of the intended return of the remaining £3.25 million upon receipt of the £9.5 million payment from Shell, with consideration to, inter alia, prevailing market conditions at that time.

The Company has entered into a buyback agreement with Stifel Nicolaus Europe Limited ("Stifel"), which will conduct the Programme and repurchase Reabold's ordinary shares of 0.1 pence each ("Ordinary Shares") on Reabold's behalf for a maximum amount of £750,000 worth of Ordinary Shares. During any closed periods of the Company, the buyback agreement will grant Stifel the authority to enact purchases of Ordinary Shares and make trading decisions concerning the timing of the purchases under the Programme independently of the Company. The purpose of the Programme is to reduce the issued ordinary share capital of Reabold.

The Programme will be conducted within certain pre-set parameters in accordance with the Company's general authority granted to the Company at its General Meeting on 28 February 2023. In line with the authority, the Programme will not exceed acquisitions of more than 2,294,346,977 Ordinary Shares (representing approximately 25 per cent. of the Company's issued ordinary share capital). Share purchases will be carried out on the London Stock Exchange. The average daily volume figure acquired under the Programme will be no more than 25% of the average daily volume traded in the 20 trading days preceding the date of purchase, and no more than 6 million Ordinary Shares in any one day.

Any Ordinary Shares acquired under the Programme shall be at a maximum price (excluding expenses) of the higher of: (i) 10% above the average of the middle market quotations for an Ordinary Share as derived from the AIM Section of the Daily Official List of the London Stock Exchange for the five business days before the date on which the contract for the purchase is made; and (ii) an amount equal to the higher of the price of the last independent trade and current independent bid as derived from the London Stock Exchange trading system.

The Ordinary Shares repurchased will be held in Treasury, to meet the obligations from employee share option programmes or other allocations of shares to employees of the Company, or to re-issue such Ordinary Shares held in Treasury outside of a pre-emptive offer.

It is intended that the Programme will be conducted within the parameters prescribed by the Market Abuse Regulation 596/2014 (as in force in the UK by virtue of the European Union (Withdrawal) Act 2018 and as amended by the Market Abuse (Amendment) (EU Exit) Regulations 2019) (the "Regulation"), the Commission Delegated Regulation (EU) 2016/1052 (as in force in the UK by virtue of the European Union (Withdrawal) Act 2018 and as amended by the FCA's Technical Standards (Market Abuse Regulation) (EU Exit) Instrument 2019) (the "Delegated Regulation").

The Programme is expected to continue until the Company's next Annual General Meeting, which is expected to be held in June 2023.

Any market repurchase of Ordinary Shares will be announced no later than 7:30 a.m. on the business day following the calendar day on which the repurchase occurred.

Stephen Williams, Co-CEO of Reabold, commented:

'The ongoing technical work related to West Newton has given the JV a high level of confidence in the planned location for the upcoming B-2 horizontal well, with drilling targeted in H2 2023. That, combined with the exciting and highly material potential we have identified at Crawberry Hill, and the confirmation of the prospectivity of the North Sea assets as confirmed by the CPR, is reflected in today's announcement that we are beginning the process of returning excess cash to shareholders by undertaking an initial up to £750,000 share buyback. We believe that this represents the most effective way that Reabold can access additional resource on a per share basis for its investors, whilst we await the drilling of West Newton B-2.'

Source: Reabold Resources