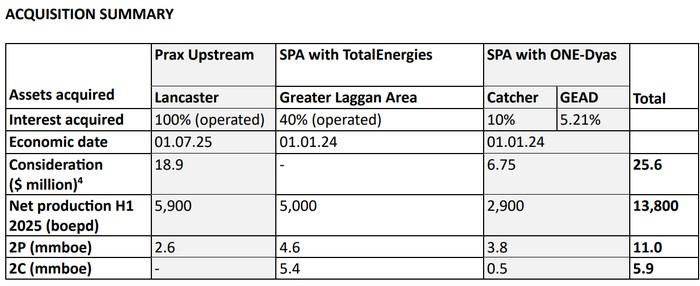

AIM-listed Serica Energy has signed a sale and purchase agreement to acquire 100% of the issued share capital of Prax Upstream from Prax Exploration & Production. Prax Upstream holds a 100% interest in, and is the operator of, the Lancaster field. In addition, Prax Upstream is party to separate executed sale and purchase agreements with TotalEnergies and ONE-Dyas for the purchase of certain assets ('Existing SPAs'). Consequently, the Acquisition, including completion of the Existing SPAs, comprises a 40% operated interest in the Greater Laggan Area ('GLA'), a 10% interest in the Catcher Field, a 5.21% interest in the Golden Eagle Area Development ('GEAD') and a 100% interest in the Lancaster field. The total aggregate upfront consideration is $25.6 million.

Chris Cox, Serica's CEO, stated:

'This transaction represents a further step in the delivery of our growth strategy - it diversifies our portfolio, increases our reserves and resources, and enhances near-term cashflows at an attractive valuation. The addition of GLA brings Serica a new production hub, with operatorship of the Shetland Gas Plant. There is an immediate boost to production and reserves, plus the scope to create significant value for shareholders through multiple subsurface, commercial, and further M&A opportunities.

This transaction illustrates Serica's ability to move quickly, utilising our strong balance sheet and skill sets to make an acquisition with strategic potential on attractive terms.'

BENEFITS OF THE ACQUISITION

Completion of the Acquisition is expected in Q4 2025 and of the Existing SPAs in Q1 2026. Taken together, these transactions will enhance the Serica portfolio as follows:

- Addition of 11.0 mmboe of 2P reserves[1] (as at 30 June 2025), at an acquisition cost of $2.3/boe[2]

- A more diverse and robust production portfolio, with H1 2025 production of 7,900 boepd associated with the Existing SPAs and 5,900 boepd from the Lancaster field (expected to cease production in H2 2026)

- A new operated hub for Serica in the West of Shetland basin with multiple sources of organic growth potential, including an infill well on the Tormore field, the Glendronach development, four exploration licences, and third-party throughput opportunities in the Shetland Gas Plant ('SGP')

FINANCIAL HIGHLIGHTS

- Upon completion, Serica will pay an aggregate upfront consideration of $25.6 million and will receive payments totalling an estimated c.$100 million reflecting interim post-tax cashflows between the economic dates of each transaction and estimated completion dates

- In addition to the completion payments, Serica expects an incremental c.$50 million of Free Cash Flow[3] from the acquired assets in 2026

- Following completion of the transactions, Serica estimates that its portfolio decommissioning liability per 2P barrel will remain amongst the lowest in the UK North Sea. Near-term decommissioning costs relate largely to the plugging and abandonment of two wells at Lancaster, forecast to cost c.$60 million

- Catcher and GEAD decommisioning is set to occur towards the end of the decade, at an estimated net cost of c.$90 million

- Decommissioning at GLA is not currently planned until well into the 2030s, with net post-tax costs potentially in the range of $200 to $250 million. As operator, Serica expects to work with partners to pursue opportunities to extend the productive life of the facilities through increasing production and securing third party throughput

- With the addition of tax losses acquired, on completion of the Prax Upstream acquisition Serica aggregate ring-fence losses as of 30 June 2025 will total $2.14 billion Ring Fence Corporation Tax, $1.83 billion Supplementary Charge, and $518 million Energy Profits Levy

KEY TERMS OF THE ACQUISITION

The Acquisition is a corporate acquisition of Prax Upstream for a consideration of £14.5 million ($18.9 million). Completion is subject only to customary regulatory approvals and is expected to occur by year end.

KEY TERMS OF THE EXISTING SPAs

Upon completion, Serica will assume the rights and obligations of Prax Upstream in relation to the two Existing SPAs.

The Existing SPAs relate to two asset acquisitions undertaken by Prax Upstream: an agreement entered into between certain Prax Upstream subsidiaries and TotalEnergies E&P UK Limited ('TEPUK') in respect of a 40% operated interest in the GLA (the 'TTE Acquisition'); and an agreement between Prax Upstream and ONE-Dyas E&P Limited ('ONE-Dyas') in relation to a 10% interest in the Catcher Field and 5.21% interest in GEAD (the 'ONE-Dyas Acquisition'). Further details on the assets underlying the Acquisition and the Existing SPAs are set out below.

The TTE Acquisition was originally signed between certain Prax Upstream subsidiaries and TEPUK on 20 June 2024. On 29 September 2025, an Amended and Restated Asset Purchase Agreement and Share Purchase Agreements, both on the same terms and conditions as the original TTE Acquisition documents (save for the extension of the applicable longstop dates) have been signed between certain Prax Upstream subsidiaries and (subject to completion of the Acquisition) Serica as Guarantor. The TTE Acquisition consideration at the economic date of 1 January 2024 (the 'TTE Economic Date') is $1 payable on completion as adjusted by certain customary completion adjustments including inter alia net cashflows after tax from the GLA interests between the TTE Economic Date and completion. In addition, the TTE Acquisition includes contingent consideration related to the sanctioning of certain third-party fields developed as tie-backs to the SGP no later than 31 December 2033. Completion of the TTE Acquisition, which is subject to customary completion conditions including NSTA and partner consents, is expected to occur in H1 2026. On completion of the TTE Acquisition Serica is expected to receive a payment reflecting interim post-tax cashflows between the TTE Economic Date and the date of completion.

The ONE-Dyas Acquisition was originally signed between certain Prax Upstream subsidiaries and ONE-Dyas on 28 March 2025. On 29 September 2025, certain amendment letter agreements have been signed between certain Prax Upstream subsidiaries and (subject to completion of the Acquisition) Serica as Guarantor. The ONE-Dyas Acquisition consideration at the Economic Date of 1 January 2024 (the 'ONE-Dyas Economic Date') is $6.75 million payable on completion as adjusted by certain customary completion adjustments including inter alia net cashflows after tax from the Catcher and GEAD interests between the ONE-Dyas Economic Date and completion. Completion of the ONE-Dyas Acquisition, which is subject to customary completion conditions including NSTA and partner consents, is expected to occur in H1 2026. On completion of the ONE-Dyas Acquisition Serica is expected to receive a payment reflecting interim post-tax cashflows between the ONE-Dyas Economic Date and the date of completion.

ASSETS ACQUIRED

Greater Laggan Area (40% and operator): Laggan, Tormore, Glenlivet, Edradour and Glendronach fields, the onshore SGP (collectively the 'GLA Assets') and four infrastructure led exploration licences

The assets acquired under the TTE Acquisition comprise TotalEnergies' entire 40% operated interest in the GLA Assets, as well as associated infrastructure usage rights and operated licence interests in four near field exploration blocks in the SGP catchment area. The GLA Assets had net 2P reserves of 4.6 mmboe and 2C resources of 5.4 mmboe as at 30 June 2025.

The GLA Assets, located north-west of Shetland, comprise eight wells from four fields connected as subsea tiebacks to, and operated from, the SGP. Production totalled 5,000 boepd net to TotalEnergies in H1 2025, 90% of which was gas. Production from these fields is in decline, with the potential to offset this through organic projects, including an infill well on Tormore and development of the Glendronach discovery. There are also estimated unrisked net mean prospective resources of over 400 mmboe in the exploration blocks.

GLA gas is evacuated from the SGP through the Shetland Islands Regional Gas Export System ('SIRGE') pipeline into the Frigg UK Association ('FUKA') pipeline to the St Fergus terminal.

The SGP was commissioned in 2016 and is the newest onshore gas processing facility in the UK. Natural gas represents nearly 40% of the UK's total energy supply with a growing gap between UK demand and domestic production. The SGP and associated infrastructure serves as the key gathering system for gas coming from the highly prospective West of Shetland basin. Serica expects that this will facilitate the exploitation of infrastructure-led development and exploration opportunities in the area including new sources of third-party throughput that offer the potential to extend the productive life of the SGP. The impending start-up of production, anticipated in Q4 2025, from the Shell-operated Victory field is a prime example of such an opportunity.

Preparation for the transfer of operatorship of the GLA Assets from TEPUK to Prax Upstream was well advanced prior to Serica's involvement and will now be expedited.

Catcher (10%) and Golden Eagle Area Development ('GEAD') (5.2%)

The ONE-Dyas Acquisition comprises ONE-Dyas' non-operated working interests in the Catcher and GEAD fields in the Central North Sea, operated by Harbour Energy and CNOOC respectively. In H1 2025 the assets delivered combined net production of 2,900 boepd with high-uptime. The ONE-Dyas Acquisition brings net 2P reserves of 3.8 mmboe and 2C resources of 0.5 mmboe, as at 30 June 2025.

Lancaster (100%)

Prax Upstream owns a 100% interest in the Lancaster oil field, West of Shetland. Lancaster produced an average of 5,900 bopd of oil in H1 2025 via the Bluewater owned and operated Aoka Mizu FPSO. This FPSO has been earmarked for a potential new contract for the Sea Lion project in the Falkland Islands and Lancaster production is not expected beyond Q3 2026. The Lancaster field had 2P reserves of 2.6 mmboe as at 30 June 2025.

Serica will host a live presentation on the Investor Meet Company platform today at 0900 BST. The presentation is open to all existing and potential shareholders. Questions can be submitted at any time during the live presentation. Investors can sign up to Investor Meet Company for free and add to meet Serica Energy plc via https://www.investormeetcompany.com/serica-energy-plc/register-investor.

(1) All 2P reserves and 2C contingent resources stated in this announcement are based on an independent evaluation carried out by Sproule ERCE, effective as of 30 June 2025, and assume that the Existing SPAs reach completion, and are irrespective of the underlying effective dates of the Acquisition or the Existing SPAs. The implied consideration per 2P boe represents the aggregate consideration of the transactions divided by the aggregate 2P boe as at 30 June 2025

(2) Based on the aggregate upfront consideration

(3) Based on a Brent oil price average of $66/bbl and NBP price of 80p/therm in 2026

Source: Serica Energy