AIM-listed Serica Energy has issued a trading and operations update in respect of the third quarter and first nine months of 2025.

Chris Cox, Serica's CEO, stated: 'Production rebounded in November to once again average above 50,000 boepd, a level that more accurately reflects the potential of our portfolio. The expected near-term addition of Lancaster production, following completion of our acquisition of Prax Upstream, will add a further short-term boost, and the resumption of regular liftings from Triton will return us to significant and sustainable cash generation going forward. This, in turn, will help us to deliver on our two-pronged growth strategy, as we seek to diversify our production both through investment in our existing portfolio and M&A. While the Budget announcements yesterday were a missed opportunity to kick-start investment across the UK North Sea, we now have greater clarity about the fiscal and regulatory regimes in which our investment decisions will be made. We have multiple, and material, organic growth options, and we will work to high-grade the investments that maximise shareholder value.'

Update on production and financial performance

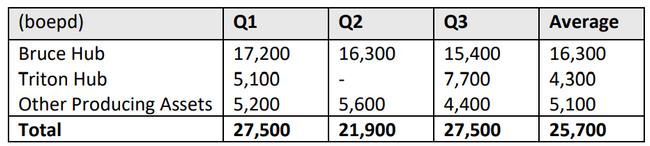

- Production of 25,700 boepd in first nine months of 2025, predominantly impacted by downtime at the Triton FPSO

- Q3 production included the planned annual maintenance periods at the Bruce Hub and across Other Producing Assets

- Following October production of 27,900 boepd, production in November rebounded to average 50,300 boepd prior to the planned outage at Triton, which started on 23 November and is expected to complete in mid-December

- Revenue of $439 million in first nine months of 2025, with $134 million in Q3 (Q3 2024: $139 million)

- Average realised Brent oil price of $70/bbl in first nine months of 2025 (first nine months of 2024: $76/bbl)

- Average realised NBP gas price of 89p/therm in first nine months of 2025 (first nine months of 2024: 71p/therm)

- Capital expenditure of $200 million in first nine months of 2025 (same period in 2024: $202 million), in line with guidance, the majority of which was spent on completion of the Triton drilling programme and ongoing subsea work to prepare Belinda for production

- Cash tax paid of $8.5 million in 2025, benefitting from group relief, which also resulted in a $71 million tax refund being received in June 2025. There are no further tax payments to be made in 2025

- Cash of $41 million as at 30 September 2025 (30 June 2025: $174 million)

- Q3 capital expenditure was $62 million, no payments for liftings were received relating to Triton production, and the final dividend of $51 million was paid in July

- - Borrowings of $231 million as at 30 September 2025 (30 June 2025: $231 million), resulting in a net debt position of $190 million as of 30 September 2025

- - Total liquidity of $300 million as of 30 September 2025, comprising cash and undrawn committed RBL facility availability of $259 million

Operational update

- Maintenance work at the Triton FPSO completed in July, with subsequent temporary issues relating to the compression train and flare system, resulting in significantly reduced production in Q3

- Production rebounded strongly in November, averaging 25,300 boepd net to Serica prior to the planned subsea work starting on 23 November. This work on the Bittern export pipeline requires production to be shut in from the Bittern, Gannet, and Evelyn fields, and is set to complete in mid-December

- The Triton FPSO is currently running with one compressor online, with maximum production net to Serica of 25,000-30,000 boepd. The start of two compressor operations would facilitate an increase in production through the optimisation of Serica wells, and then production from the Belinda field (Serica 100%). Testing of the second compressor is currently underway, and the operator of the Triton FPSO, Dana, continues to review the start date of two-compressor operations

- Production from the Bruce Hub averaged 22,000 boepd in the period prior to planned annual maintenance, which began on 15 August. Following the completion of maintenance, bull-heading operations (in which gas is pumped into a well to reduce back pressure and enhance production) were only able to resume in November, resulting in curtailed production of 16,100 boepd in October. With the resumption of bull-heading, production has returned to over 20,000 boepd from the Bruce Hub

Update on acquisitions

- The acquisition of Prax Upstream is set to complete in mid-December, at which point production from Lancaster, currently around 5,900 boepd, will be added to the Company total. Completion of the TotalEnergies and ONE-Dyas Acquisitions continues to be expected in H1 2026

- In November, Serica announced the acquisition of a 40% holding in the P2530 Licence from Finder Energy, containing the Wagtail oil discovery and the low-risk Marsh and Bancroft exploration prospects. The addition of the stake in Wagtail will add an operator estimated c.8 MMbbls of net 2C Contingent Resources to the Serica portfolio, and enhanced the already attractive organic growth opportunity set

Update on UK Government consultations

- As announced in the Budget yesterday, the Energy Profits Levy (‘EPL’) will be retained in its current form until 2030

- After EPL ends, or ceases due to average oil and gas prices falling below triggers set under the Energy Security Investment Mechanism (‘ESIM’), currently Brent $76.12/barrel and 0.59p/therm, the government yesterday confirmed that it will be replaced by a new permanent mechanism, the Oil and Gas Price Mechanism (‘OGPM’). Unlike EPL, the OGPM will be applied separately to oil and to gas and will tax only the proportion of revenue earned above new OGPM trigger levels, those being $90/barrel and 90p/therm (for 2026 to 2027, then rising with the Consumer Price Index), at a tax rate of 35% (as opposed to 38% for the EPL)

- Also announced yesterday was the North Sea Future Plan. This reconfirmed the government’s commitment that all existing licences will be honoured, and licence extensions can be granted. It is not therefore expected that, once legislated, the new regime will impact Serica’s current portfolio, future developments, or growth strategy

- The North Sea Future Plan also introduces a new concept of Transitional Energy Certificates which are designed to support further development in currently unlicensed areas adjacent to existing licensed blocks

Outlook and guidance

- Serica expects production for FY 2025 to average 27,000 to 28,000 boepd

- Capital expenditure expected to be around $250 million, in line with guidance

- Opex is expected to be around 10% above the previously guided $330 million, due in part to the relative strength of Sterling against the US Dollar

- Serica continues to analyse multiple M&A opportunities, focused on the UK North Sea, while progressing the numerous organic growth options in the existing portfolio

- Serica remains committed to the move from the AIM to the Main Market of the London Stock Exchange, which continues to be expected following publication of Serica's audited FY 2025 accounts and consolidated year end CPR information

- In line with previous years, guidance for 2026 will be provided in a Trading and Operations Update to be announced on 21 January 2026

Source: Serica Energy