Star Energy Group, a leading onshore hydrocarbon producer in the United Kingdom, delivering natural gas and crude oil to Britain’s energy market, has announced its unaudited interim results for the six months to 30 June 2025.

Commenting today Ross Glover, Chief Executive Officer, said:

'We welcome the UK government's recent recognition of domestic energy's strategic value, as reflected in policy priorities aimed at reducing reliance on imported fossil fuels, enhancing energy security, and creating new green jobs and economic growth. The mission of Great British Energy similarly champions clean, secure, home-grown energy as a catalyst for job creation and energy independence. Our strategy is closely aligned with these objectives: we manage our oil and gas assets responsibly and efficiently, while reinvesting operating cashflows into making our oil and gas business more resilient and maturing our geothermal opportunities.

However, the operating environment remains challenging. Our core oil and gas operations-critical to funding the Group-are under increasing strain from the Energy Profits Levy, which has elevated the headline upstream tax rate to 78%. This, combined with a more complex and costly regulatory environment, creates substantial barriers just as the UK's dependence on energy imports remains pronounced. In the first quarter of 2025, the country's net energy imports underscored the urgent need to prioritise and support domestic supply.

Despite these headwinds, we remain committed to developing a robust UK geothermal business and are lobbying the Government to provide consistent and practical policy and regulatory support. With this support, the potential is considerable: geothermal energy offers secure, low-carbon, and price-stable heat at scale. We aim to be a highly active player in the energy transition and are well-positioned to be so.

Promoting genuinely home-grown energy is essential-not only for strengthening the UK's energy security, but also for supporting skilled employment, generating tax receipts for the government, and fostering regional and national growth. This opportunity is of strategic importance both to the country and to Star Energy, and we are dedicated to realising its potential. Our approach is disciplined and measured. We are focused on operational excellence in our oil and gas business, making selective investments where returns are compelling, and steadily advancing our geothermal development pipeline in the UK and Croatia and generating value for shareholders'.

Corporate & Financial Summary

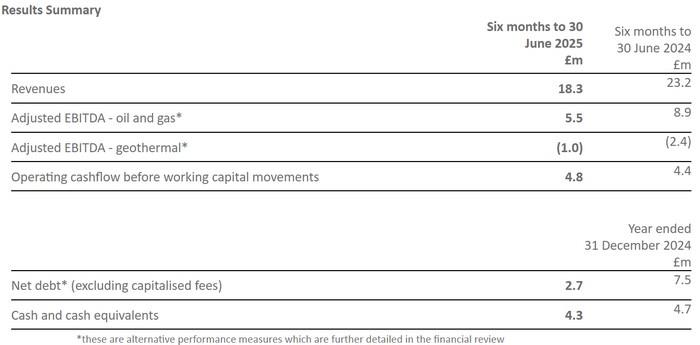

- Cash balances as at 30 June 2025 were £4.3 million (31 December 2024: £4.7 million) and net debt reduced to £2.7 million (31 December 2024: £7.5 million). £8.7 million (€10.2 million) remains undrawn under our Finance facility which can be used to fund a portion of the Singleton Gas-to-wire project and our geothermal activities.

- Adjusted EBITDA was £4.5 million. Lower commodity prices, a weaker US dollar, and lower production impacted oil revenues. However, the savings of £1.6 million that we have generated in administrative costs and reduced expenditure on our Croatian geothermal licences has partially offset this.

- Operating cash flow before working capital movements increased to £4.8 million (H1 2024: £4.4 million). Reduced cashflows from oil sales net of hedges were more than offset by a reduction in administrative expenses, geothermal expenditure and other expenses.

- We received £6.3 million of proceeds from the sale of our Holybourne site.

- We invested £2.0 million in our oil and gas assets in the period including on our Singleton gas-to-wire project and on smaller projects across our sites to enhance production and optimise operations. Net cash capex for FY 2025 is expected to be £8.4 million, primarily relating to our conventional assets.

- We recognised a gain of £1.3 million on our commodity and foreign exchange hedges, of which £0.5 million was realised in the period. We have hedged 152,800 bbls with swaps for H2 2025 and Q1 2026 at an average price of $72.9/bbl and have additionally created some downside protection for 237,800 bbls with a three-way put/call options for H2 2025 and for 20261. We have also put in place USD/GBP foreign exchange hedges for $0.5 million/month at a rate of $1.227/£1 for the remainder of 2025.

- The Group had ring fence tax losses of £249 million at 30 June 2025.

(1) A summary of our commodity hedges is shown on our June 2025 AGM trading update on our website

Operational Summary

- Net production averaged 1,894 boe/d in H1 2025 (H1 2024: 2,012 boe/d). Full year production is expected to be c.2,000 boe/d, in line with our previous guidance.

- Work on our Singleton gas-to-wire project has started, and we have entered into contracts for the procurement of two generators and the connection to the grid. Planning permission was received for the cable installation in July. We have been informed by the distribution network operator that energisation of the grid connection will not be completed in 2025. Accordingly, whilst we are working with the operator to expedite this, we expect the project's scheduled launch to be delayed into 2026.

- We are continuing the development of our UK geothermal pipeline and are working with both public and private entities to expand this. During the first half, we announced the following:

- MoU signed with the University of Southampton and Bring Energy to decarbonise the existing Southampton District Heat Network and explore the provision of geothermal heat to the University; and

- MoU signed with Veolia on the decarbonisation of heat supply to new and existing customers. We will work together on decarbonising district heating schemes, commercial buildings, hospitals, campuses and industrial processes.

- We have completed the detailed feasibility studies for our projects at the Wythenshawe Hospital and Salisbury District Hospital, both of which confirm the presence of viable geothermal reservoirs.

- We continue to mature our Croatia geothermal portfolio by establishing the exploitation field within the Ernestinovo licence and preparing the conceptual field development plan to be submitted to the Croatian Ministry of Economy. Following the acquisition of magnetotelluric data on both Sjece and Pcelic exploration licences, we are undertaking a technical de-risking of the licences to enable a phased development of the portfolio.

A results presentation will be available at https://www.starenergygroupplc.com/investors/reports-publications-presentations

Source: Star Energy