Star Energy Group, a leading onshore hydrocarbon producer in the United Kingdom, delivering natural gas and crude oil to Britain’s energy market, has announced full year results for the year ended 31 December 2024.

Commenting today, Ross Glover, Chief Executive Officer, said:

'I am very pleased to be presenting my first annual results as Chief Executive Officer of Star Energy. Our strategic aim is to be a profitable energy business generating strong cashflows from our oil and gas assets whilst progressing growth opportunities in the geothermal sector. By focusing on maximising profitability from our oil and gas activities, we ensure long-term sustainability and can successfully navigate a volatile oil price environment, which is increasingly important in today's uncertain geopolitical climate. We have maintained strong production across our fields and made good progress in reducing costs, with substantial general and administrative savings projected for 2025.

Investing in our producing assets provides a robust financial foundation for future growth, and I am confident that geothermal energy presents a significant growth opportunity in both the UK and Europe. Successful project development will create material incremental asset value and can deliver strong returns for shareholders. We recognise that it will take time to bring our geothermal projects to production and are committed to rigorously assessing project commerciality in order to allocate capital based on strict criteria for achievement of milestones and creation of value. This approach will enable us to build a portfolio of profitable projects over time.'

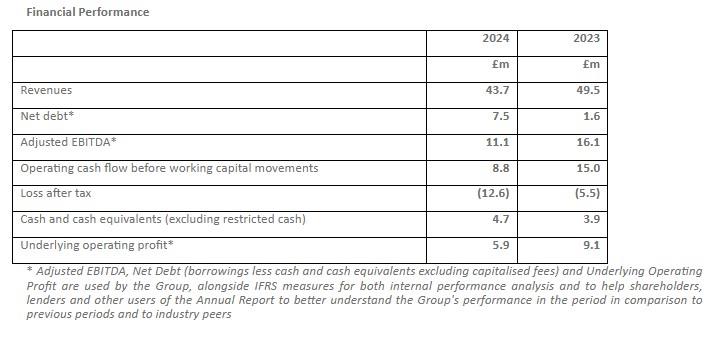

Corporate & Financial Highlights

- Successfully secured a €25 million financing facility provided by Kommunalkredit Austria AG which, while primarily supporting the development of our geothermal energy sector, also enables continued investment in the oil and gas business utilising existing cash flows

- Cash at 31 December 2024 was £4.7 million, excluding restricted cash, and Star Energy had drawn £12.2 million under its loan facility. Restricted cash was £4.3 million and relates to the cash backing of performance bonds for licence commitments of the Company's Croatian subsidiary relating to the Sjece and Pcelic exploration licences

- Increased our stake in our Croatian subsidiary post year end, from 51% to 71%, allowing us to control the development of this initiative until appropriate value inflection points are achieved

- Exchanged contracts for the sale of non-core land for £6.3 million in November 2024 with proceeds received in April 2025

- Hedging in place for 400bbl/d for H1 2025 and H2 2025 with swaps at an average price of $79.8/bbl and $73.0/bbl, respectively

- Energy Profits Levy of £1.0 million paid in February 2025 based on the taxable profits for the year ended 31 December 2023. The Company estimates a charge of £2.1 million for 2024

Operational Highlights

- Net production, in line with guidance averaging 1,989 boepd in 2024 (2023: 2,100), with uptime across the portfolio remaining strong over the year

- Continued to optimise oil production from our existing wells through selective investment in short cycle developments which deliver quick payback

- DeGolyer & MacNaughton updated CPR values 2P NPV10 at $188 million (2023: $235 million). The decrease in reserves value is due to a development project moving out of the reserves category due to project prioritisation

- Work has begun on the Singleton gas-to-wire project which will deliver c.74 boe/d, utilising gas which is currently being flared. The project, which satisfies the regulatory requirements for the facility, now has planning consent and a secured grid connection. Procurement for long lead items is underway, with a first export of electricity from the site expected late 2025

- Ernestinovo licence commitments have been fulfilled and the acquisition of magnetotelluric data across the Sjece and Pcelic geothermal licence blocks in Croatia is complete, with the incorporation of this data into the geological models underway. Work is ongoing on the technical analysis to rank the optimal sequencing of their commercial development

- Seismic data was acquired and analysed for the Salisbury NHS Foundation Trust project, and pre-applications have been submitted for planning and permitting for both Salisbury and the Wythenshawe Hospital projects

Outlook

- We anticipate net production of c.2,000 boepd and operating costs of c.$40/boe (assuming an average exchange rate of £1:$1.27) in 2025

- 2025 forecast capital expenditure is c.£10.0 million. This includes £5.8 million on the Singleton gas-to-wire project which is forecast to come online in late 2025 with production of 74 boe/d. Star Energy also plans to invest £1.7 million on quick returning incremental projects and the balance on regulatory improvements, site resilience and projects to reduce operating costs going forward

- Holybourne sale proceeds of £6.3 million will be used to repay Facility A of our Kommunalkredit loan which is due on 30 June 2025

- Good progress on G&A costs reduction expected to generate savings of c.£1.5 million in 2025

- Data analysis continuing to further derisk our Croatian portfolio

- Seeking strategic partnerships in the UK to advance our pipeline

Source: Star Energy