Highlights:

- RPS Energy Consultants ('RPS') completes Competent Person's Report ('CPR') illustrating the potential economic value of UKOG's Loxley Gas discovery, located 9 miles south of Guildford in Surrey.

- Up to £124 million net UKOG mid-case 2C post-tax net present value (at 10% discount rate).

- 31.0 billion cubic feet 2C Contingent Resources within UKOG's 100% owned PEDL234 licence

- Planning and environmental consents in place for Loxley-1 appraisal campaign.

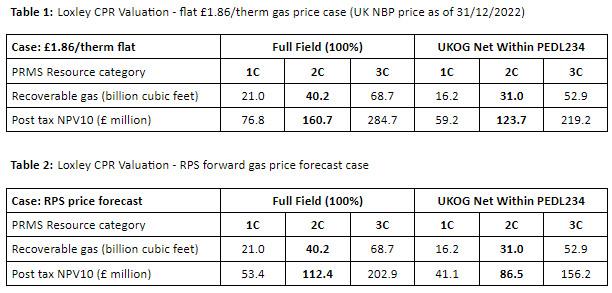

- The CPR's estimates of recoverable gas, pre-tax revenues and associated post-tax present values discounted at 10% per annum ('NPV10') are summarised in Tables 1 and 2 below, and the associated potential pre-tax revenues are given in CPR Appendix C:

The potential future cashflows for all 12 of the above valuation cases are shown in Appendix C of the CPR. The 2C £1.86/therm cashflow cases above are in tables C8 (full field) and C11 (UKOG net), the 2C RPS forward gas price cashflows being shown in tables C2 (full field) and C5 (UKOG net).

The CPR was prepared in accordance with the requirements and standards of the Petroleum Resources Management System ("PRMS") of the Society of Petroleum Engineers and will be made available on the Company's website (www.ukogplc.com).

UK Oil & Gas (UKOG) has announced receipt of an RPS CPR demonstrating the potential economic value of the Company's 100% owned Loxley gas discovery. RPS are a leading global consultancy with specialist oil and gas sector reserve assessment and advisory expertise.

The CPR demonstrates that the NPV10 of Loxley's 2C recoverable gas ranges from £123.7 million net to UKOG, assuming a gas price of £1.86/therm, the UK gas price on 31st December 2022, the effective date of the CPR, and £86.5 million net to UKOG utilising RPS' proprietary gas price forecast (see tables 1 and 2 above).

Delivery of a successful Loxley-1 appraisal programme, currently planned for 2024 and which has full planning and environmental consents, could further help cement this value in the foreseeable future.

The directors believe that UKOG will be able to offset a significant portion of the CPR's calculated Corporation, Supplementary Charge and Energy Profits Levy taxes against prior UK onshore sunk costs and future investments, further improving the Company's net revenue from any future Loxley production.

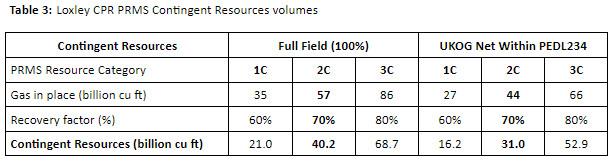

Table 3, below, reflects the CPR's revised gas in-place and recoverable volumes. Reassuringly, they are not materially different from those stated in the Company's 2022 Annual Report which utilised Xodus' prior estimates of 20th September 2020.

It should be noted that at present the potential recoverable volumes stated in this announcement are defined as Contingent Resources (as more fully described in the glossary) and should not be construed as Reserves. Further development of the asset would be required to seek to move the classification to Reserves.

Stephen Sanderson UKOG's Chief executive commented:

'The CPR confirms that Loxley, one of the UK's largest onshore gas discoveries, possesses material present value in today's prevailing higher gas price world. Its potential future revenue streams have the capacity to deliver material shareholder value in the foreseeable future and its recoverable resources to contribute towards the UK's future energy security.

Loxley's illustrated potential commercial robustness also means that UKOG can now plan to fund a future development via normal conventional oil and gas debt funding. The option of a farmout, where UKOG's costs are carried by a new partner, remains a further viable funding option. Our focus will, therefore, now be on implementing the necessary steps to deliver the planned Loxley-1 appraisal programme during 2024 and, if successful, gas production and sales targeted from 2026.

I'd also like to reiterate, that we also still plan to sell future Loxley gas for reforming into low-carbon blue hydrogen, entirely in accord with the low carbon ethos underpinning our proposed Portland hydrogen hub project. Once Loxley is depleted of natural gas by around 2036, we are also investigating its use to store around 1 billion cubic metres of hydrogen, a further addition to the Company's and UK's much-needed future energy storage portfolio.'

Source: UKOG