A look at the current status of global floating offshore wind targets and key takeaways from Westwood’s recent Floating Wind Survey

Targets indicate the ambition and pathway of an industry, helping to align stakeholders. Following recent market upheaval caused primarily by cost inflation, together with the subsequent re-focusing of developer strategies, means that many offshore wind targets are now likely to be missed.

According to Westwood’s WindLogix analysis, for floating wind specifically, the UK is set to miss its 2030 target by around 90% and the US its 2035 target by around 82%. As a result of increasing uncertainty, Westwood now takes a more risk-based assessment of the offshore wind pipeline and projects. Download our Project Certainty White Paper for further details.

Only a few years ago the floating wind industry generated huge targets and expectations. In 2022, the UK government set a target of up to 5GW by 2030, the 1GW Trollvind project was announced with startup in 2027, the US set itself a 15GW target by 2035, and most notably 22.4GW of floating lease capacity was awarded (across Scotwind, Scotwind Clearing and Pacific Coast).

However, the outlook for floating has been challenged, and two years on, it is time to consider how the future of the floating industry is now being perceived.

Floating Wind Survey 2024

Westwood, in partnership with Norwegian Offshore Wind and World Forum Offshore Wind (WFO), surveyed over 180 floating offshore wind stakeholders on industry sentiment and attitudes across the value chain. Four key themes emerged from the findings.

Theme 1: More optimism than headlines suggest

General consensus deviates when it comes to the question of optimism, relative to the highs of two years ago. On balance there is a more positive picture around sentiment than a lot of the headlines suggest. While optimism has waned, 62% of respondents have either maintained their optimism or are more positive about the industry. There are regional nuances to this, with 42% of European respondents less optimistic about the floating offshore wind sector, compared with 30% for non-Europe respondents.

Globally, and importantly, 44% of developers are more optimistic about the sector than two years ago whereas that shrinks to just under a quarter of supply chain respondents, potentially pointing to a lag in projects coming to tender for their services.

Relative to two years ago, has your view of floating wind changed?

Source: Westwood Floating Offshore Wind Survey 2024

Theme 2: A question of pace

When asked how much capacity would be operational by 2030 and 2040 and which countries would be key to bringing floating wind to life, there is now a lot more realism in the market for near-term growth, with Europe and the UK playing a central role.

The majority of respondents (54%) expect under 3GW of global capacity to be operational by 2030, with Europe reaching 0.5-2GW in the same timeframe (61%). Leading up to 2040 respondents continue to have diverse views of the pace of growth the industry can achieve. There is still a lot of uncertainty, as would be expected.

To bring that ambition to life though, a great deal of importance was placed on achieving momentum in the UK in particular – 71% chose this as their main front-runner – with South Korea, Mainland China, France and Norway being other key markets to watch.

How much floating wind capacity do you anticipate will be operational by 2030 and 2040 respectively?

Source: Westwood Floating Offshore Wind Survey 2024

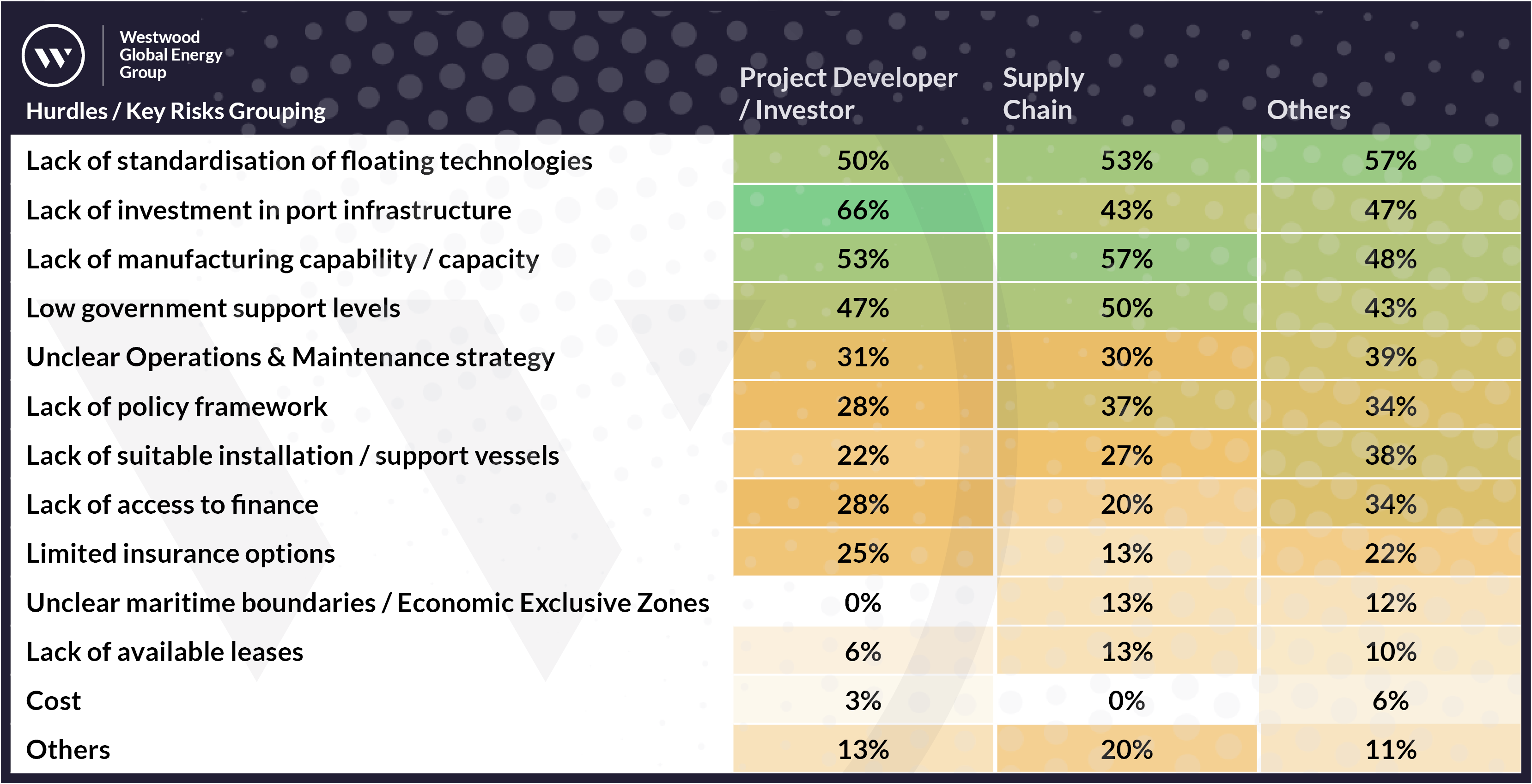

Theme 3: Hurdles across the value chain

The challenge for the industry is that it is facing a broad range of hurdles that is holding it back from progress.

The survey revealed that a lack of standardisation of floating technology (55%), manufacturing capability and capacity (51%) and port infrastructure (50%) as the most commonly cited hurdles and risks to floating offshore wind progress. This indicates a need for accelerated investment, regulation and supply chain co-ordination globally for the sector to achieve its ambitions.

It is worth noting that each group of respondents has its own top tiered issue. For example, developers are particularly port focused, which highlights that while there is a broad consensus, groups are prioritising different areas.

What do you think are the major hurdles/key risks to floating wind development?

Note: The last two risks (Cost and Others) represent grouped responses to capture freeform replies.

Source: Westwood Floating Offshore Wind Survey 2024

Theme 4: More, please

The final emerging theme reveals that the floating wind industry is asking the government for more, and more focused, support. Aligning with the hurdles, calls are ringing out for governments to provide more specific policy and regulatory support for technology development in addition to cost reduction and investment in port infrastructure to accelerate adoption.

In conclusion, the survey results revealed a generally optimistic outlook relative to two years ago, especially amongst developers, but recognises that a set of broad and fundamental hurdles to growth persist. This has led to more realism in the growth trajectory of the industry. More focused policy, regulatory support and direct investment into port infrastructure and projects are part of the ‘ask’. If governments want this industry to progress, they really need to do a lot more to help it grow.

David Linden, Executive Director & Head of Energy Transition

dlinden@westwoodenergy.com

First released at Norwegian Offshore Wind’s Floating Wind Days in Haugesund, Norway, Westwood’s full Floating Offshore Wind Survey 2024 is available to download, with an option to include 30-days of free access to WindLogix. See original article via link below.

Source: Westwood Global Energy Group